![]()

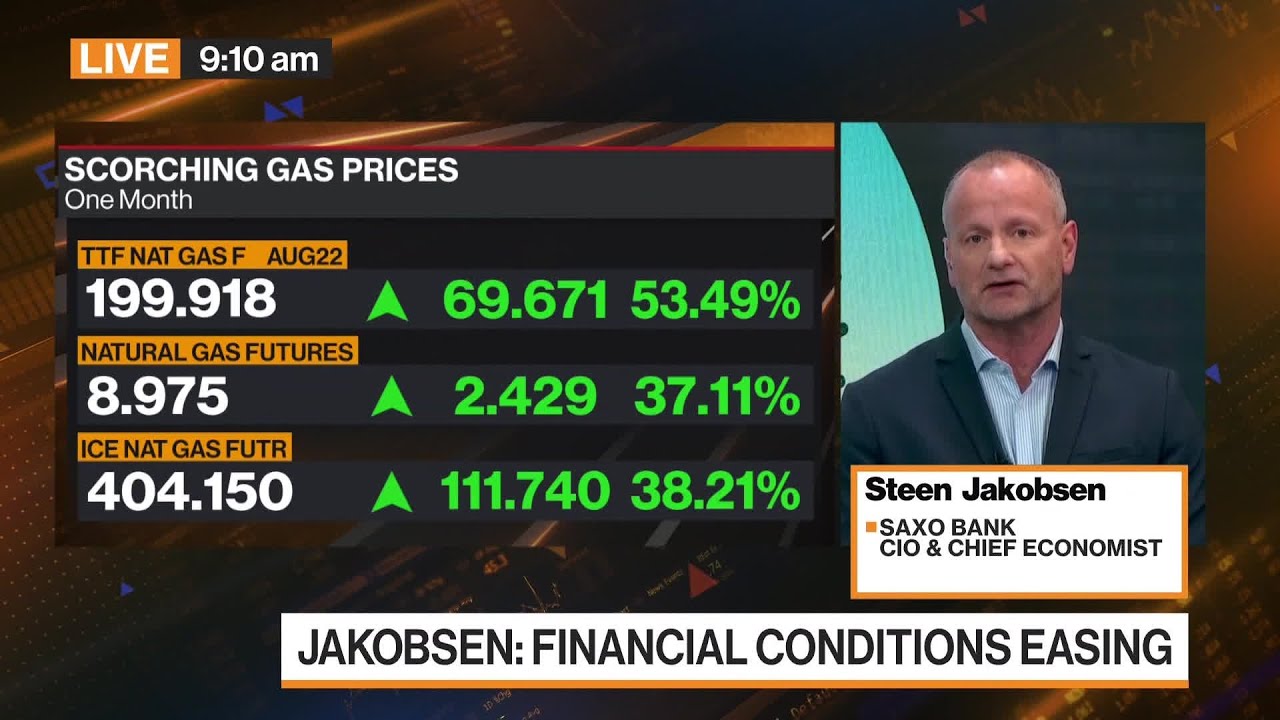

Steen Jakobsen, chief investment officer and chief economist at Saxo Bank, discusses the US economy, what to expect from the Fed decision and his investment strategy for markets. He speaks on Bloomberg Television.

——–

Follow Bloomberg for business news & analysis, up-to-the-minute market data, features, profiles and more:

Connect with us on…

Twitter:

Facebook:

Instagram: …(read more)

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

US to See High Inflation for Longer: Saxo Bank’s Jakobsen

Ole Hansen, Head of Commodity Strategy at Danish investment bank Saxo Bank, forecasts that the United States will continue to experience high inflation for an extended period. According to Hansen, factors such as supply chain disruptions, fiscal stimulus, and pent-up demand will contribute to this prolonged inflationary pressure.

Hansen’s analysis aligns with the recent surge in US consumer prices. Inflation levels accelerated more than expected in June 2021, with prices soaring at their fastest pace in nearly 13 years. Concerns over rising inflation have led to considerable speculation about the Federal Reserve’s response and the potential impact on the economy.

Supply chain disruptions, primarily due to the COVID-19 pandemic, have played a crucial role in fueling inflation. Manufacturers are grappling with raw material shortages and transportation bottlenecks, leading to increased costs. These additional expenses are often passed on to consumers, causing a surge in prices across various sectors.

Furthermore, fiscal stimulus measures, including direct payments to individuals and businesses during the pandemic, have injected substantial liquidity into the economy. This influx of money has exceeded the actual demand for goods and services, resulting in higher prices. With a significant portion of the stimulus checks still unspent, Hansen expects this trend to persist.

Pent-up demand, a consequence of lockdowns and restrictions during the pandemic, is another factor driving inflation. As economies reopen and vaccinated individuals gain confidence, there is a surge in consumer spending. However, supply chain constraints prevent businesses from meeting this sudden surge in demand, leading to further price hikes.

The above factors suggest that inflation in the US is not transitory, as Federal Reserve Chairman Jerome Powell has repeatedly stated. Saxo Bank’s Hansen argues that the Federal Reserve may be underestimating the duration and consequences of elevated inflation. He further cautions that if the central bank fails to act promptly, the situation could spiral out of control.

Hansen recommends that investors closely watch for key inflation data releases, such as the US consumer price index, Federal Open Market Committee meetings, and statements from the Federal Reserve. These developments will offer insights into the central bank’s approach and provide guidance for market participants.

In conclusion, Saxo Bank’s Ole Hansen predicts a prolonged period of high inflation for the United States. Supply chain disruptions, fiscal stimulus measures, and pent-up demand are expected to foster this extended inflationary environment. Investors and consumers alike should remain vigilant, closely monitoring inflation trends and the actions taken by the Federal Reserve, as they navigate this uncertain economic landscape.

If you want to do one thing right this year check fidel peter carthy

Drunk sleeping on the floor. Yes, Time to sit up, sobering mildly happening…and try to remember …your password.

Finally a good honest interview. Hate the pumpers always Buy, buy, buy. Now is the time to sell, and wait until interest rate cuts to buy stocks again.

The inflation train is going to ram its way up the collective bum of the clown show on wall street. Unless inflation tanks hard and fast, prepare for a total bloodbath as rates continue to rise.

Bank’s can freeing or reduce banks accounts withdraw

UK prime minister candidate collapse at middle debate

Let’s go Brandon!

Takes 300 pounds rocks melting down to get one ounce silver price 18$

No Fed interest rates change

My greatest happiness is the $ 28,000 weekly profit I get consistently

.

Interest rate will be at 3.75 at the end of 2022

beware of scams in comments. wassap numbers and investor reccomendations. youtube wont close those accounts