![]()

FOR MORE INFORMATION VISIT OUR WEBSITE

www.RetireSharp.com

OR CALL OUR TOLL-FREE NUMBER

1-800-566-1002

TO SPEAK WITH A STRATEGY SPECIALIST AT NO COST!!!…(read more)

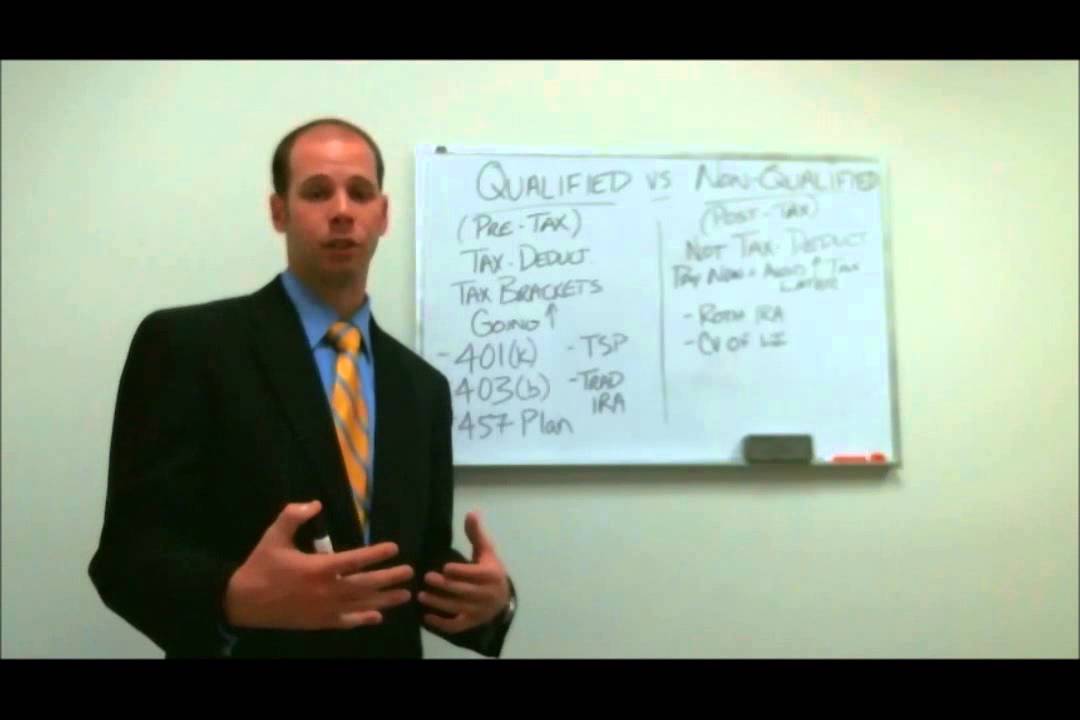

LEARN MORE ABOUT: Qualified Retirement Plans

REVEALED: How To Invest During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

this video very old, is all this information up to date or still the same?

That’s not correct, you can contribute Roth into a qualified 401(k), the main difference is a qualified 401(k) has an IRS limit of $19,000, $6,000 for catch up, and allows pre and after Tax dollars, non qualified plan are typically “deferred compensation” plans and it mainly for the executives of a company and non qualified plans could be subject to discrimination unlike a qualified plan.

a traditional ira is not a qualified plan

Great video, but you are speaking way too fast. Just to let you know. Thanks

nice