![]()

Source: “Comparing past and present inflation”, Bolhuis et al. (2022) Bureau of Labour Statistics

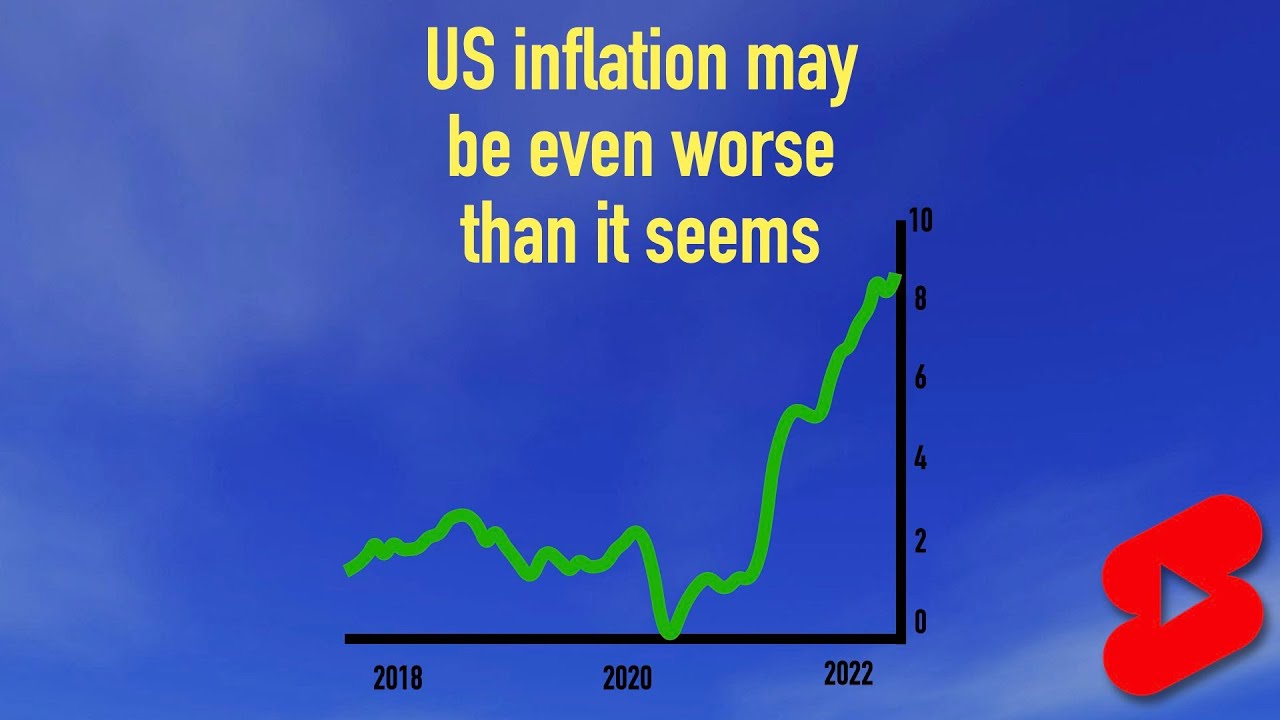

US inflation may be even worse than it seems.

Average prices rose by 8.6% over the last year, which is the highest rise since 1981.

Back in the 1970s and 80s there was a decade of high inflation which peaked at 14.8%.

Some will take comfort in the fact that today’s price rises are still well below this figure.

However, comparisons of today’s inflation with the past may be misleading, because the way inflation is measured was changed in 1983.

If we recalculate historic inflation using the new methodology used today, we can see that price rises in the 70s and 80s were much lower.

The 14.8% peak recorded in March 1980 was actually only 11.4%.

While this is still higher than today, current inflation rates are getting close to a time known as ‘the Great inflation’.

This should be concerning to policymakers, because the policies used to bring down such high inflation rates usually result in slower economic growth, and even a recession, just like we saw back in the 80s.

Check out the Shorts playlist for more videos like this!

Subscribe for more videos looking at everything to do with the subject of economics. Put suggestions for video ideas in the comments section below and any feedback offered would be greatly appreciated.

My videos are intended for educational and entertainment purposes. I try to credit the relevant parties for any work that I refer to in my videos (for example, citing relevant academic papers). If you believe a video does not observe good academic practice, please do not hesitate to contact me by email at everythingbetting@gmail.com…(read more)

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

The United States has long been a global economic powerhouse and a beacon of stability in the world of finance. However, recent reports reveal that the country is facing a major economic problem – inflation. Inflation is affecting everyone, from consumers to businesses.

Inflation is a sustained increase in the price level of goods and services in an economy over time. Simply put, as inflation rises, the buying power of our money decreases. For years, the US has been experiencing a low inflation rate, but that has dramatically changed in recent months. Prices have been going up at an alarming rate, and this trend is expected to continue.

The current inflation rate in the US is much higher than what is being reported. The official inflation rate as estimated by the Bureau of Labor Statistics (BLS) shows an increase of 5.4% year over year as of July 2021. However, this number only takes into account the prices of a basket of goods and services that are deemed to be the most traditional consumer purchases. This means that many prices, such as housing, healthcare, and education, which have seen exponential increases in recent years, are not being factored into the official inflation rate.

One major reason why US inflation is worse than it seems is due to the monetary policies of the Federal Reserve. The central bank has been printing money at an alarming rate, which has increased the money supply and contributed to inflation. The massive infusion of money into the economy has led to a rise in demand for goods and services, which in turn, has led to an increase in the prices of these goods and services.

Another major factor contributing to the current inflationary pressures is the supply-side disruption caused by the pandemic. Disruptions in global supply chains and a labor shortage have led to increased production costs and a shortage of goods. This has contributed to price increases for various goods and services.

Furthermore, the rising cost of housing and healthcare has contributed significantly to the current inflation rate. Housing prices have been rising rapidly due to factors such as low-interest rates and a shortage of housing inventory. Healthcare costs have also been rising, partly due to increased demand from the aging population and rising drug prices.

In conclusion, the current inflation rate in the US is much higher than what is being reported, and it is affecting everyone. The official inflation rate fails to capture the true extent of the rising prices of goods and services that are significant in everyone’s daily lives. The Federal Reserve must take immediate action to address the situation as the longer-term effects of inflation can be catastrophic to the country’s economy.

If it happens and Russia and china change the Dollar like they said 2 days ago inflation might go all the way to 80 % and it's well deserved they did the worst things to poor country Zimbabwe Venezuela Libya Irak etc so it we'll deserved for there government i feel bad for the ppl but they are also responsible of there government act so now its time for the usa to go beck to sleep

Today 9.1 percent !

I think it’s bidens fault coz Donald trump was good friends with putin and he had a deal with him to keep gas down to 4-5 dollar a gallon

Your contents are exactly the kind we need for stonk users.

Let us collaborate! We’ve sent details to your email(plz check your Spam as well)