Get a 10-Day Free Trial of Market Insiders: .

. 🚨Read Our FREE eBook🚨 Get Richer Sleeping – Investing 101:

The 401k is considered the holy grail of investments – the pros of the 401k are obvious, but do you know the costs of investing in your 401k – let’s discuss.

Subscribe To Our Channel:

Recommended:

401K Alternatives To Keep More Money:

Roth 401k vs. Traditional 401k – How Will You Retire Richer?:

The TRUTH About Your 401(k) That No One Tells You

0:10 – What’s the best way to plan for your future?

0:27 – For the majority of people investing is investing the 401k

0:56 – Why does your 401(k) exist

1:30 – Your company was on the hook for your retirement with pensions

2:22 – The benefits of the 401k

2:53 – The cost of your 401(k)

3:26 – What the average American pays in 401(k) fees

4:18 – The risk of investing in your 401(k)

5:23 – The tax benefits or costs of investing in the 401k

6:34 – The flaws of 401k being a tax shield

8:00 – Tax rates will greatly affect your 401k

What Is The Minority Mindset?

The Minority Mindset has nothing to do with the way you look or what kind of family you’re from. It’s a mindset.

Give the majority $200 and they will come back with a pair of shoes. Give the minority $200 they will come back with $2,000.

Think from the mindset of a consumer and be the provider, that’s the Minority Mindset. Don’t be the majority. #MIH #ThinkMinority #FinancialEducation

Twitter: @M2JaspreetSingh

Personal Instagram: @M2JaspreetSingh

Instagram:

Facebook:

See more & read our blog!

This Video:

Channel:

Video host: Jaspreet Singh…(read more)

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

401(k) plans have become an increasingly popular option for retirement savings in the United States. According to the Investment Company Institute, Americans held $6.2 trillion in 401(k) accounts as of June 2020. However, there are critical truths about 401(k) plans that many people are unaware of. This article will explore the essential facts about 401(k) accounts and how they affect our retirement savings.

First, 401(k) plans may have high fees that cut into our savings. These fees include administration fees, investment management fees, and expense ratios, among others. According to the U.S. Department of Labor, a 1% difference in fees could reduce an account balance by 28% over 35 years of saving. Therefore, it is crucial to research and compare fees before choosing a 401(k) plan.

Second, the investment options for 401(k) plans are often limited. In most cases, the plan sponsor chooses the investment options available in the plan, which may not be suitable for all employees. There may be limited diversity in asset allocation, meaning that the investments may not be distributed equally between stocks, bonds, and cash.

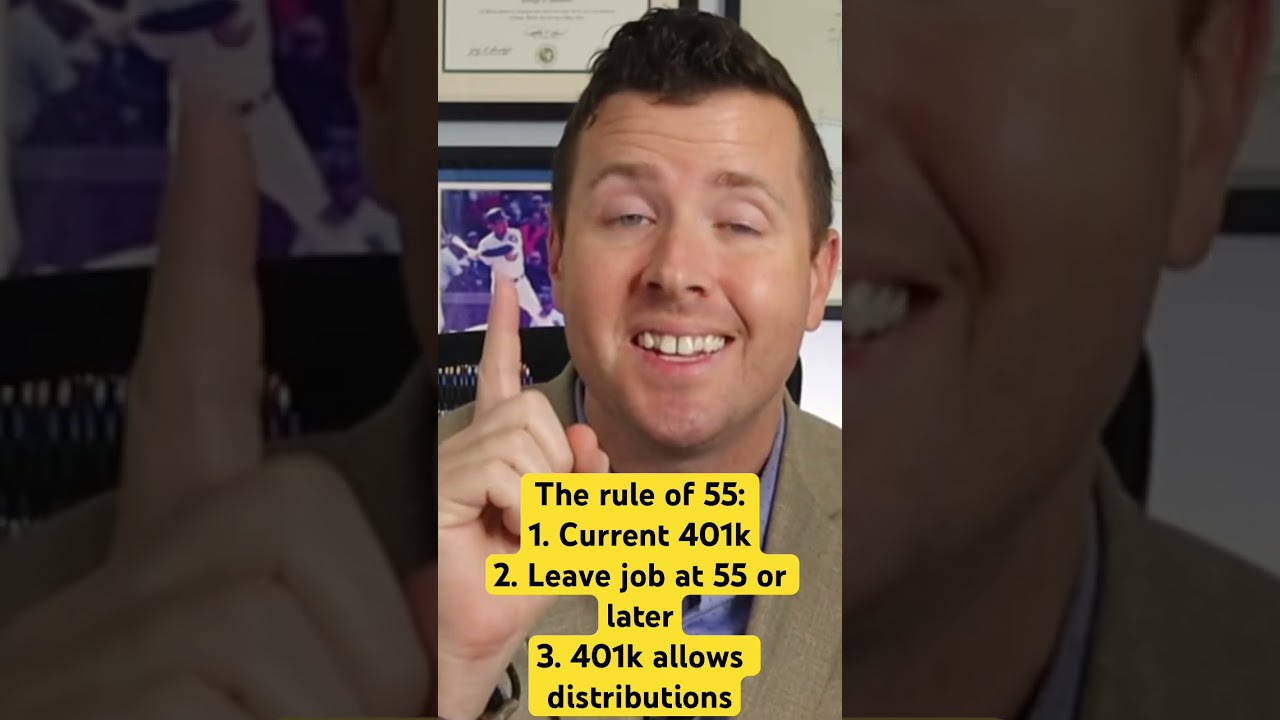

Third, 401(k) plans may have withdrawal penalties. While these plans are designed for retirement savings, unforeseen circumstances may require someone to withdraw money before reaching retirement age. In such cases, a 10% penalty may apply to the withdrawal, which can significantly reduce the account balance.

Fourth, 401(k) plans may not provide enough retirement income for some people. According to the Employee Benefit Research Institute, more than one in four baby boomers who participated in a 401(k) plan are projected to run out of money in their retirement years. One reason for this is that many employees do not contribute enough to their plans to achieve a comfortable retirement income.

Finally, 401(k) plans may have tax implications. Contributions to these plans are typically tax-deductible, meaning that they reduce the taxable income. However, the withdrawal of funds in retirement is subject to income tax, which could result in higher taxes than expected for some individuals.

In conclusion, 401(k) plans are an essential tool for retirement savings, but they also have pitfalls. High fees, limited investment options, withdrawal penalties, inadequate retirement income, and tax implications are some of the truths about 401(k) plans that no one tells you. Therefore, it is crucial to understand these facts and take appropriate measures to mitigate their effects. This includes researching and comparing fees, contributing enough to the plan, diversifying investments, and consulting a financial advisor to help make informed decisions.

Canceled my 401K a few months ago. I turned 44 a month ago and this sham of an economy isn't going to last that long.

One thing to add: Population dynamics are changing in America and we’ve been seeing a decline in birth rates in recent years… with a lower population growth rate, I suspect that the retirement systems will become less and less rewarding as the worker/retiree ratio continues to drop

This is very helpful, love the video!

This whole system is very, very tamasic.

Pensions were never "handed out" the employees made their pension contributions as well as the company's contribution.

Can you do a video for beginners on understanding tax codes?

Lol, wall street and government (fauci) came up with 401k….

Can't make this shit up….

I think I should’ve just been buying gold.

Fees on my 401k is $0.01 and $6/quarter Jaspreet 401k plans offer both Traditional and Roth IRAs and can contribute up to $27k in Roth. Link doesn't work!

To be perfectly honest with you, your appearance scared me until I listened to one of your videos, now I'm hooked! I love your approach and your videos and will use you as a source of my investment information. Thanks!

Newbies think that the best way to play the stock market is to buy stocks then sell them a day or few months later, than repeat the process. This method of investing usually loses money. The people who buy and hold for long periods are the people who make the most money.

My 401k is awesome vanguard and other ultra low cost funds

Little confused one way you are putting 401k investor may loose good returns as it may not have good diversification but if we do not invest we would be missing employer match… I feel that is good income… even returns are low..

Well articulated good details… your videos gave me good information on 401k… Thank you very much…

Buy Ihl please I wanna help you make money

You are…Fantastic! Love your content!

Love your content and good things to keep in mind for 401ks. However, I think this channel mostly focuses on the negatives of 401ks. Roth 401ks and Roth IRAs solve many of the issues you bring up regarding taxes. Even with Traditional IRAs, you can typically choose S&P 500 Indexes with 0.04% expense ratios. 401ks, are a great supplement to whatever additional income you have in retirement.

what the hell do people mean by a “company match”, match what???