![]()

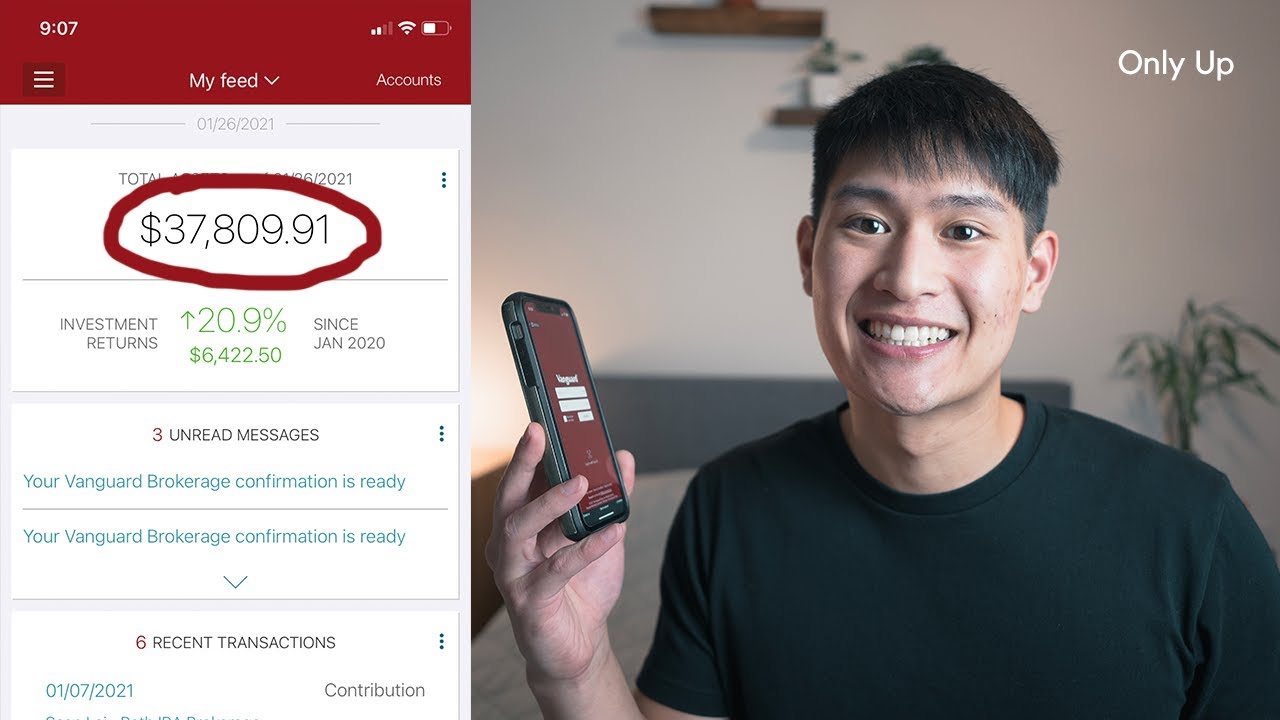

Here’s my Vanguard Roth IRA Update in 2021. Last year was a wild year, where my investing portfolio fluctuated heavily. I recap my portfolio growth, holdings, and set-up that got me through the stock market crash.

▼ ▽ WATCH NEXT!

Stock Market Investing for Beginners 2021 |

Vanguard Roth IRA Guide (Step by Step) |

Revealing My Entire Stock Portfolio |

The Only Stock You Need To Invest In |

▼ ▽ Below are products I personally use and recommend

Track your net worth + get $20 free:

Easy investing with M1 Finance | Sign-up below and invest $100 in a taxable brokerage or $500 in a retirement account for $30 for free!

Best Overall Travel Credit Card with $750+ sign-up bonus:

▼ ▽ Recommended Investing Apps, Credit Cards, and my Camera Gear!

▼ ▽ Instagram: @theseanlei (Go ahead and slide in)

I’m Sean, a data scientist who helps beginner investors dominate their personal finances. Join the FamiLei and start living a more rewarding, intentional and vibrant life.

Background music by LAKEY INSPIRED and Blue Wednesday:

0:00 Vanguard Roth Ira

1:59 Portfolio Growth

5:28 Portfolio Holdings

9:35 Important Account Setup

#PersonalFinance #Vanguard #RothIRA…(read more)

LEARN MORE ABOUT: IRA Accounts

INVESTING IN A GOLD IRA: Gold IRA Account

INVESTING IN A SILVER IRA: Silver IRA Account

REVEALED: Best Gold Backed IRA

How's your Roth IRA looking like!?

Thanks for the video. I your simple portfolio. It's a wise approach. Do you plan to invest in bonds when you get older and closer to retirement?

I was thinking about creating a Roth IRA in TD Ameritrade bc I already have an account. Why did you switch to Vanguard? This would be helpful to know. Thanks!

I am a first time investor and looking to use vanguard to invest in global funds. 80 In equity and 20 in bonds. Open to suggestions and tips?

Hopefully i can get a response, should i just let stuff sit until i retire? OR should i be actively selling? I want to be a millionaire but i dont want to constantly open my account and do research..please help with a response, thanks.

Why don't you use vanguard for your taxable brokerage account?

Hi Sean , can a nurse with valid DACA status, employment authorization , and 7 years worth of income taxes documented with the IRS open a Roth IRA with vanguard?

Are you allowed to dump 6k at the start of the year? I thought you could only invest equal to how much earned income you have for the year. So you can't have 6k invested until you've earned 6k for the year?

My advice to new investors: Buy good companies stocks and hold them as long as they are good companies. Just do this and ignore the forecasts and market views which are at best entertaining but completely useless.

Great, simple, and straightforward video!

Thank you for sharing this.

What’s the Max you can withdraw just in case on an emergency ?

Hi Sean! If you have extra money you want to invest after maxing your Roth IRA, would you recommend mirroring the investments in your Roth IRA (80/20 split between VTSAX & VTIAX) in a taxable brokerage account with Vanguard?

Background 'music' is so annoying. We're on computers listening to our own music, why do you need dance music to discuss ROTH?

How's your Roth IRA looking right now? Did you add any other funds to it? Keep up the great work, Sean!

How to get the mobile app?

How do you set up drip or dividend reinvestment plan?

What made you move from TD Ameritrade to V

I have a Roth IRA with Fidelity and only have VTI & Apple!!! I want to do a 2-fund portfolio of index funds of FZROX & FZILX. Problem is VTI & FZROX have the exact holdings but FZROX carries a zero expense ratio. Would you suggest selling VTI and doing the 80/20 split???

And lastly, would it make sense to buy VTI in a regular Brokerage? Just mad bcuz I got in VTI at $198

I am 19 and am going into ten Cybersecurity field. I know I will be making 6 figures pretty quickly so I would only qualify for a 401k. Would you recommend a Roth or regular 401? Great channel!

Glad to hear that you are taking a simple approach to investing. I like that kind of investing.

"the only person you should be comparing yourself to is your past self"

Thank you for acknowledging that all of us are here because we are new to this and want to be better.

is it okay to start off with etfs if you don't have $3000 to invest into an index?