![]()

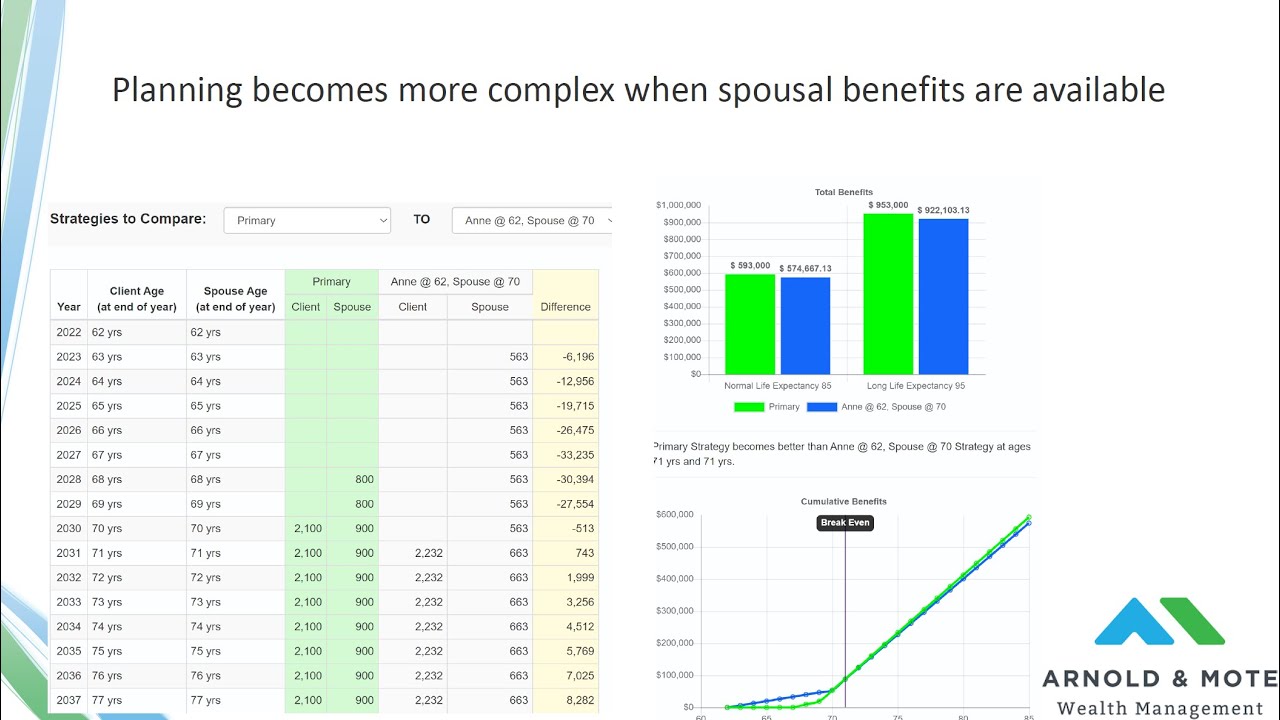

Although many of the complicated strategies around Social Security regarding spousal benefits have been eliminated, there are still options to consider regarding when to begin your, or your spousal, benefits with Social Security.

In this webinar we covered common questions we receive about Spousal Social Security benefits, and strategies to maximize your benefits.

Topics include:

– Scenarios when it makes sense for one spouse not to delay their benefits.

– The negative impact of beginning your benefit early, even if you qualify for spousal benefits.

– Claiming benefits available to you from an ex-spouse.

We cover 3 examples of common mistakes we see with spousal social security benefits….(read more)

LEARN MORE ABOUT: IRA Accounts

CONVERTING IRA TO GOLD: Gold IRA Account

CONVERTING IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

Are you considering applying for spousal Social Security benefits? It can be a great way to maximize your retirement income and make sure you have the financial security you need to live comfortably in retirement. But understanding the rules and strategies for getting the most out of spousal Social Security benefits can be complicated. Here’s a guide to help you make the most of your spousal Social Security benefits.

First, you need to understand how spousal Social Security benefits work. If you’re married, you’re eligible to receive up to half of your spouse’s Social Security benefit, depending on your own work history and the amount of Social Security benefits your spouse is eligible for. It’s important to note that you’re not eligible for spousal Social Security benefits if you’re divorced or if your spouse has passed away.

Once you understand the basics of spousal Social Security benefits, there are a few strategies you can use to maximize your benefits. First, it’s important to wait until you’re at least full retirement age (66 or 67, depending on when you were born) before you start collecting spousal Social Security benefits. If you start collecting before full retirement age, your benefits will be reduced.

You can also maximize your spousal Social Security benefits by taking advantage of the “file and suspend” strategy. This strategy allows you to file for Social Security benefits and then suspend them, allowing your spouse to collect spousal benefits while you continue to accrue delayed retirement credits. This can be especially beneficial if your spouse is eligible for a higher benefit than you are.

Finally, it’s important to understand the tax implications of spousal Social Security benefits. If you’re married and filing jointly, up to 50% of your spousal Social Security benefits may be taxable. It’s important to factor this into your retirement planning to make sure you’re getting the most out of your benefits.

Spousal Social Security benefits can be a great way to maximize your retirement income and ensure you have the financial security you need in retirement. By understanding the rules and strategies for getting the most out of your spousal Social Security benefits, you can make sure you’re getting the most out of your benefits and planning for a comfortable retirement.

What if higher earning spouse takes benefits before 67? e.g., 65?

If the spousal benefit recipient file at the same time as the spouse and at 62. Both her benefit and the spousal benefit get reduced. Also, the reduction schedules are slightly different. So if her FRA is 67 and FRA benefit is 800, and she starts her benefit at 62, she will receive 560 (563, your number) and also receive $65 as her spousal benefit. But if her husband waits till she is FRA to file, she will get the 100% of the $100. If she waits till after FRA to file, I think she still gets 100% of spousal benefit. even though the total is more than 50% of his benefit. Value of maximum benefit is based upon FRA values and not on actual filing date. After FRA value of spousal benefit does not get increased but her benefit does continue to increase. Before FRA, the value gets reduced.

Nicely explained video. Based on the spreadsheet example, they are the same age and Anne's spouse is not currently receiving benefits. I think that your spousal benefit calculation is not correct for the scenario shown. If I understand the SSA documentation and calculators, in calculating the MaxSP, the total would be reduced by the same percentage as Anne's early benefit amount (29.7%) because of deemed filing, so the MaxSP in this case would be $70.30 not $100, resulting in a total payment to Anne when her spouse files of $563+$70.3=$633.7. Am I mistaken?

IF— primary files before FRA and spouse takes spousal benefit at 62, if primary then dies, can the spouse remain on just the spousal benefit until FRA and then switch to survivor benefit which would be a higher benefit than survivor benefit taken earlier than 67? Or, is there no choice in the matter as to when the spousal benefit shifts to survivor? Thanks.

Good video. However, at 9:46 I don't see the breakeven in this example as being ~71.

* ($563/mo * 5yr * 12mo/yr) ~ $33,780 (Early-file advantage)

* ($33,780/$237-per-mo) ~ 143months ~ 11.9yr ~ 12yr (Years to breakeven with age-67 filing, thus age 79 breakeven).

Excellent Video – Thank You!