![]()

Secure Act 2.0 and Roth 401k RMDs…(read more)

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

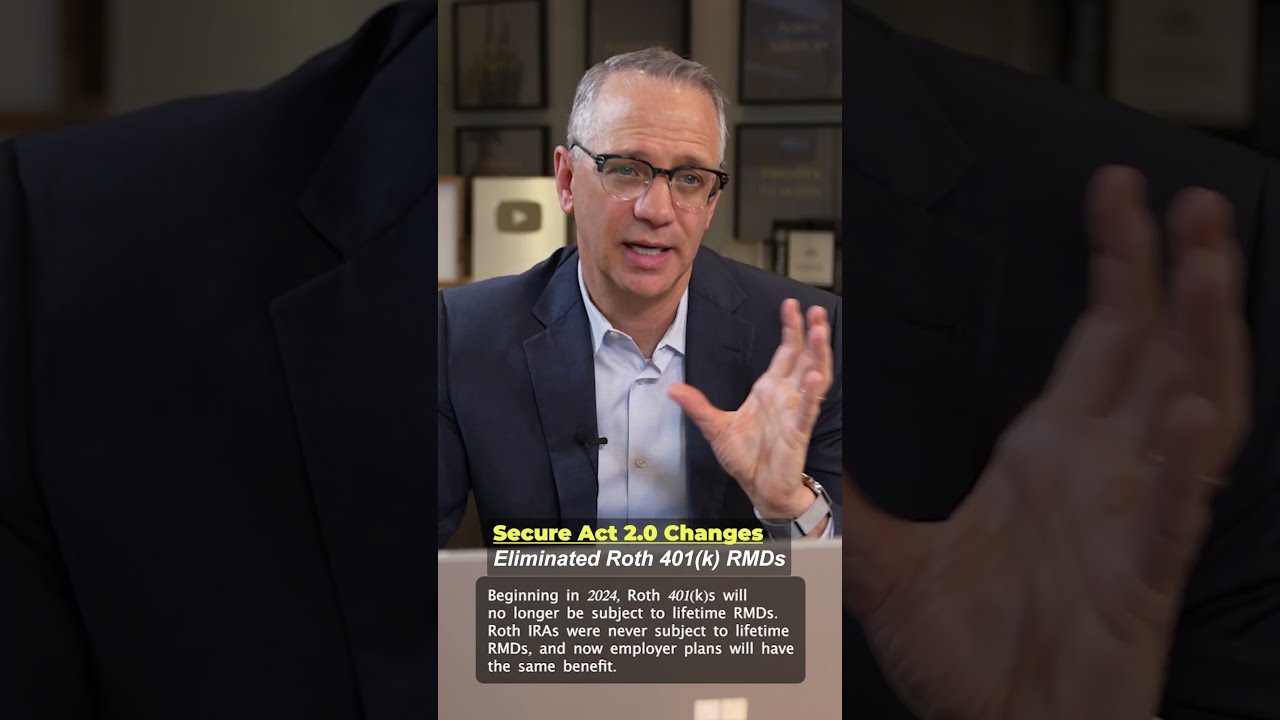

In recent news, the Roth 401k Required Minimum Distribution (RMD) is going away. This is a welcome change for many individuals who have been saving for retirement.

Roth 401k accounts are a great option for retirement savings because the money grows tax-free and can be withdrawn tax-free after age 59 ½. However, when you reach age 70 ½, the IRS requires you to begin taking a Required Minimum Distribution (RMD) from your Roth 401k account. This RMD was a set percentage of your total account balance and had to be taken each year.

Now, the IRS has eliminated the Roth 401k RMD. This means that you can keep your Roth 401k account growing tax-free for as long as you want. This is great news for those who want to continue to save for retirement without having to worry about the RMD.

The change also allows individuals to pass on their Roth 401k to their heirs without having to worry about RMDs. This means that their heirs will be able to enjoy the tax-free growth of the account for years to come.

This change is a welcome one for many individuals who are saving for retirement. It allows them to keep their Roth 401k growing tax-free and to pass it on to their heirs without having to worry about RMDs. If you have a Roth 401k, it is worth taking a look at the new rules to make sure you are taking advantage of this change.

Thanks!