![]()

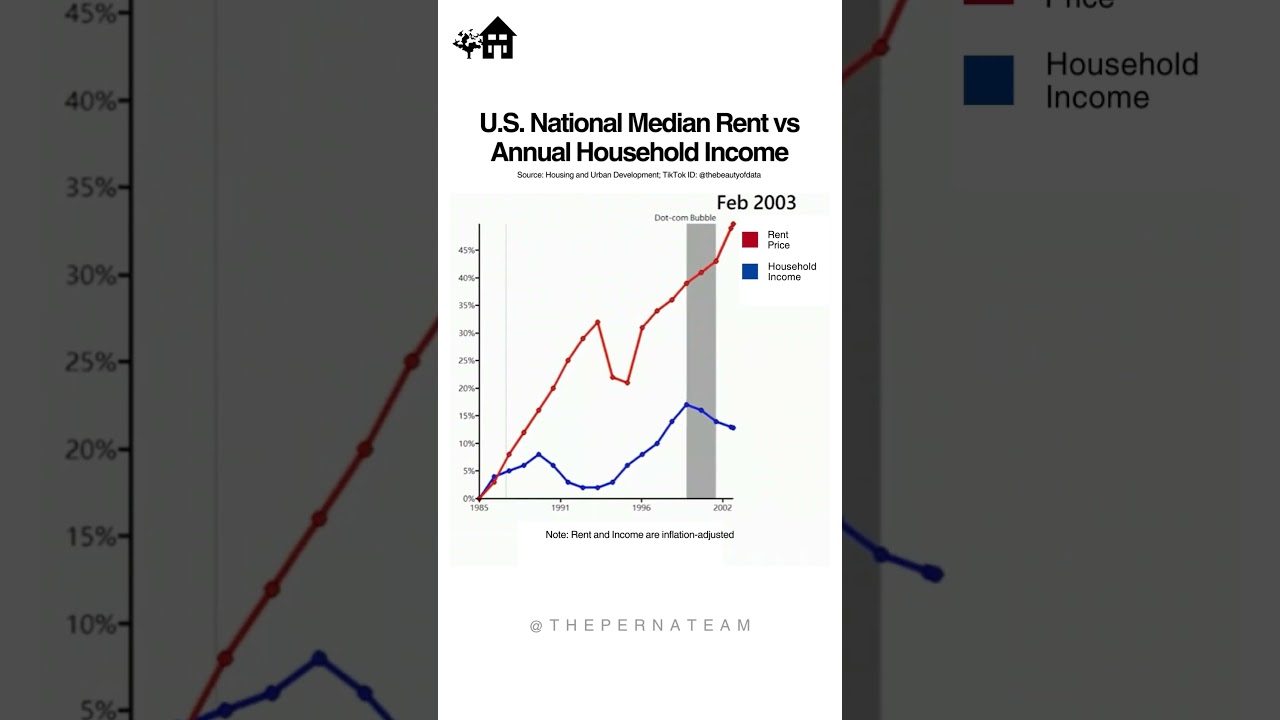

For the past 40 years, the issue of rising rent prices compared to household income has been a growing concern for many people across the world. As the cost of living continues to rise, individuals and families are finding it increasingly difficult to afford suitable housing in many urban areas.

According to a recent study, the average rent in the United States has increased by over 70% over the past four decades, while household incomes have only grown by around 30% during the same period. This disparity has led to a situation where many individuals and families are struggling to make ends meet, as a significant portion of their income is being spent on rent payments.

One of the main factors contributing to the rise in rent prices is the shortage of affordable housing in many cities. As urban populations continue to grow, the demand for housing has outpaced the supply, leading to a surge in rental costs. Additionally, gentrification has also played a role in driving up rent prices, as wealthier individuals move into lower-income neighborhoods, pushing out long-time residents who can no longer afford the rising rents.

The impact of this trend has been particularly felt by low-income households, who often spend a significant portion of their income on rent, leaving little left over for other necessities such as food, healthcare, and education. This has led to a rise in homelessness and housing insecurity, as many individuals are forced to choose between paying their rent and meeting other basic needs.

In response to this growing crisis, policymakers and advocates have been pushing for solutions such as rent control, affordable housing initiatives, and increased funding for social services. However, progress has been slow, and many individuals and families continue to struggle with the burden of high rent prices.

As we look to the future, it is clear that addressing the issue of rising rent prices compared to household income will require a concerted effort from government officials, community leaders, and individuals alike. Only by working together can we create a more equitable housing market that ensures all individuals and families have access to safe, affordable housing.

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

This is what Congress should be addressing rather then all the made up BS politics that’s banding around now

necessities will always be on the up.