![]()

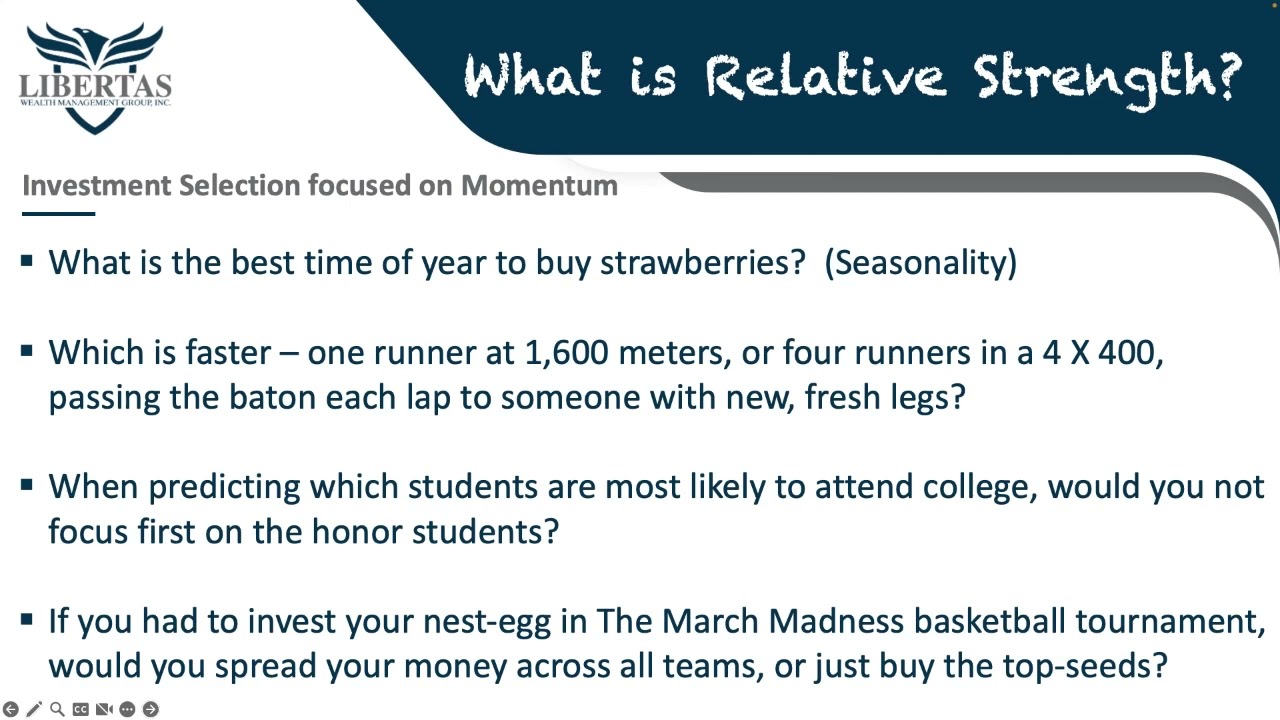

In this new NERDvember episode, Adam is taking a look at the question “how do I know what investments to buy”? There are many things to consider when making decisions like this, such as investment strategy based on momentum. Adam also looks at the anatomy of a collapse featuring CitiGroup. Adam also analyzes Relative Comparison charts and why good information isn’t always actionable information. Lastly, Adam looks at removing “time” from your investment strategies and why it is important to use Relative Strength analysis to build a portfolio management strategy.

Libertas Wealth:

Subscribe on iTunes:

Subscribe on Spotify:

Subscribe on Google Podcasts:

For more VIDEO podcasts like this one:

For more AUDIO podcasts:

For educational VIDEOS and Stock Market Updates:

For general financial educational ARTICLES:

For more Real-Time Updates on the Economy and State of the Markets Follow Adam Koós on Twitter @AdamKoos:

Or follow Adam on Instagram @FinancialSurgeon:

— Adam Koos, CFP®, CMT® is a CERTIFIED FINANCIAL PLANNER and one of only 2,600+ Chartered Market Technicians (CMT) worldwide, as well as a Certified Financial Technician (CFTe®) thru the International Federation of Technical Analysts (IFTA). He’s been named by Columbus Business First as one of their 20 People to Know in Finance, was a recipient of the Forty Under 40 award, is ranked by Investopedia as one of America’s top 100 Most Influential Advisers, and is the winner of the coveted Better Business Bureau Torch Award for Ethical Enterprising. Adam serves his clients as the president and portfolio manager at Libertas Wealth Management Group, Inc., a Fee-Only Registered Investment Advisory (RIA) firm, located in Columbus, Ohio.

******* The audio and video contained herein is intended for those interested in finance, searching for a financial advisor, wealth manager, financial planner, and/or retirement planning. While we are CERTIFIED FINANCIAL PLANNERS (through the College for Financial Planning) and work with clients all over the country, our business is run out of Columbus / Central Ohio. If you are looking for wealth management, financial planning, a financial counselor, wealth advisor, or financial consultant – especially a fee-only, Fiduciary Registered Investment Advisor – we provide money management and financial services for individuals and couples (i.e. – a 401k rollover), as well as business owners (i.e. – 401k, SIMPLE, SEP IRA’s, as well as cash balance and other various retirement plans)….(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

Investing can be a daunting task, especially for those who are new to the world of finance. With so many options available, it can be challenging to know which investments are the best fit for your financial goals. In a recent episode of The CASH Podcast with Adam Koos, the host shared some valuable insights on how to determine which investments to buy.

According to Koos, the first step to deciding which investments to buy is to understand your financial goals and risk tolerance. “It’s important to have a clear understanding of what you’re investing for,” Koos said. “Are you saving for retirement, education, or a major purchase? Once you have a clear picture of your goals, you can better assess which investments will help you achieve them.”

In addition to understanding your financial goals, Koos emphasized the importance of assessing your risk tolerance. “Risk tolerance refers to the amount of market risk an investor is comfortable taking on,” Koos explained. “It’s important to have a portfolio that aligns with your risk tolerance so that you can weather market fluctuations without losing sleep at night.”

Once you have a clear understanding of your financial goals and risk tolerance, Koos recommended conducting thorough research on potential investment options. “Research is key when it comes to investing,” Koos said. “You want to have a good understanding of the potential risks and rewards of each investment before making a decision.”

Koos also stressed the importance of seeking advice from a financial professional. “Working with a financial advisor can be extremely beneficial when it comes to making investment decisions,” Koos said. “An advisor can help you navigate the complex world of investing and provide valuable insights that can help you make informed decisions.”

When it comes to determining which investments to buy, Koos advised against making emotional decisions. “Emotions can lead to impulsive decisions that may not be in your best interest,” Koos said. “It’s important to approach investing with a logical and disciplined mindset.”

Ultimately, Koos emphasized the importance of having a diversified investment portfolio. “Diversification is key to a well-rounded investment strategy,” Koos said. “By spreading your investments across different asset classes, you can reduce the overall risk of your portfolio.”

In conclusion, determining which investments to buy requires careful consideration of your financial goals, risk tolerance, and thorough research. Seeking advice from a financial professional and maintaining a disciplined approach to investing can help you make informed decisions that align with your long-term financial objectives. With the right approach, you can build a strong investment portfolio that can help you achieve your financial goals.

0 Comments