Call 844-457-7278 Toll Free for more information

How to pick a Medicare supplement plan 2016 Tempe AZ

How do I pick a Medicare supplement plan…(read more)

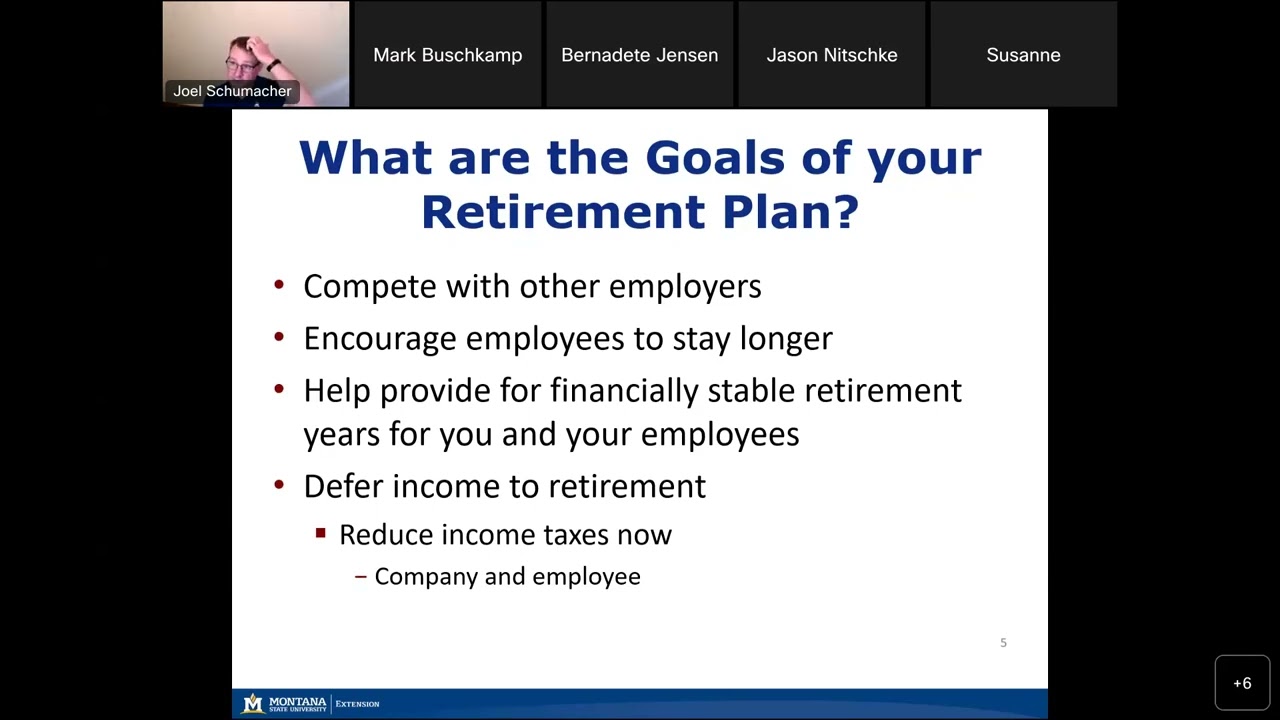

LEARN MORE ABOUT: Retirement Planning

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

When it comes to healthcare, Medicare is an essential part of providing coverage for seniors aged 65 years and above. However, Medicare does not cover everything, and individuals will need to supplement their coverage with a Medicare supplement plan, also known as Medigap coverage.

Choosing the right Medicare supplement plan can be a daunting task, but it is an essential decision that can impact your healthcare expenses and coverage. The following are some tips on how to pick a Medicare supplement plan for 2016 in Tempe, AZ.

1. Identify your healthcare needs

The first and foremost step is to determine your healthcare needs. You should consider your current healthcare expenses, prescription drug costs, and any potential health concerns that you may have. This will help you to determine which Medicare supplement plan is best suited to your requirements.

2. Research the plans

Once you have identified your healthcare needs, it is time to research the available Medicare supplement plans. There are ten standardized Medigap plans, each with varying levels of coverage. It is essential to go through each plan and compare the benefits, premiums, and ratings to find the one that fits your needs.

3. Compare prices

Medicare supplement plan premiums vary from one insurance company to another. Research and compare prices to find the most affordable plan that provides adequate coverage for your needs.

4. Check the insurance company’s reputation

When picking a Medicare supplement plan, it is crucial to check the insurance company’s reputation. Look for a company with a good ratings history and one that has been in business for a long time.

5. Review the policy

Before signing up for a Medicare supplement plan, review the policy thoroughly to ensure that it meets your requirements. Pay attention to the policy’s terms and conditions, benefits, and coverage areas.

In conclusion, selecting the right Medicare supplement plan requires a thorough understanding of your healthcare needs and research on the available plans. Contact Medicare Insurance Solutions at (844) 457-7285 to find the right Medicare supplement plan for you in Tempe, AZ. Our team of dedicated professionals will guide you through the entire process and provide you with the most affordable and effective Medigap coverage.

0 Comments