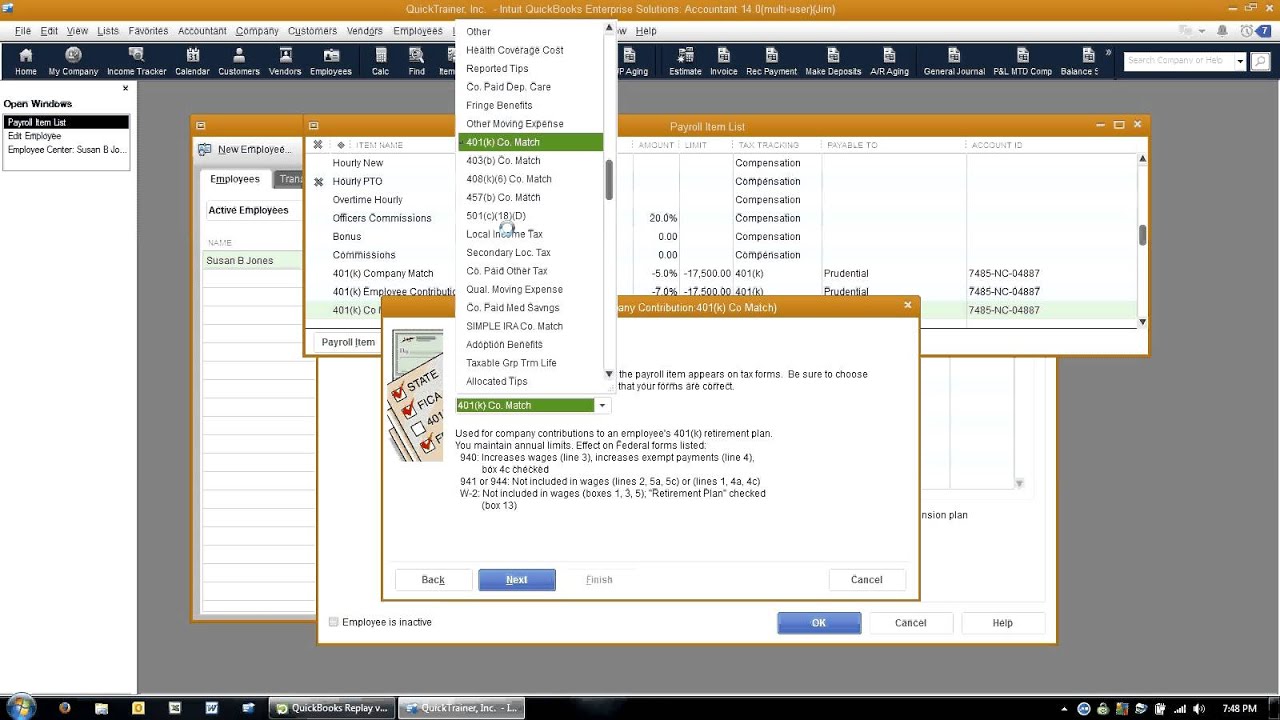

This new for 2014, QuickTrainer, Inc. video shows you how to correct a 401(k) payroll item. In this video, Jim Merritt, Advanced Certified ProAdvisor, describes a recently encountered scenario whereby a 401(k) Company Contribution was setup as a Deduction type item instead of a Company Contribution payroll type item. This resulted in a negative outcome. Merritt shows you how to correct this issue….(read more)

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Oops

https://chrome.google.com/webstore/detail/threelly-ai-for-youtube/dfohlnjmjiipcppekkbhbabjbnikkibo

Thank you so much. What would be the correct way to correct this? Would you just add back that amount in, in the next paycheck? Would any other ADJ entries be necessary or would this take care of it?