Premiere retirement planning and Wealth Management

(800) 313-6659

If you’re changing jobs or retiring, it’s important to know the rules regarding moving funds from your employer sponsored retirement plan. The wrong move could cost you in income taxes and early withdrawal penalties.

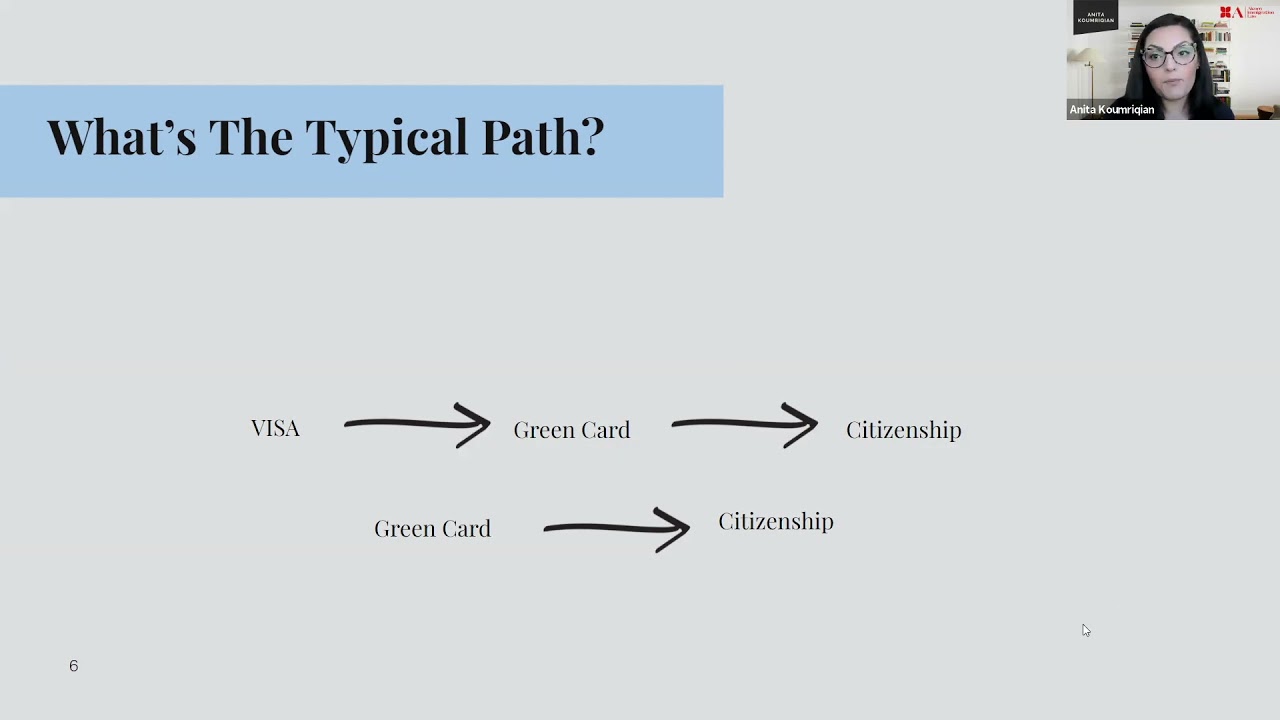

There are two basic ways to move retirement plan assets from one retirement plan into another with no tax consequence.

With a direct rollover, your financial institution or plan directly transfers the payment to another plan or IRA; no taxes are withheld and your account continues to grow tax-deferred.

With an indirect rollover, a check is made payable to you. You have 60 days to deposit it into a Rollover IRA – but indirect rollovers are subject to 20% withholding. For example, if you had $10,000 eligible to rollover, your employer would withhold $2000 and you’d get a check for $8,000. You’ll get the $2000 that was withheld back when you file a tax return, either as a refund or a credit toward any tax owed.

However, in 60 days you still have to deposit the entire $10,000 in a rollover account – the $8,000 from your employer plus $2000 from your own resources. Any amount you don’t rollover is considered income, and subject to taxes when you file your return. You could also face a 10% early withdrawal penalty, depending on your age.

To learn more about how to avoid complications with a retirement plan rollover, give us a call today.

…(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

How to Avoid an IRA Rollover Mistake

Individual Retirement Accounts, or IRAs, are popular investment tools that enable individuals to save for retirement with certain tax advantages. One common strategy used by investors is to rollover their funds from one IRA to another. However, despite its potential benefits, an IRA rollover can be a complex process that can lead to costly mistakes if not handled correctly. This article aims to provide guidance on how to avoid IRA rollover mistakes and ensure a seamless and effective transition of your retirement savings.

Understand the Rules and Requirements

Before proceeding with an IRA rollover, it is crucial to have a clear understanding of the rules and requirements that govern these transactions. Different types of IRAs, such as Traditional, Roth, or SEP IRAs, may have distinct rules regarding contributions, withdrawals, tax treatment, and eligibility. Familiarize yourself with the IRS guidelines and consult a financial advisor or tax professional if necessary to fully comprehend the implications of an IRA rollover.

Choose the Right Rollover Option

When it comes to an IRA rollover, investors have two main options—direct rollover and indirect rollover. A direct rollover involves transferring funds directly from one IRA to another, typically avoiding any tax implications or penalties. On the other hand, an indirect rollover occurs when funds are withdrawn from an IRA and then reinvested into another account within 60 days. However, with an indirect rollover, individuals must be wary of taxes and potential penalties, especially if the funds are not reinvested within the specified time frame. Evaluate your options carefully and choose the one that aligns with your financial goals and minimizes potential tax liabilities.

Beware of the 60-Day Rule

As briefly mentioned above, if you opt for an indirect rollover, be mindful of the 60-day rule. The IRS allows this grace period for individuals to complete a rollover transaction. Failure to meet the deadline can result in the entire distribution being treated as taxable income, making it subject to income taxes, and potentially incurring early withdrawal penalties if the account owner is younger than 59½ years old. Plan your rollover transaction carefully to ensure the funds are reinvested within the given timeframe, and keep track of the deadline meticulously.

Avoid Custodian-to-Custodian Transfer Mistakes

During an IRA rollover, it is crucial to ensure a seamless transfer of funds from one custodian to another. In the case of a direct rollover, the responsibility primarily lies with the financial institutions involved in the transaction. However, mistakes can still happen, such as delays or incorrect amounts transferred. Stay actively involved in the process, communicate with both custodians, and ensure that all necessary documentation is completed accurately. Adopting a proactive approach will help mitigate potential errors and prevent any delays or financial losses caused by the mishandling of the funds.

Consider a Trustee-to-Trustee Transfer

To eliminate the potential for mistakes during an IRA rollover, consider opting for a trustee-to-trustee transfer. This method involves the direct movement of funds from one IRA trustee to another, bypassing the account owner altogether. By utilizing this process, there is no risk of missing the 60-day rule or being subject to withholding taxes. Additionally, a trustee-to-trustee transfer offers a smoother transition as the funds are never directly in the account owner’s possession. Cooperate with your current and new IRA trustees to facilitate this transfer efficiently.

Stay Mindful of Contribution Limits

One aspect to be cautious of during an IRA rollover is the contribution limits imposed by the IRS. Depending on the type of IRA and other factors, there may be limits on the amount that can be contributed within a particular tax year. Be aware of these limits, especially when combining multiple IRAs or converting funds from one type of account to another. Exceeding the contribution limits can result in penalties and the need to withdraw the excess amount, leading to potential taxation. Keep track of your contributions diligently to ensure compliance with the IRS guidelines.

Consult with Professionals

When in doubt, seek guidance from financial professionals, such as financial advisors or tax experts, to avoid IRA rollover mistakes. Their expertise and experience can offer invaluable insights, ensure adherence to regulations, and help create a strategy that aligns with your financial goals. Consulting professionals will not only address any concerns you may have but also minimize the likelihood of errors or oversights throughout the rollover process.

In conclusion, an IRA rollover can be an effective strategy for managing retirement savings, but it requires careful planning and execution to avoid costly mistakes. By understanding the rules and requirements, choosing the right rollover option, being aware of time limits, ensuring seamless custodian transfers, considering trustee-to-trustee transfers, staying mindful of contribution limits, and consulting with professionals, you can navigate the IRA rollover process with confidence. Remember to approach this important financial decision with caution and diligence, and you will be well on your way to successfully transitioning your retirement savings.

0 Comments