![]()

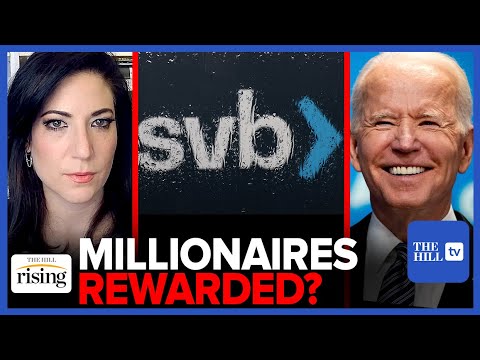

Batya Ungar-Sargon comments on the Fed’s questionable priorities in choosing to bailout banks following Silicon Valley Bank’s failure. Originally aired March 16, 2023: #svb #fed #workingclass

About Rising:

Rising is a weekday morning show with bipartisan hosts that breaks the mold of morning TV by taking viewers inside the halls of Washington power like never before. The show leans into the day’s political cycle with cutting edge analysis from DC insiders who can predict what is going to happen. It also sets the day’s political agenda by breaking exclusive news with a team of scoop-driven reporters and demanding answers during interviews with the country’s most important political newsmakers.

Follow Rising on social media:

Website: Hill.TV

Facebook: facebook.com/HillTVLive/

Instagram: @HillTVLive

Twitter: @HillTVLive…(read more)

LEARN MORE ABOUT: Bank Failures

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Batya Ungar-Sargon is an American journalist who has made significant contributions to the field of investigative journalism. One of her most recent works involves the uncovering of bias in Silicon Valley Bank Bailouts. In this article, we will discuss Ungar-Sargon’s findings and their implications.

Ungar-Sargon’s investigation reveals that Silicon Valley banks received an enormous amount of federal bailout funds during the 2008 financial crisis. However, these bailouts were not allocated in a fair and unbiased manner. She found that banks owned by white individuals were given preference over banks owned by minorities, particularly those owned by African Americans and Latinos.

Ungar-Sargon conducted an analysis using data provided by the Treasury Department. The data shows that minority-owned banks were subject to significantly stricter bailout terms than their white-owned counterparts. For example, while white-owned banks received larger amounts of bailout money with fewer restrictions, minority-owned banks were given smaller amounts of money with more stringent conditions attached.

Ungar-Sargon’s research also suggests that the lack of proper allocation of funds had a direct impact on the survival rate of minority-owned banks. In a study of 744 banks that received bailout funds, only 23% of minority-owned banks were still in operation four years after the financial crisis, compared to 61% of control-group white-owned banks.

The bias identified in Silicon Valley Bank Bailouts is not unique to the financial crisis. It is a frustrating reality in our society that minorities often receive less aid and support than their white counterparts. Ungar-Sargon’s work has brought attention to this issue and will hopefully lead to more equitable treatment of minority-owned companies in the future.

Ungar-Sargon’s findings also have implications beyond the specific issue of the financial crisis. Her research highlights the need for journalists to continue to hold powerful institutions accountable for biased practices. The press plays a vital role in promoting transparency and justice in our society.

In conclusion, Batya Ungar-Sargon’s work in investigating the allocation of federal bailout funds during the 2008 financial crisis has revealed an alarming level of bias. Her research clearly shows that minority-owned banks were significantly disadvantaged compared to their white-owned counterparts. Her findings highlight the need for journalists to continue exposing such biases and promoting transparency in our institutions.

The rich control the Federal Reserve Bank. The government can't control them. The Feds own the government. When they say jump, the government says how high.

Let me thank the FEDs for saving me extra 11M that was uninsured. Pays to give $$ to the right people.

They should absolutely let SVB fail no bailout whatsoever.

wait… she thinks that it's democrats bailing out banks? for the past 30 years, it's been taxpayer handouts to the wealthy regardless of who is in power. she has to be old enough to remember when Hank Paulson proposed a 700 billion taxpayer bailout that he managed to author all the details needed to justify it on … 2 pages. 2 pages was all he needed to convince rich people that other rich people needed 700 biliion taxpayer dollars. Biden probably got his 2 page justification too. This is not about party affiliation.

Thursdays repeat

Next bailout? Blue Cities and there pension funds.

2024 Steal the Election has officially started.

Virtually no one needs more than ten million dollars. If you want to get richer than that, fine, but the government should never be saving people past that amount.

We've seen layoffs at our place of employment: community college.

How's your employer?

Batya makes very good points about the SVB bailouts. The Fed's tool to lower inflation, raising interest rates, hits lower and middle-class home buyers and workers intentionally. Bailing out the typical SVB client only increases the need to raise rates. The rich get bailed out, and everyone else pays the price. What a f'd up policy.

Nancy Pelosi has accounts and Gavin newsome they would be wiped out someone needs to ask the White House if that’s true

The Bidens,pelosi and obamas and Gavin newsome have bank accounts in this bank

In Israel they solved the problem. Direct donation to politicians – prohibited. Members of Parliament receive an allowance from the state. This should also be the case in the USA. Each member of Congress and Senator will receive the same budget from his party. The party will receive a budget from the state according to its size.

This is such a sloppy analysis.

No, Biden would never cater to the rich donors, Union donors or China who donate to his family. Would he? Vote better.

Batya, learn to outline. Watching someone read right off her laptop is a little tough to take

If state residents voted against Trump, why should they suffer from consequences of his deregulation of regional banks? Next time a red state regional bank fails, we can try the Republican approach to resolving it and let depositors get hosed.

tax the rich .lol. Suckers.

THEY BAIL OUT THE RICH…NOT THE THE POOR. "THE BLACK VETERAN FOR JUSTICE". B1..FBA. CUT THE CHECK NOW…NO REPARATIONS NO VOTE.

So Janet and her ! Board of 14 choose banks they ! ! Say ? Wow . March 22nd looms ! Our turn . It is a starting date. Get up dancing.

Can’t stay on topic without going after Trump yikes

8:46

Inflation is caused by companies putting their prices up. This latest round of inflation was caused by the oil companies raising their prices. Soon it was a pile on and everyone was at it. I wish though you would make clear that the Federal Reserve is a private company and not in any way a part of the Government. Therefore would it not be better to get rid of it entirely since it is it and not the Government that is laying the blame for inflation on workers.

Money has to leave politics.

Coke products have increased in price from $1.99 a year ago for a 2 liter bottle to $3.29 today

So we pay for FDIC insurance. They did not on deposits over 250K. Why should they be covered? If you don't pay homeowners insurance and your house gets knocked out, you aren't covered.

No. A long list of tech startups got their working capital protected so they didn’t go out of business and could make payroll. Etsy could pay it’s sellers the profits they earned. It’s not a bunch of dumb millionaires who had idle cash parked in one bank