Stock Investment Portfolio Game Plan – How I Manage $300,000 (401k, 457, Roth IRA)

#investing #fidelityinvestments #investingforbeginners #stockmarket

In this video, I walk you through my stock investment portfolios. I think it’s important for beginning investors to visualize what a successful investor’s portfolio looks like.

In my 20 years of investing, I managed to grow my $2000 life savings into over $300,000 while paying off over $100,000 in debt.

—————————————————————–

Subscribe to the channel and learn how to achieve financial freedom!

Click the Like button if you enjoy this content! Thanks so much!

—————————————————————–

In this video, I share my holdings and my game plan for my emergency fund and my investment portfolios. I’m able to invest in individual stocks in my 401k and 457 retirement plans through Fidelity BrokerageLink, offered by my employer.

1:23 Emergency Fund

3:40 401K Portfolio

5:31 457 Portfolio

9:08 Roth IRA Portfolio

—————————————————————–

Free Investment Ebook

Free Emergency Fund Calculator

The Best S&P 500 ETFs

Best Places to Park Your Emergency Fund

Stock of the Month

—————————————————————–

DISCLAIMERS:

1. I’m not a financial advisor and this is not financial advice. This video is based on my opinion, provided “as-is”, and for entertainment purposes only.

2. Any specific promotions I mention were available when I published my video and are subject to change without notice.

3. All content is provided “as-is” without warranty.

AFFILIATE DISCLOSURE: My videos and content may include affiliate links where I receive a commission if you click on them and make a purchase. For your consumer protection, you should assume that all of my links are affiliate links….(read more)

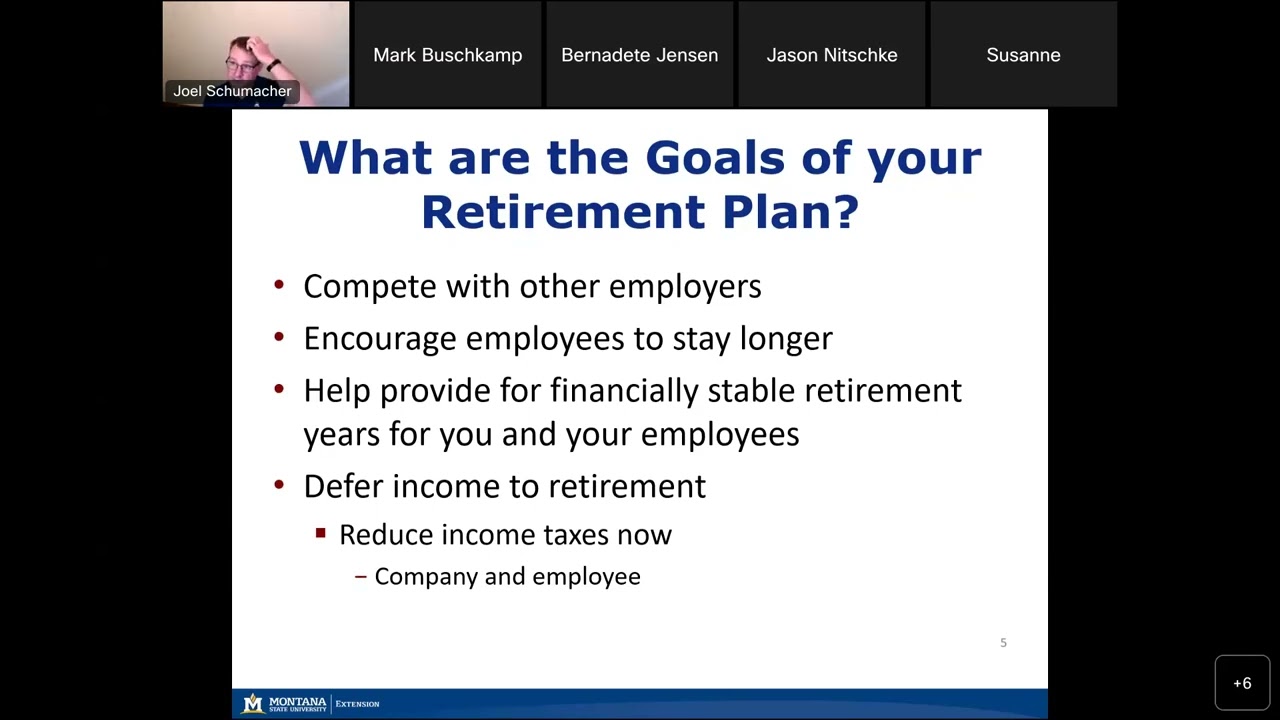

LEARN MORE ABOUT: Retirement Planning

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

What are you investing in? Mutual funds, individual stocks, or other? Leave a comment below.

Your thumbnails are great

Smashed the like button 12th like Thanks for sharing us your game plan I really want to grow my portfolio up to 1M before 40.

Thanks for the breakdown – good point on the matching, if we dont take it we are just leaving the opportunity to double our money that year! Big problem in the UK, seems so straightforward but as soon people hear the word pension they switch of :-/ maybe burying their head in the sand? eeeek!

Enjoyed your video! You're getting close to 300 subscribers! Nice!

Great video, Dropped a like! I recently made a video on this similar topic, we should collab!

Awesome video brother! Having a game plan is SO important. I love this kind of content and I look forward to seeing more content!

Great stuff Donnie! Right now I have my individual stocks and 401K. I’ll probably look to open up say a fidelity or vanguard account to strictly invest in mutual funds. Another excellent video man!

I agree with you, emergency funds are super important, especially in this market. My ER funds also can last me a lot longer than 6 months. Currently I mainly invested in stocks, ETFs, & real real estate. Thanks for the share. #2 like.