Checked your 401k lately? The recent financial collapse has devastated this retirement resource. Older workers are hardest hit, as their financial futures may now be at risk. Steve Kroft reports….(read more)

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

The 401k Fallout: Exploring the Consequences of Retirement Savings Decline

In recent years, the decline of 401k retirement savings has sparked concerns about the financial well-being of future retirees. With 401k plans being a popular option for retirement savings in the United States, the implications of this downturn are vast and far-reaching. Let’s explore the factors contributing to this fallout and the potential consequences facing individuals and society as a whole.

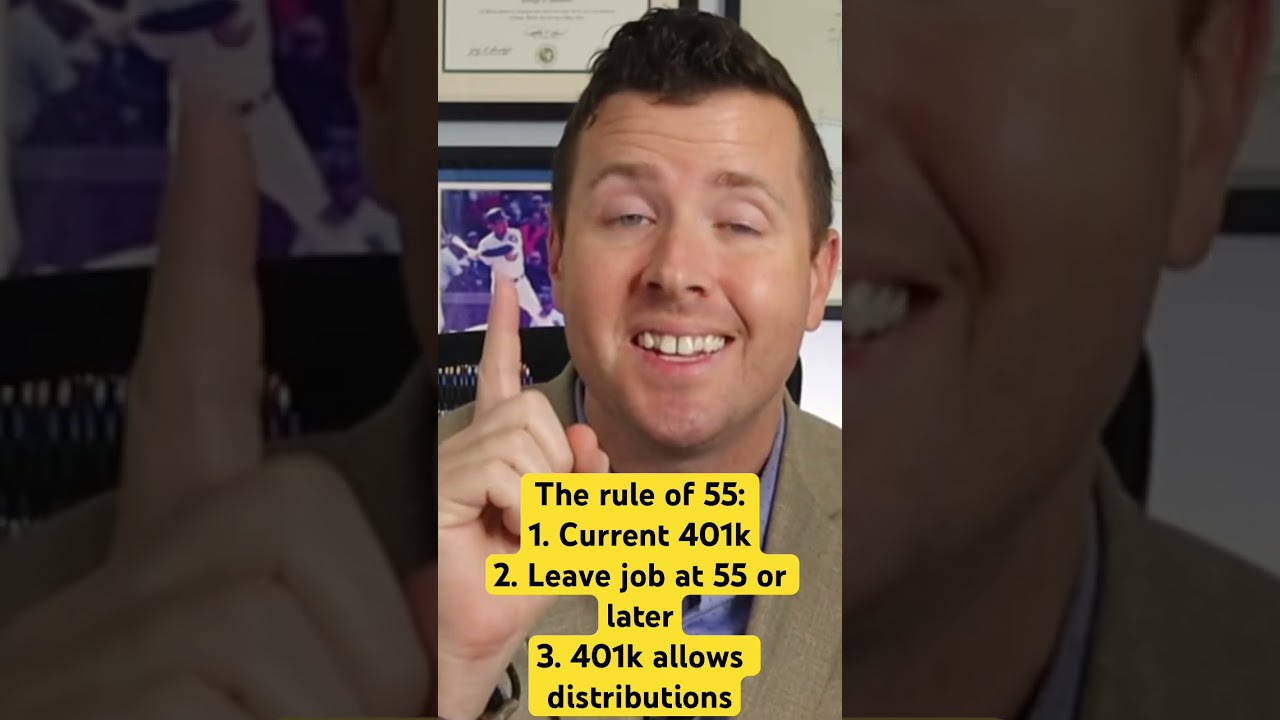

First and foremost, it is important to understand what a 401k plan is and its significance. A 401k is a tax-advantaged retirement savings account offered by employers to their employees. It allows individuals to set aside a portion of their pre-tax salary, which is then invested in various financial instruments such as stocks, bonds, and mutual funds. The goal is to accumulate a substantial nest egg to support oneself during retirement years.

One significant factor contributing to the decline in 401k savings is the lack of financial literacy among individuals. Many employees may not fully comprehend the importance of actively contributing to their 401k plans, failing to maximize the potential growth of their investments. Studies have shown that a substantial number of employees do not take full advantage of employer matching contributions on their 401k plans, missing out on essentially free money.

Moreover, stagnant wages and the rising cost of living have left many individuals struggling to make ends meet, leaving little room for retirement savings. As people prioritize immediate financial needs, the priority of saving for retirement falls lower on their list of concerns. This, coupled with the absence of comprehensive financial education, creates a perfect storm for dwindling 401k contributions.

Additionally, the reliance on 401k plans as the primary source of retirement savings has become increasingly risky. Traditional defined benefit pension plans, which were common in past decades, have become less prevalent, shifting the responsibility of retirement savings onto individuals. This shift places the burden of investment decisions and market fluctuations onto the employees themselves, leaving them vulnerable to the risks and uncertainties of the stock market.

The consequences of the 401k fallout are varied and far-reaching. On an individual level, retirees may find themselves struggling financially during their golden years. Without substantial savings, they may have to rely on social security benefits, which may not be sufficient to maintain a comfortable lifestyle. Increased financial stress on retirees ultimately translates to increased strain on government resources as well.

Furthermore, the decline in 401k savings has broader societal implications. With fewer individuals accumulating significant retirement funds, the burden may fall on the younger generation to financially support their aging parents or relatives. This may lead to increased financial pressure and economic strain on younger individuals who are already grappling with their own financial challenges.

To tackle the 401k fallout, several key measures can be implemented. Firstly, comprehensive financial education programs should be introduced at various stages of an individual’s life, starting from schools to workplaces. Providing individuals with the knowledge and tools to make informed financial decisions is crucial for their future well-being.

Secondly, employers should actively encourage and incentivize their employees to contribute to their 401k plans. Offering robust matching programs and educating employees about the long-term benefits of retirement savings can help drive participation rates.

Lastly, policy changes should be considered to provide additional support to retirees. An increase in the minimum social security benefits or the creation of alternative retirement savings options can help alleviate the burden on individuals and promote a more secure retirement future.

In conclusion, the decline of 401k retirement savings presents significant challenges for both individuals and society. Addressing the root causes of this fallout through increased financial education and employer participation, coupled with policy changes, is crucial to mitigating the potential consequences. By taking proactive steps today, we can work towards securing a financially stable retirement tomorrow.

These peaples money was stolen in a planned "wealth transfer",yet the average American thinks they just lost their money and it went nowhere.It went to clever international bankers.Now fast forward to now 2/1/2019–the trap is set again to steal from unexpecting working people except this time there will be no "quanitative easing"and the dollar will fail totally.It always goes this way for fiat currencies.When will America wake up?Probably after it is too late.These thieves are heartless.

Obama and the crooked politicians took care of the banks and not the people!!!!!

Good thing I never enrolled in a 401k plan. I thank a PBS documentary for warning me. And this video just added to it.

The market takes a planned strategic short by those in the know… the wealthy buys back up at cent to the dollar. The trick,. match 5% for 7 years to establish greed (pile-up) potential; than rinse and repeat the shorts.

the financial service industry economically sodomized each person who was conned by their employer……get ready to work till you die…….

It's called a transfer of wealth, folks. Guess what? They'll do the same thing to the next generation again and again. Why? Because they've got nothing to lose and you'll let them. Keep supporting the fat cats and voting for their favorites.

In simple terms, 401K is workers giving their retirement money to some dude in stock market to gamble w/t. Any fool knows this is a disaster in the making. You lose your money when you are in your 60s. You live, work, and die poor… American greed!

1:50. – $140K is half of your life savings ?? thats sad

He is wrong and offensive. Citizens had no control over the decade that was lost to earnings. If I had it to do over again, I would never have any money in an account that the government was involved in

I am one of those effected. My 401(k) did not survive 911, two wars, and too recessions, early retirement due to disability, and seven surgeries. On top of that I got caught up in the governments WEP program which claimed I had a pension which I did not have. That program cut my Social Security in half. So now I live in a one room hotel room in Mexico on $800 a month. As an ex pat, this is not enough.I worked 40 years and can't even afford an apartment in the United States. It has caused depression, and even here,, have trouble eating all month. But daily there are poorer Mexican's begging because they think I am rich because I am American. It is tragic. If I had not had back surgery ,which gave me SSDI, I would be living on six hundred a month. Americans are not rich unless you are a Trump

No one's broadly diversified 401(k) is "gone"; it's just fluctuated downward temporarily. Who are these idiots who don't grasp that the market fluctuates? Even in the bubble, ALL of the brokerage statements warned people that fluctuations are part of the game. How are people acting like this is somehow news to them?

if these people were retiring in a few years, their allocations should be such that you will not have a 50% loss in your overall investment…. If you have the correct allocation, maybe lose 20% tops? Am I crazy?

I thought he said "Do you have any nipples?" My hearing is not so good, but that was funny.

It’s a rip off

My 401K isn'y gigantic but neither is it tiny small. My 401K is not meant to carry me fully into retirement. I still have a pension and social security I've experienced the ups and downs in the market but over time I'm better off today in 2017. I did not touch my 401K money when the stock market tanked. I just left the 401K alone. Half of my 401K is geared to conservative investments while the other half goes for slightly more aggressive stocks. I remember losing $12,000 in a single quarter and it scared me to death BUT, I stuck with it left the 401K money alone in the same allocations and after 10 years I've recovered all of my losses and a LOT more.

If you stick with the market over time you do come out ahead of the game in the 401K war at least that has been my experience.

This video was made in 2009 or earlier. Since that time the market has come back.Those close to retirement that lost in equity mutual funds should have been in CD's or equivalent. The losses in the 40iK retirement funds pales in comparison to the billions lost in property values due to denial of the fact American cities are failing in scope because of worsening demographic values. Read the list then ask why. Ferguson Mo, Chicago, Camden NJ, Atlantic City, Kansas City,Lynn Mass, Stockton Ca, Rochester NY, Suffolk County LI, Cleveland Ohio, Philadelphia, St Louis, Gary Indiana, Sioux City Iowa, Pittsburgh, Portland Or, Milwaukee, Wilmington Delaware, New Orleans, Charlotte NC, Sacramento or Richmond Va? Detroit was the canary in the mine signaling the devastation of American cities. Think not? There is nothing on the horizon to turn them around. Lies and denial of the Violence and lawlessness is baked into the mix and no one has the courage to step forward and call the shots. Cleveland will follow Detroit with a property foreclosure rate of three to one! New Jersey will be the first state to declare bankruptsy; homeowners are strangled with obscene property taxes with no relief in sight. The ponzi scheme in that state will end soon. Suffolk County NY has average property taxes of 10 thousand to 30 thousand for homes in the range of 1300-3500 sq.ft. The ratio of sales to foreclosure is 13,810/5117. This is a looming housing disaster. Florida lists 131,848 thousand properties for sale; including 28,853 thousand foreclosures; 18,336 of new construction and another 18435 rental properties. The foreclosure rate in Tampa is one out of every 2 for sale! How much property has violence and disorder destroyed? Billions! It has caused the financial ruin for homeowners, retirees and business destroying both the property and income tax base. Cites are added to this list on almost a daily bases! These cities and towns will never recover or rebuild! Despite the appearance of prosperity the undercurrent is apathy, despair and perhaps regret; the legacy of unintended consequences and procrastination.

The 401K was designed primarily as a safety net against larger market crashes, which inherently keeps fat cats fed longer as well. If a 401K offers 15 mutual funds for your placing of money into one or more of them, and each has 120 companies, do the math! Millions of Americans sinking hard earned money into hundreds of companies unwittingly helping their (stock company) bottom line, and cushioning a market crash, yeah, it makes sense from a Wall ST seat! But that's it…….

Nobody thought they needed the kind of sophistication that a floor trader has or someone with a degree in finance. Nobody thought they needed to watch their 401K and 403B like a damn day trader. Why didn't the sponsors of these instruments come in and say hey that's enough, we need to intervene on behalf of our clients? They could've simply mailed out cards saying check this box if you want to live and send it back, we got your back! Oh that's right, they were shorting our positions and siphoning the profits into their own pockets, oh I'm sorry, MY BAD! GEEZUS!!

OMG what a tragedy!!!

That guy who lost 140k in his 401k who said he'll probably never get it back would be up probably over 300% today if he didn't touch it

The problem with this video is you don't know if the people invested in the market themselves or if they used a finical adviser who uses dollar cost averaging. I don't invest myself. I leave that to my Vanguard adviser. I don't pay attention to the market at all . It goes up and goes down. But over the time you invest and retire will in fact give you a 10 percent on your return. It worked for me . I only gave 5 percent to my 401k over my lifetime along with my company matching funds. If you want to talk about a nightmare think about the employees who's retirement pension was in the company that went bankrupt. Then they have nothing.

There are bad Financial IRA companies that sell bad funds, you'd be lucky what you put in still remains.

Small Businesses are major targets where fees and poor performance kills hard workers earnings.

Its kinda like the movie Boiler Room; who knows perhaps there are fake Financial Ira companies out there.

So far only two we know about and others we don't who are too smart to be caught.

yikes…

WHAT IS CLEAR IS THAT SINCE WE ELECTED OBAMA AND GOT A DEMOCRATIC HOUSE AND SENATE — NOTHING HAS CHANGED

WAKE UP – REPUBLICANS AND DEMOCRATS LOVE YOUR MONEY TOO

This video was misleading when it was made, and has since been completely overtaken by events.

The only problem with 401k money invested bank deposits is that the interest rate has not kept up with inflation. There was no loss of nominal principle.

401k money invested in bonds did not do badly in 2008, and did well 2009-mid 2013, because of a major decline in long term interest rates. There has been a bull market in long term bonds since 1981. Do not expect this to continue.

The content of this video is based on the fact that USA equities declined 72% between October 2007 and February 2009. But they have since risen 105%. Hence the average equity investor is 33% better off than she was at the start of the Great Recession, in October 2007. I do not deny that the stock market may have benefited strongly from the Fed's QE program. But it remains the case that American business has been very profitable in recent years.

In my view, the main threat to 401k balances has been long term unemployed families running down those balances by hardship and premature withdrawals. One can always access 401k (and IRA) money by paying a 10% penalty income tax. A random sample of households surveyed in 2008 revealed that 40-50% of American households begin retirement with little more than SS or SSI, and an owned home. (About 15% retire millionaires). A major consequence of the Great Recession is that a great many Baby Boomers will start collecting SS at age 62, and will limp through retirement with very limited resources.

If the 401k industry wants individual account holders to be personally responsible, then I want my taxes back from the big bank bailouts!

Damn greed. Have you heard some the pitches insurance agents use to push 401K into your life? They're no different from dumb quacks saying anything to tickle your fancy.