▸▸▸Enroll in our 365 Days to F.I.R.E. Program! – Enrollment is now open for our class of 2024, 365 Days to F.I.R.E. program! As part of the program, you will get to attend our 2024 meetups in Portugal (with more than 500 people attending the meetups this year!), get assigned daily FIRE tasks to complete, participate in live monthly Q&A sessions with us, be broken into smaller accountability groups with other people in the program, attend quarterly book club meetings, get personal coaching from us (for those in the coaching plan) . . . and more!!! Enroll today!

▸▸▸Enroll in our Stock Market Investing Course for Financial Independence and Retiring Early: Enroll in our new 21 module, 4-plus hour stock market investing course with more than 30 handouts of summary notes, homework assignments, and resources. Learn how to research and select investments, how to determine your asset allocation, how to rebalance your portfolio, how to optimize your investments for tax purposes, how to automate your investments, and much more (including a 19-page Investment Plan to work on)!

▸▸▸Enroll in our FIRE Master Class: This FIRE Master Class is designed for people interested in pursuing financial independence and retiring early. In the Master Class, we explain how to live off of your investments during early retirement; how to withdraw money from your investment accounts to support your living expenses during retirement; how to calculate your FIRE number; new and creative ways that you can save money; new side hustles for making money; how to invest in the stock market and in real estate; we discuss healthcare options in retirement . . . and MORE!

▸▸▸Enroll in our How to Move to Portugal Course: A Step-By-Step Course to Relocating and Living in Portugal: This course is designed for people interested in moving to Portugal. In the course, we explain the visa process, the documents you need to submit for your application, and the step-by-step process that we took to obtain our visas; we explain the residency permit process and how we obtained our residence permit here in Portugal; we explain the process for buying and renting a house in Portugal; we discuss healthcare, school options, and setting up NIFs, we explain taxes here in Portugal, and MORE!

▸▸▸Follow us on Instagram:

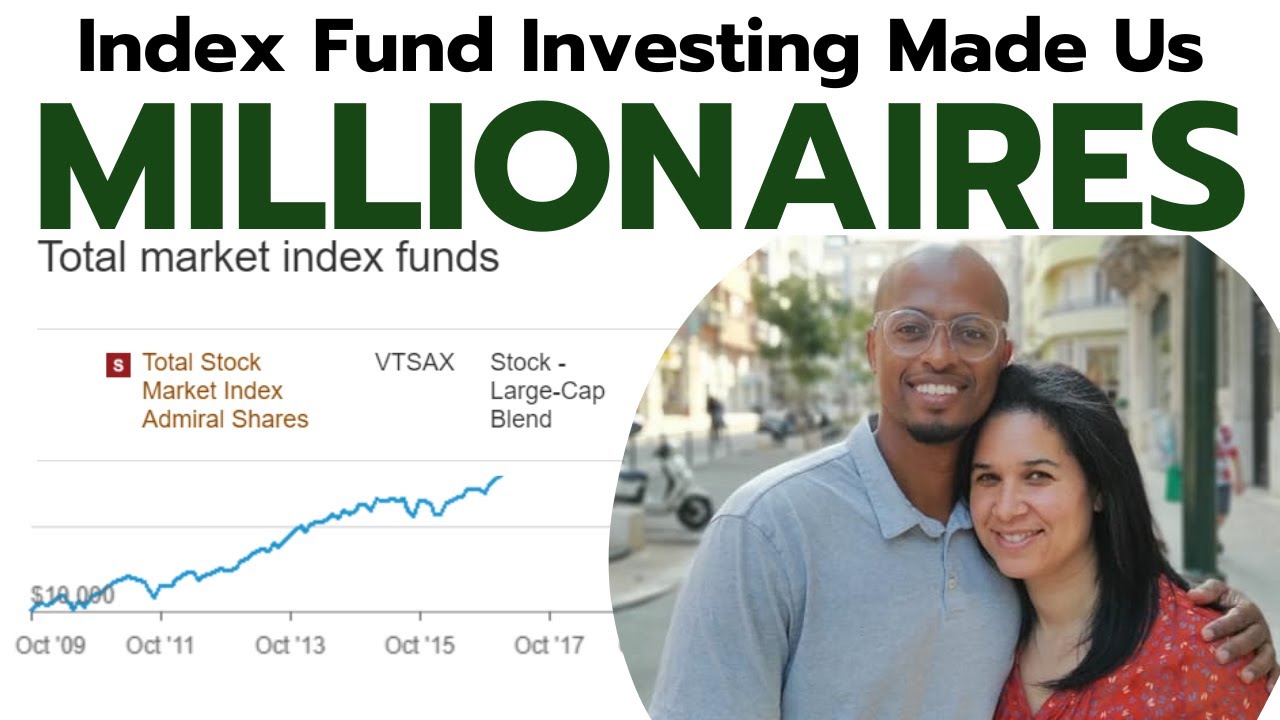

Our Rich Journey – How to Become a Millionaire with Index Funds | Vanguard, Schwab, & Fidelity: If you’re familiar with our FIRE journey, you know that a large part of our FIRE success is due to investing in index funds. Several months ago, we did a video on VTSAX (a Vanguard index fund). We got so many questions from that video and so much interest in index funds, we decided to do an in-depth video on index funds. So . . . in this video, we dive more into our discussion on index fund investing. We talk about the history of the index fund, why the index funds was originally created back in 1975, we share index funds we invest in, and we share our top picks for index funds with Vanguard, Schwab, and Fidelity. Thanks for watching!

▸▸▸Check out some of our other videos!

Vanguard’s VTSAX Index Fund: Our #1 Investment for Financial Independence Explained:

Music: bensound.com

▸▸▸PLEASE SUBSCRIBE:

If you like our video, please make sure to “like” the video and subscribe to our channel. We post two videos a week related to our journey towards financial independence, including making money, saving money, and investing money. Make sure to check out all our videos and . . . join the journey!

DISCLAIMER:

We are not financial advisors. Our videos are for educational purposes only and merely cite our own personal opinions. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary. Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Always remember to make smart decisions and do your own research!

AFFILIATE DISCLOSURE: Some of the links on this channel are affiliate links, meaning, at no additional cost to you, we may earn a commission if you click through and make a purchase and/or subscribe. However, this does not impact our personal opinions.

#FinancialIndependenceRetireEarly #IndexFundInvesting #StockMarketInvesting…(read more)

LEARN MORE ABOUT: IRA Accounts

INVESTING IN A GOLD IRA: Gold IRA Account

INVESTING IN A SILVER IRA: Silver IRA Account

REVEALED: Best Gold Backed IRA

How We Became Millionaires with Index Funds: Vanguard, Schwab, & Fidelity

In a world where financial success seems elusive for many, there is a simple investment strategy that has made thousands of people millionaires – index funds. These popular investment vehicles offered by companies such as Vanguard, Schwab, and Fidelity have reshaped the landscape of personal finance, allowing ordinary individuals to build substantial wealth over time.

So, how exactly do index funds work, and how did they contribute to the creation of millionaires?

Firstly, let’s understand what an index fund is. An index fund is a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific market index, such as the S&P 500. Instead of relying on an expert fund manager to handpick individual stocks, an index fund invests in the entire index, providing broad exposure to a diverse range of companies.

One of the key advantages of index funds is their low cost. Traditional mutual funds often charge high management fees, but index funds typically have rock-bottom expense ratios. This means that more of your money is working for you rather than being eaten up by fees. Over time, the compounding effect of this cost-saving can significantly boost your investment returns.

Another advantage of index funds is their low turnover. Since they aim to replicate the performance of an index, there is no need to frequently buy and sell stocks within the fund. This reduces transaction costs and capital gains taxes, further enhancing the overall return on investment.

Now that we understand the basics of index funds, let’s explore how they contributed to individuals becoming millionaires.

Firstly, the power of regular contributions cannot be understated. By consistently investing a portion of their income in index funds over a long period, individuals have been able to harness the power of compounding. Reinvesting dividends and capital gains, along with the steady growth of the overall market, have enabled investors to accumulate substantial wealth.

Secondly, index funds provide a level of diversification that individual stock picking simply cannot match. By investing in thousands of companies through a single fund, investors are shielded from the volatility and risk associated with betting on individual stocks. This diversification not only provides potential downside protection but also allows investors to participate in the overall growth of the market.

Furthermore, the simplicity and accessibility of index funds have made them an excellent choice for investors of all backgrounds. Whether you are an experienced investor or just starting on your investment journey, index funds offer a straightforward way to participate in the growth of the global economy.

Companies such as Vanguard, Schwab, and Fidelity have played a significant role in the popularity and success of index funds. Their commitment to low-cost, customer-focused investing has made index funds accessible to a wide range of investors. These firms have also placed a strong emphasis on education, empowering individuals to make informed investment decisions and achieve their financial goals.

In conclusion, index funds offered by Vanguard, Schwab, and Fidelity have revolutionized the investment landscape, turning many ordinary individuals into millionaires. By providing low-cost, diversified exposure to the market, index funds have proven to be a reliable tool for long-term wealth creation. So, if you dream of becoming a millionaire, harness the power of index funds and start your investment journey today.

![[Global Debut] “The Financial Dark King of the Dragon Emerging from the Abyss” – Delivery Guy Delivering Abortion Pills Turns Out to Be Ordered by Girlfriend? I Sacrificed Everything for You, Only to Face Such Betrayal, Truly Outrageous! #HotShortDrama #ShortDramaRecommendation #Rebirth #Urban #PowerfulWriting #City](https://i.ytimg.com/vi/NYhbyUCTvw0/maxresdefault.jpg)

Fidelity is a great company, buy and hold forever.

Please give advice. Im currently using Vanguard Voo for brokerage account and Swab S&P 500 for IRA. Should i try something other than S&P 500?

How do you get your money out ???

Once a year

Started with Vanguard set up by my mom when I was 15 and kept maxing out the Roth IRA every year in first a target retirement fund and then a full 100% stock VFIAX index fund. I’m currently 35 and it’s grown to almost 400k, still won’t stop and keep grinding.

How much would I receive if I’m starting now at 27 or is it too late at my age?

I'm using Vanguard. Is it better to buy 1 index fund (VTSAX) and throw ALL money there. Or buy multiple index funds and throw money at all 3 equally?

Thank you very much!!! Your experience inspires me a lot!

Sounds great, thanks!

So you need to reinvest the dividends separately every time?

And what about the taxes – need to submit every time you get dividends, isn't it?

Maybe it's better to buy "accumulating/reinvesting" ETFs so these 2 things will be easier?

What are the accumulating ETFs similar to the ones mentioned in this video?

Thanks

How is possible to open three Roth IRA account with the same broker?? That means you can only contribute $2,000 on each now for 2023 and choose different investments on each??

Very informative. Thank you for putting this together!

Which one is better to invest VOO vs VOOG.?

How to create my account for these mutual funds account

Thank you so much for this video! I can’t wait to get started!

Do you look at turn over ratio when deciding which funds to invest in?

Good for you, it seems you are both responsible and helpful

I love Vanguard! I’m a big buyer of VOO and VBR.

Wait.. so y'all just invested into one index fund?

Hi i was trying to watch a couple of your sold videos and get caught up abt Index Funds and Vanguard but they wouldnt play..gave a msg that says the vid is private

I told my ex girlfriend many years ago to save money or invest and she said you’re the man of the house you pay rent and bills and with her pay she would only buy food for the house and the rest was her choice of spending it shopping, clubbing, clothes and taking the kids out to amusement parks, movies and when her job got slow she was frustrated and I felt like she always wanted to fight and would bring out money problem. We ended up splitting I left on my own . I don’t need to pay her child support cause the kids are from another father which never supported them but still love the kids and now I can say I live well I got some investments and some money saved. I wish she would have agreed to invest and we probably still be together. I wish her the best in life.

Can you please do a video showing in detail which to invest in and how to even invest in these funds from anywhere in the world?

Does vanguard allow fractional share buying?

I love index investing. Thanks for the inspiration to keep index investing!

Did you invest in taxable brokerage accounts for most of this?

good morning. what type of accounts you have

All good if you speak about 2009 2016

if I invest in sp500 index fund, is there any penailty if I withdraw at some point?

This is all very nice, but retirement is not a good thing. The most dangerous year of your life is the first. The second most dangerous year of your life is your first year of retirement. Making money is one thing but retirement is not desirable.

This was a great video! I invest in VFV which is essentially the Canadian version of VOO (Tracks S&P) by putting $100 into it every week and reinvesting dividends. I'm 30 now and I wish I started earlier but I'm happy it started now. Another thing that's popular is people that retire at the age of 60 after index fund investing their whole life, they will withdraw all the money tax free and put it in a REIT or high dividend yield Vanguard fund that's pays monthly dividends and you can live off it. Literally like $10,000 a month in dividends and then you have your actual shares too. I will always be index fund investing thank you!

watching this at 16 so I can start investing at 18

Is it possible to invest on Vanguard whilst you are outside the US? I live in Zimbabwe.

Coherent and confidently presented . Thank you.

congrats to you two. great to hear that you are both on the same page when it comes to investing

We had an 11 year bull run since 2009. All people had to do was go equities and dump as much cash into the market as they could. Instead, people spent that time complaining about Obama and then Trump. Not one of them seriously impacted your life.

Are these funds still good to invest in?

Can this be set up in a ROTH IRA?

Thank you for the info. Once you begin any index, ETF, mutual fund when or how do you withdraw cash?

Hey! I am from india… New member in your family ❤️

Very clear explanations! Thank you!