25% of Americans are delaying their retirement due to inflation. What type of budget strategy should you use to achieve financial independence and then retire early?

Sign up for Grammarly to make your writing clear and effective.

Please Read Affiliate Disclosure at the bottom of the description.

📝 Affiliate Link:

📖 Get Your Free Financial Spreadsheets and Resources 📖

➡️

👨🏫 1:1 Financial Coaching 👩🏫

Schedule a free 20-minute 1:1 Coaching Session

Schedule a free 30-minute 1:2 Couple’s Coaching Session

➡️ Introductory Forum:

📧 Email: hello@firepsychat.com

📖 What’s on my bookshelf? 📖

➡️

“1,000 Nights: Death’s Love Letter to Afghanistan”

“The Millionaire Next Door”

📷 Additional FIRE Videos Mentioned In this Video 📷

Financial Infidelity –

Our $2.8 mil Fat FIRE Plan –

$250K/Year Paycheck to Paycheck –

The 10-Step FIRE Checklist –

Calculate FIRE Number –

Customize Your Emergency Fund –

Build a $2.8 mil Investment Portfolio –

Pay Yourself First Budget –

How to withdraw $2.8 mil Fat FIRE –

How I saved my first $100K –

HSA vs FSA –

For sponsorships and business inquiries, please contact media@firepsychat.com

⏰ Table of Contents ⏰

0:00 Inflation

2:35 Pay Yourself First Budget

6:41 Spending Half of Income

#FIREPsyChat #FinancialIndependence #fatfire

🤳 Social Media🤳

Facebook:

Instagram:

Twitter:

🎵 Music and Sound Effects Provided by Epidemic Sound 🎵

Disclaimer: I am not a financial advisor. I am solely sharing my personal experience and opinions. All Strategies, tips, suggestions, and recommendations shared are solely for entertainment and educational purposes only. There are financial risks associated with investing. You must conduct your own research and due diligence, or seek the advice of a licensed advisor if necessary.

Affiliate Disclosure: Some of the links on this webpage are affiliate links, meaning, at no additional cost to you, we may earn a commission if you click through and make a purchase and/or subscribe. However, this does not impact our opinions and comparisons….(read more)

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

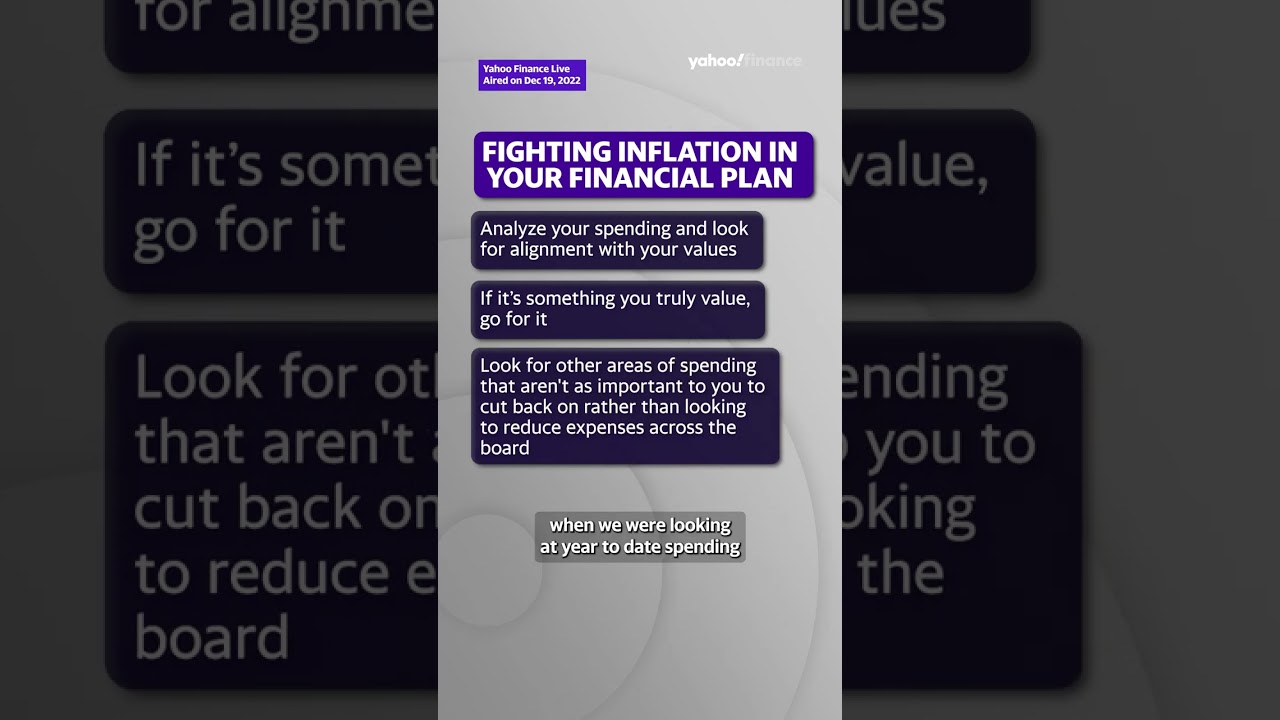

Retiring early is a dream for many, but can seem impossible during times of high inflation. However, with a sound budget strategy and some smart investments, it is still possible to retire early even when inflation is high.

Our strategy, known as the Fat FIRE (Financial Independence Retire Early) budget method, focuses on building a substantial nest egg and investing wisely to combat high inflation rates. Here are some key steps to follow to achieve early retirement during high inflation:

Step 1: Save aggressively

The first step to retiring early during high inflation is to save aggressively. This means living below your means and dedicating a significant portion of your income towards savings. The rule of thumb is to save at least 25% of your income each year, but the more you can save, the faster you will reach your savings goals.

Step 2: Build a diversified investment portfolio

To combat high inflation rates, it is important to invest your savings in a diverse range of assets that will retain their value over time. A diverse investment portfolio should include stocks, bonds, real estate, and other alternative investments.

Step 3: Invest in assets that protect against inflation

Inflation can erode the value of your savings over time, so it is important to invest in assets that protect against inflation. These may include commodities, gold, and real estate, which tend to appreciate in value during times of high inflation.

Step 4: Consider a part-time job during early retirement

If you are retiring early during high inflation, it may be worth considering a part-time job or freelance work to supplement your retirement income. This can help cover any gaps in your retirement income and provide a safety net during times of economic uncertainty.

Overall, the Fat FIRE budget method offers a solid strategy for retiring early during high inflation. By saving aggressively, building a diverse investment portfolio, and investing in inflation-protective assets, you can achieve financial independence and retire early despite challenging economic conditions.

How do you budget for FIRE? Contact us for a complimentary coaching session at https://www.firepsychat.com/coaching

Can you explain how you can retire at 45 when you can’t collect from your retirement accounts until much later?