(636) 777-4200

If you’re changing jobs or retiring, it’s important to know the rules regarding moving funds from your employer sponsored retirement plan. The wrong move could cost you in income taxes and early withdrawal penalties.

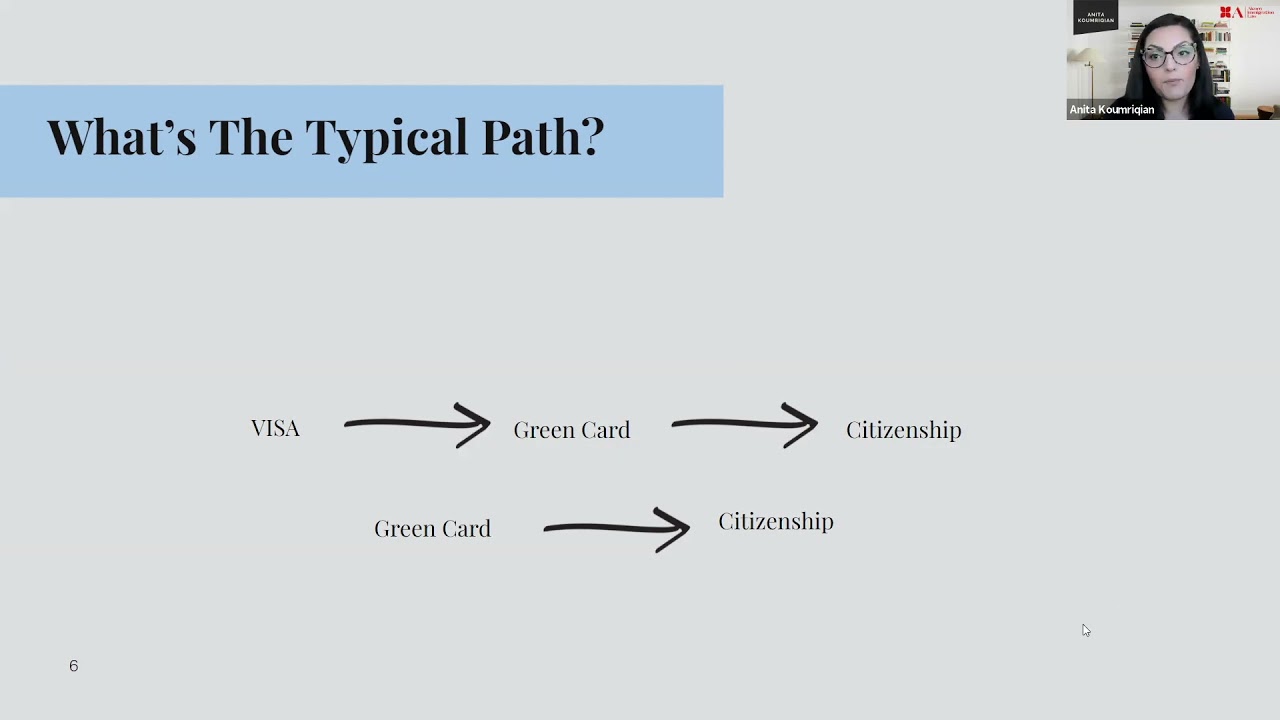

There are two basic ways to move retirement plan assets from one retirement plan into another with no tax consequence.

With a direct rollover your financial institution or plan directly transfers the payment to another plan or IRA; no taxes are withheld and your account continues to grow tax-deferred.

With an indirect rollover, a check is made payable to you. You have 60 days to deposit it into a Rollover IRA – but indirect rollovers are subject to 20% withholding. For example, if you had $10,000 eligible to rollover, your employer would withhold $2000 and you’d get a check for $8,000. You’ll get the $2000 that was withheld back when you file a tax return, either as a refund or a credit toward any tax owed.

However, in 60 days you still have to deposit the entire $10,000 in a rollover account – the $8,000 from your employer plus $2000 from your own resources. Any amount you don’t rollover is considered income, and subject to taxes when you file your return. You could also face a 10% early withdrawal penalty, depending on your age.

To learn more about how to avoid complications with a retirement plan rollover, give us a call today.

…(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

How to Avoid an IRA Rollover Mistake

An individual retirement account (IRA) rollover can be a smart financial move, providing flexibility and potential tax advantages. However, it is crucial to understand the process and potential pitfalls to avoid making mistakes that could cost you money. In this article, we will highlight some essential steps to help you avoid IRA rollover mistakes.

Firstly, the most important step is to understand the difference between a direct and indirect IRA rollover. A direct rollover is when your funds are transferred directly from one retirement account to another without you ever receiving the money. An indirect rollover, on the other hand, is when you receive the funds and then deposit them into another retirement account within 60 days. While both methods can be used, it is generally advised to opt for a direct rollover to avoid potential tax complications and penalties.

When initiating an IRA rollover, it is necessary to choose a reputable and reliable financial institution. Consider a well-established bank or brokerage firm with a good track record and competitive fees. The chosen institution should offer a wide range of investment options suitable for your financial goals and risk tolerance.

Furthermore, it is crucial to understand the tax implications of an IRA rollover. If you have a traditional IRA, rolling over to a Roth IRA will make the funds subject to taxes. However, if you have a Roth IRA and decide to roll over to a traditional IRA, you might be eligible for a tax deduction. Consult with a tax professional or financial advisor to determine the most advantageous option based on your financial situation and long-term goals.

Timing is another critical factor when it comes to IRA rollovers. Make sure you have a clear understanding of the IRA rollover deadlines to meet the IRS guidelines. For an indirect rollover, the deposited funds must be made within 60 days to avoid penalties and consequences. Therefore, it is essential to plan and execute the rollover accordingly, allowing for any delays that may occur during the process.

Additionally, it is important to be aware of the once-a-year IRA rollover rule. According to this rule, you can only perform one rollover per year, regardless of how many IRAs you have. This limit is based on a calendar year, not a rolling 365-day period. Therefore, if you have multiple IRAs, be cautious not to exceed the once-a-year limit, as this mistake can lead to additional taxes and penalties.

Lastly, keeping an eye on the paperwork and following up with the relevant parties is crucial during the rollover process. Ensure all necessary forms are completed accurately and submitted promptly to avoid delays and potential mistakes. Maintain open communication with your financial institution throughout the rollover process to ensure a smooth transition without any surprises.

In conclusion, an IRA rollover can be an effective strategy to optimize your retirement savings and provide more flexibility in managing your financial future. However, to avoid costly mistakes, it is essential to understand the intricacies of the rollover process and follow the guidelines provided by the IRS. By choosing the right financial institution, understanding the tax implications, adhering to deadlines, and being mindful of the once-a-year rule, you can confidently navigate an IRA rollover and maximize your financial benefits.

0 Comments