![]()

There’s a very easy “do it yourself” method to investing that not only outperforms the vast majority of retail and professional investors, but also saves you a ton of time, energy, and money along the way.

And that investing method is called…wait for it…The 3 Fund Investment Portfolio.

In this video, I’ll show you what makes the 3 fund portfolio so successful, the steps to properly create this portfolio in your own account…which aren’t always so obvious, I’ll give you a list of the funds needed to create the portfolio, and show you the actual historical returns based on a few backtested 3 fund portfolios I put together.

Check Out My Recommendations (It helps support the channel):

🔥 M1 FINANCE Investing- Free $10 (once you deposit at least $100 within 30 days)

Here’s a video on how to use M1 Finance

📝 Empower (previously called “Personal Capital”)- Free Net Worth Tracker & Retirement Planner

🔒 AURA – 14 day free trial to see if your personal information has been leaked online

💎 WEBULL – Up to 12 Free Stocks When You Deposit Any Amount Of Money

💵 ROBINHOOD – 1 Free Stock

Join the Private Financial Independence Community for monthly private live streams, video calls (with myself and the community), as well as access to a discord group where we talk all things money (and a lot more):

📧 Business Inquiries: JarradMorrowYT@gmail.com

00:00 Intro

00:46 What Is The 3 Fund Portfolio?

01:43 Benefits Of Using Total Market Index Funds

02:15 3 Fund Portfolio Benefit #1

02:33 3 Fund Portfolio Benefit #2

05:01 3 Fund Portfolio Benefit #3

06:14 3 Fund Portfolio Benefit #4

08:09 3 Fund Portfolio Benefit #5

09:05 The 3 Funds To Invest In

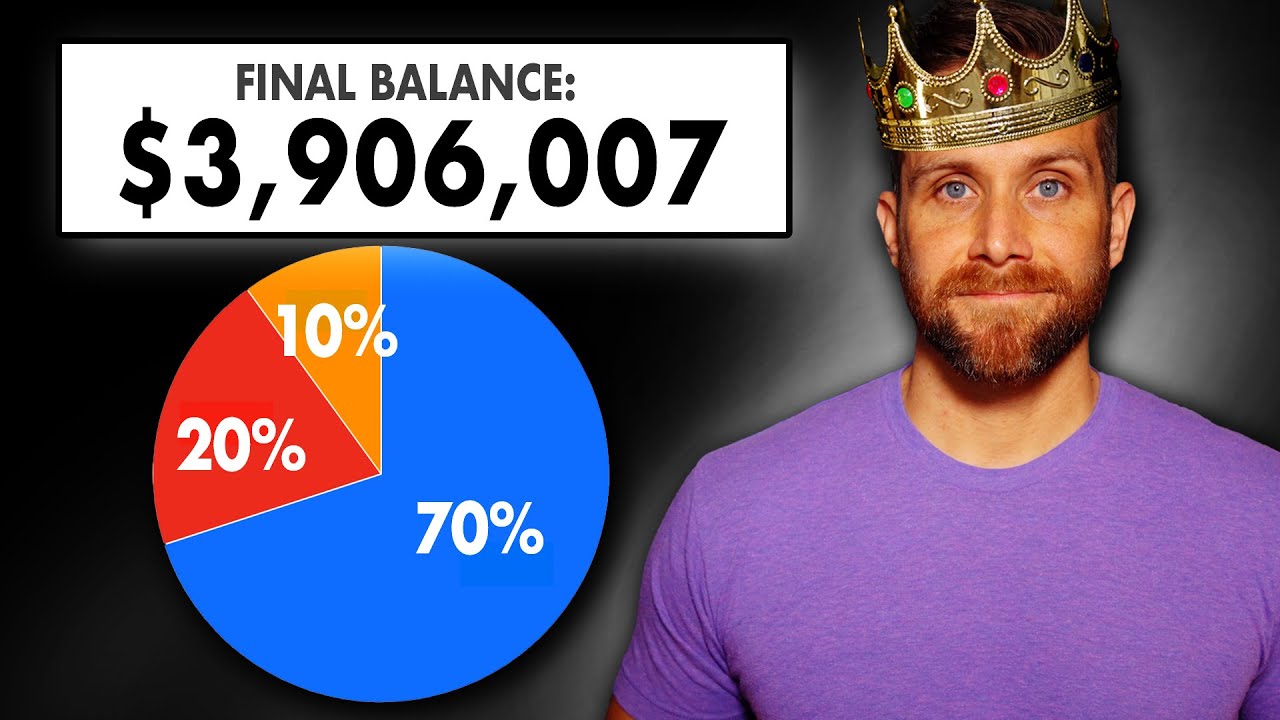

11:07 3 Fund Portfolio Asset Allocation

14:33 International Asset Allocation

15:20 When To Rebalance 3 Fund Portfolio

15:42 How To Apply The 3 Fund Portfolio

Affiliate Disclaimer: Some of the above may be affiliate links. Support the channel by signing up or purchasing through those links at no additional cost to you. I appreciate you for helping me keep this channel running

Disclaimer: This video is for entertainment purposes only. Everyone’s situation is different so do your own research before making any decisions with your money. If you need help then contact a Certified Financial Fiduciary before trying anything that is mentioned in this video. I prefer a Fiduciary financial advisor that charges an hourly fee as opposed to an ongoing fee based on a % of your portfolio. Always remember that incentives determine the type of advice they give you so one that charges an hourly fee is less likely to be problematic….(read more)

LEARN MORE ABOUT: IRA Accounts

INVESTING IN A GOLD IRA: Gold IRA Account

INVESTING IN A SILVER IRA: Silver IRA Account

REVEALED: Best Gold Backed IRA

Why The 3 Fund Portfolio Is King

Achieving financial success is a goal that many individuals strive towards. Whether it be saving for retirement, purchasing a home, or simply building wealth, investing is often seen as a viable means of achieving these goals. However, the world of investing can be complex and overwhelming, with countless options and strategies to choose from. One investment strategy that has gained significant popularity and is often hailed as the king of portfolios is the 3 fund portfolio.

The 3 fund portfolio refers to a simple, yet highly effective investment strategy that involves investing in just three broad index funds: a total stock market fund, a total international stock market fund, and a total bond market fund. The beauty of this approach lies in its simplicity and diversification.

Diversification is a key principle of investing. By holding a variety of assets, investors can minimize their risk exposure and spread it across different sectors and markets. The 3 fund portfolio achieves this by investing in different asset classes. The total stock market fund provides exposure to the entire U.S. stock market, including both large and small-cap stocks. The total international stock market fund gives investors exposure to companies outside of the United States, allowing them to benefit from the growth of global economies. Lastly, the total bond market fund helps to provide stability and income through fixed-income investments.

Furthermore, the 3 fund portfolio is known for its low costs. By investing in index funds, which are passively managed and mimic a specific market index, investors can avoid the high fees associated with actively managed funds. This cost advantage can significantly impact long-term returns, allowing investors to keep more of their hard-earned money.

Another compelling reason why the 3 fund portfolio is considered king is its historical performance. Numerous studies have shown that holding a diversified portfolio of low-cost index funds can outperform more complex investment strategies, including those managed by professionals. This is because actively managed funds often struggle to consistently beat the market after accounting for fees and other expenses. By keeping costs low and focusing on broad market exposure, the 3 fund portfolio provides investors with a higher probability of long-term success.

Additionally, the 3 fund portfolio requires minimal effort to maintain. Unlike other investment strategies that require constant rebalancing and monitoring, the simplicity of this portfolio allows investors to spend less time managing their investments and more time focusing on other aspects of their lives. This hands-off approach is particularly appealing to those with busy schedules or limited knowledge about investing.

In conclusion, the 3 fund portfolio has earned its reputation as the king of portfolios for several reasons. Its simplicity, diversification, low costs, and historical performance make it an ideal choice for both novice and experienced investors. By investing in just three broad index funds, individuals can achieve their financial goals and enjoy peace of mind, knowing that their portfolio is well-positioned for long-term success. So, if you’re looking to build a solid investment strategy, consider the 3 fund portfolio as your royal path to financial prosperity.

Why didnt you show data proof point comparing such a portfolio over say last 20 years invested with $10k versus S&P, NYSE, NASDAQ each???

The bond funds keep losing money. I don't understand why this is a good investment. Over 5 years, it's lost value. Over 10 years, it's lost value. What am I missing?

Creating a hypothetical portfolio of high return investments is really easy to do in retrospect.

Low risk low reward.

because only the needle is valuable? the haystack is low value.

Dave Ramsey always talks about investing in Mutual Funds with a track record of outperforming the market. Even with fees he getting a better return than the S&P 500. Is it as easy as he is making it seem? Thanks

BRK has beaten the market for over 30 years for me. Simple, easy, I’m sticking with it

This is one of the most important investing videos ever. Your closing thoughts, along with the varying strategy options, while maintaining the singular strategy, were phenomenal. Thank you for summing it up so well

So the Vanguard funds in row 1 beat fidelity in 3 – even with the double expense ratio

Earlier in the video you’d mentioned looking for the lowest expense ratio

I was looking toward the first row, but that’s $7.5k difference in $500k, which does add up

What do you feel on the double expense ratio, versus VTI and row 1 being the winners – aside from the amount of stocks included (which was the big point you’d mentioned, though they’re close – the bonds are further off in amount!)

I have 200k lumpsum to invest. Should i do lumpsum followed by regular basis? Or even DCA this lumpsum as well? If latter, then what to do with lumpsum in the meanwhile?

Thank you so much

The only one that doesn't make sense is BND. Why invest in something that has a 10 year average of 5% when you can just get a high yield savings or a CD for around 5% ABY for no risk.

Yo, Bradley Cooper, thanks for the info! 🙂

Lame. Just invest in SPY

Does it matter if I max out my Roth IRA at one time, or slowly and consistently throughout the year?

this guy is cuuuute

Im trying to invest my kids custodial accounts. What 3 fund ratio would you recommend. they are only 2 years old.

Jarrad,

On your different asset allocations worksheet do the returns, worst year, and max drawdowns still apply?

As I get closer to retirement I think I would be happy with a 6% return if the worst year is around -4% while in retirement.

Your thoughts?

Thanks

Why did you choose VTI which has on average underperformed SPY/VOO by around 1%?

Bonds got rekt recently, this portfolio got crushed.

How about vti, vxus and schd?

Substitute the bond with Warren Buffett's Berkshire Hathaway

VGT and SCHD all day every day!

Great video thanks!

Love the edbassmaster clip you threw in there @JarradMorrow hahahahaha

I’m confused, I just watch your video about how target date funds are bad because you shouldn’t be in any bonds when your young?

Excellent advice for the novice. Me.

I currently do a 50/40/10 split every week in order 1)VTI 2)VOO and 3)BND. Should I switch out the # 2 for an international stock index fund ?

My wife and I just opened Roth IRA accounts and 32 years old. Is it smart to choose Vanguard for me and either Fidelity or Schwab for her? Assuming it’s not smart to choose the same portfolio. If I do total stock fund (VTI) is it smart for her to do an S&P index fund (SWPPX)?

what are your thoughts on replacing the international fund with a large cap growth? Replacing the bond fund with a dividend fund?

What do you guys think about these proportions:

40% VTI

20% VXUS

40% BND

Yay or nay?

What site did you use to get the different returns (minute 11:40)? Looking for one that uses specific index funds (not market segments).

Hello,

I came to this channel because the algorithm, but, what surprising amount of knowledge you share for people like me who has little knowledge about financial strategies. Quick question. Does Vanguard has the same portfolio mix for a Roth IRA? It so sad how my Latino community doesn’t know all of these. Don’t know if you have the capability to include Spanish subtitles. You will be increasing your audience, plus impact a less privileged sector in much need of this information. Thanks

9:44 Hi, I'm currently investing in the 3 Fidelity funds in row #5 of your chart. Quick question… I want to add a nice paying dividend ETF as a 4th fund in my portfolio (ie. SCHD). What type of allocation % would you recommend if adding in SCHD?

I’m new to vanguard .. I know how to buy ETF and know how much percent I want to put in my 3 fund portfolio, I’m just not seeing the percentage option on vanguard… I NEED help….

Really outdated IMHO

A aggressive growth etf

And dividend etf

Income etf

QQQ or like as aggressive

Schd or like as dividend

Jepi or like as income

What major company in USA is not global?

Thoughts???

Good video. But my friend, both international index fund investing and bond investing is not that simple also. Developed markets and Emerging markets have different risk and return profiles. During market downturn, emerging markets fall swiftly and much more than the developed market. Also, bonds fall swiftly in case of interest rate rise (like what is happening since last year). So, portfolio reallocation, according to the economic & market conditions is the key. It may be difficult, but is the secret behind long-term outperformance.

Where can I buy total US BOND INDEX FUND?

This video made me subscribe. Specifically the part where you discussed the risk and reward of the stocks vs bonds. I'm new to investing in a Roth IRA and this is very helpful. Thank you!

Our 401k doesn’t offer an index fund for the total US market, but it has S&P 500, extended market, and small cap. I’m leaning towards S&P 500 and small cap—or is there a reason I should opt for the extended market instead of small cap? Extend market index fund had a much bigger loss this past year than the small cap one, but I guess that could mean a bigger rebound potential.

It’s a great advice! That’s pretty much all of it.

Great video! I was wondering, how do you go about rebalancing within a taxable account? Since you'd likely want to avoid triggering any taxable event. When rebalancing, would I just focus on adding more money within the allocation that is lower?

Should I have my

3 fund portfolio inside a Traditional IRA or Roth IRA account ?

Which is better

Good common sense!

Is a 5% onetime fee on a mutual fund advisor

Thanks for the video. I'm 24 and ready to start building a portfolio. I'm going to start investing 100% in stocks. It's high risk, but I know it will grow in the long term so there is no need to panic when the stock market dips. My question though is when exactly should you start to incorporate bonds in your portfolio? And once you start to do that, how often should you increase the percentage of bonds in your portfolio and by how much?