![]()

This video examines the best age to file for Social Security Retirement Benefits and the big decisions around this important topic.

Every year million of American file to receive Social Security benefits. The decision is permanent and cannot be undone and is quite possible the single most important decision leading up to retirement, yet so many people treat filing for Social Security Benefits as casually as choosing a car color for their next automobile.

This video answers critical questions around: when to file early, when to file late and most importantly what the BAD reasons to file for Social Security benefits.

Questions to Ask A Financial Planner to Determine if They Know How Social Security Really Works

Please explain what the best age is for me to file for Social Security and Why?

Please explain provisional income to me.

What is the best age for my spouse to file for Social Security if her/his retirement benefit is less than half of mine?

What are Social Security Credits and how are they calculated?

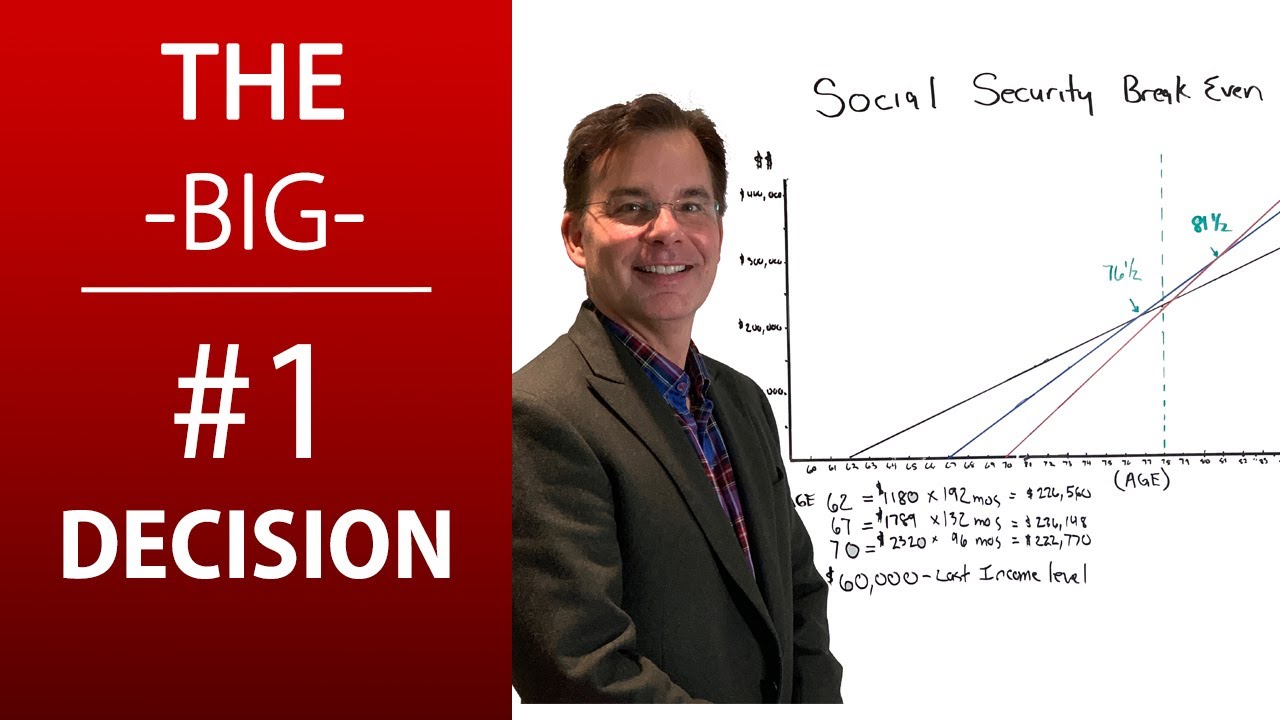

What is a Social Security Breakeven Analysis and is this a good way to determine when to file?

Do I need to file for for Social Security for my spouse to receive spousal benefits.

What is the Survivor Benefit and how is it determined?

What is the payout percentage difference between filing at full retirement age and minimum filing age?

Note: If you financial planner does not know the answer to these basic questions, I recommend that you move on to someone who does.

RECOMMENDED VIDEOS

Average Retirement Savings at 60 –

Average Retirement Savings at 50 –

3 Easy Ways to Boost Your Retirement Savings –

Average Retirement Savings at 40 –

How to Report Property Gains and Losses –

Disclaimer: this video is for educational and entertainment purposes only and is not meant to be a substitute for legal, accounting, tax, or professional advice. If you have any specific questions about any legal, accounting, tax or other professional service matter you should consult the appropriate professional services provider….(read more)

LEARN MORE ABOUT: IRA Accounts

CONVERTING IRA TO GOLD: Gold IRA Account

CONVERTING IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

Thanks to all of those who have commented. Please see my video on The Average Retirement Savings at Age 60 here -> https://www.youtube.com/watch?v=8lPdFPaXa1k&t=15s

The biggest think money can’t buy is time.

My SS benefit is $40K per year. I have additional Fixed income of $10K. (Taxed as ordinary income) I am mid-sixties, live in a state without Income Tax, Single individual doing Roth Conversions and can chose whatever AGI I want under $111K. (Level 2 IRMAA maximum) What would be the Conversion sweet spot from a Social Security tax perspective within a annual range between 20K to 60K which I'll be doing over 10 to 15 years? PS love the Videos, keep up the great work.

Will the value of my social security diminish over time, say the next 10 to 20 years due to inflation? Do you have any historical data?

This was great! Thank you.

Good, straight forward video.

I never know if these charts assume you quit working at 62 or keep working until 70. I guess it assumes you quit working at 62 but dont file until 70.

If a person only has 25 years of work credits at 62, what are the points to wait for the full retirement age to take SSB? The average of the income credit for the 5 waiting years are 0. His/hers SSB maybe reduced comparing with the SSB estimate statement due to 0 credit from these 5 years. Am I wrong?

I turn 68 in May 2022 and still working a full schedule. This is enjoyable for a bachelor's life. Also, when SSA income starts it may move my base tax bracket up. Since I work for WDW my hourly income is not that much. So should I take it this year at 68? I did notice on the SSA website the sliding scale shows if I wait till 68.8 there is a big increase monthy. Have a Magical Day.

I don't think it's correct to look into this without looking at inflation. A $2,000/month benefit today isn't going to be worth $2,000 in 7 years in todays dollars. Baring deflation, the today's dollars are worth more than future dollars. Also worth investigating is Cost of Living Adjustment's. Obviously a bigger payment is going to grow more over time through COLA than a smaller payment.

No man in my family has ever made it to 76. I'm not waiting a day past 62 to file. Even if I make it past 76, I'll likely be slowing down.

The best age to begin collecting Federal welfare is 70. If you don't believe me look at your SS statement. This is not difficult, let's not make it difficult.

The best year to retire is when you are 64 and your company offers you $40,000 to retire 6 months before you planned on retiring…. ;o)

Terricfic analysis with some caveats. Many variables exist and this is contingent on predicting the future. With so many variables one is less likely to get all the correct answers. A person's health can change with a visit to the doctor. I would say that as one gets older their quality of life will surely diminish regardless of how old they live. The life expectancy is higher today then it use to be due to medicine. I had a relative with memory issues who was alive but her mental facilities were severely impaired.

Thanks for the videos – I have watched quite a few of yours over the last few weeks.

I'm in my early 50's and working hard on retirement savings. I am seriously considering early retirement due to family genetics on my dads side. Very few people on that side made it much past 80. I would like to enjoy a few years of good health / do some traveling before the possible shortening of my years hits….

If you can live that long.

What is you file early and invest the money?

My break even point is at 78. My wife and I plan on taking SS out at 62. I want to do things before my health starts to fail me. We will not be hurting financially.

Can I ask you I am 74 and retired for years don't think I will make it past 85 to 88 having challenges now.. My wife is a corporate director makes 6 figures and will be 66 & 3 month full retirement age in March 2022 not far away 5 months but wants to work until at least 2 more years. She also has a very healthy 401K. She thinks she will be like her Mom which is 94 right now and may live a couple more years. Not worried about the 401k more on the SS for her to start collecting or because of her income thinking she should wait to collect SS only after she really QUITES the day job. Thank You

I intend to take it early as I'm older than my wife. We are savers so in 7 years I will be able to retire and she will follow suit 4 years later. Plan to ahve everything we own paid off by then so hopefully can live and enjoy our later years without stress. Good video.

The only reason for the "dislike" is that at some point in time SS will be done. AKA….no funds

For folks that have funded retirement, like us, we never expected SS to be available.

In a previous video…you mentioned age to maximize the funding.

Not one single person in our family has lived longer than 77 years old.

While I would love to live past it to be in both my wife and I going past 80…….it probably won't happen.

Please discuss this scenario in a future video.

In the last three months I have had two friends tell me I’m wrong for taking Social Security when I plan to. Mind you, these people have no idea what my financial situation is, what my investments are, or the balance of my 401(k) is. They got advice from a broker or another friend and figured if the advice is good for them, it’s gotta be good for me. Everybody’s situation is different but these friends seem to have forgotten that.

I'm 63 but have good friends in their 90s. Both have fair to poor health and wanted to go home to revisit England 2 years ago. I went along because they could never have made it on their own. Moral of the story: All the money in the world is useless if you cant spend it and enjoy it while healthy. Good health is everything. Great Video!

You only have NOW

I’m 63, l have no expenses, should I start collecting ss now and invest?

78 is too young to use as age of death for this calculation. It should use at least 82 because that is the life expectancy for men who are past age 62, and it goes up to 84 for women.