![]()

Recent studies show that most self-employed Americans are saving little, if anything, for retirement. Why? Excuses include a lack of steady income, paying off major debt, healthcare, education, and business expenses.

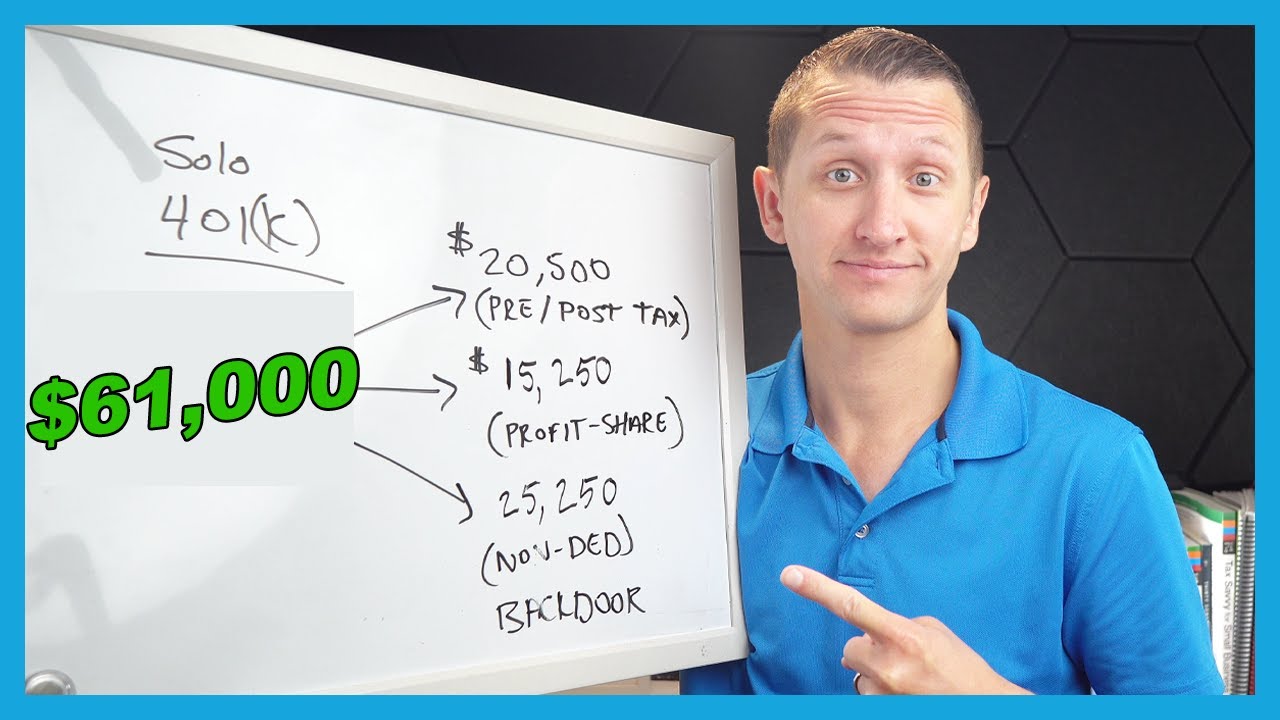

But when the future depends on you, making an investment in yourself is worth it. The retirement saving options most preferred by self-employed workers are solo 401(k)s, SEP IRAs and SIMPLE IRAs.

The solo or individual 401(k) is like a traditional 401(k), but it’s for sole business proprietors with no employees other than a spouse who works for the business. It permits contributions as both the employee and employer, which means higher limits than many savings plans. In 2014, the employer could save $17,500; or $23,000 if over 50 years old, plus an additional 25% of net income up to a maximum of $52,000; or $57,500 if over 50.

A simplified employee pension, or SEP IRA, suits individuals and businesses with employees. A SEP IRA can be opened at just about any bank or brokerage. The business owner can contribute up to 25% of each employee’s income, up to $52,000. When making a contribution, the owner must contribute for every employee. Since employees do not make contributions, the plan is most popular with one-person businesses.

Savings incentive match plan for employees, or SIMPLE IRAs, are like SEP IRAs, but the employees can make contributions. The employer must contribute dollar-for-dollar up to 3% of each eligible employee’s contribution, and 2% for those who don’t contribute. In 2014, contribution limits of $12,000 — $14,500 if over 50 — and the matching requirement made SIMPLEs best for those with no employees and incomes of less than $45,000.

Read more: Retirement Planning For The Self-Employed – Video | Investopedia

Follow us: Investopedia on Facebook…(read more)

LEARN MORE ABOUT: Keogh Plans

REVEALED: How To Invest During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

0 Comments