![]()

…(read more)

LEARN MORE ABOUT: IRA Accounts

INVESTING IN A GOLD IRA: Gold IRA Account

INVESTING IN A SILVER IRA: Silver IRA Account

REVEALED: Best Gold Backed IRA

Investing in the stock market is an excellent way to grow your wealth over the long term. However, with so many investment options available, selecting the right ones can be overwhelming. This is where index funds come in as they offer a straightforward approach to portfolio diversification with lower fees compared to actively managed funds. Vanguard, renowned for its low-cost index funds, has been a go-to for many investors. In this article, we’ll provide you with the best Vanguard index fund tip to help you make an informed investment decision.

The Vanguard Total Stock Market Index Fund is the best Vanguard index fund tip for investors seeking to invest in the entire U.S. stock market. This fund has over $1 trillion in assets under management and provides exposure to 3,641 stocks across various sectors and market capitalizations. Its low expense ratio of 0.04% makes it a cost-effective investment option.

The fund’s objective is to track the performance of the CRSP US Total Market Index, which includes large-cap, mid-cap, and small-cap stocks of U.S. companies. By investing in this index fund, you’ll have a diversified portfolio that reflects the broad U.S. equity market. The fund’s top holdings include Apple, Microsoft, Amazon, Facebook, and Alphabet (Google).

The Vanguard Total Stock Market Index Fund has delivered consistent returns over the years, outperforming many actively managed funds. Over the last decade, the fund has generated an average annual return of 14.1%, outpacing the S&P 500’s average annual return of 13.6%. As with any investment, past performance is not a guarantee of future results. It’s essential to understand that index funds experience fluctuations in value, and investors may incur losses.

Investors can purchase this fund directly through Vanguard or via a brokerage account. The minimum initial investment is $1,000, and subsequent investments must be at least $1. There are no transaction fees when investing in the fund via Vanguard. However, investors may incur broker commissions when purchasing the fund through a brokerage account.

In conclusion, the Vanguard Total Stock Market Index Fund is an excellent investment option for investors seeking to invest in the broad U.S. equity market. Its low expense ratio, broad diversification, and consistent returns make it our top Vanguard index fund tip. However, it’s essential to do your due diligence and consult a financial advisor before making any investment decisions.

Is there a reason why I would do the mutual fund and not that etf?

What are some reasons why I should do VFIAX instead ?

when you talk about different financial products as if they are interchangeable without any comparison you look like a moron. there is a reason these different products exist. please stop uploading

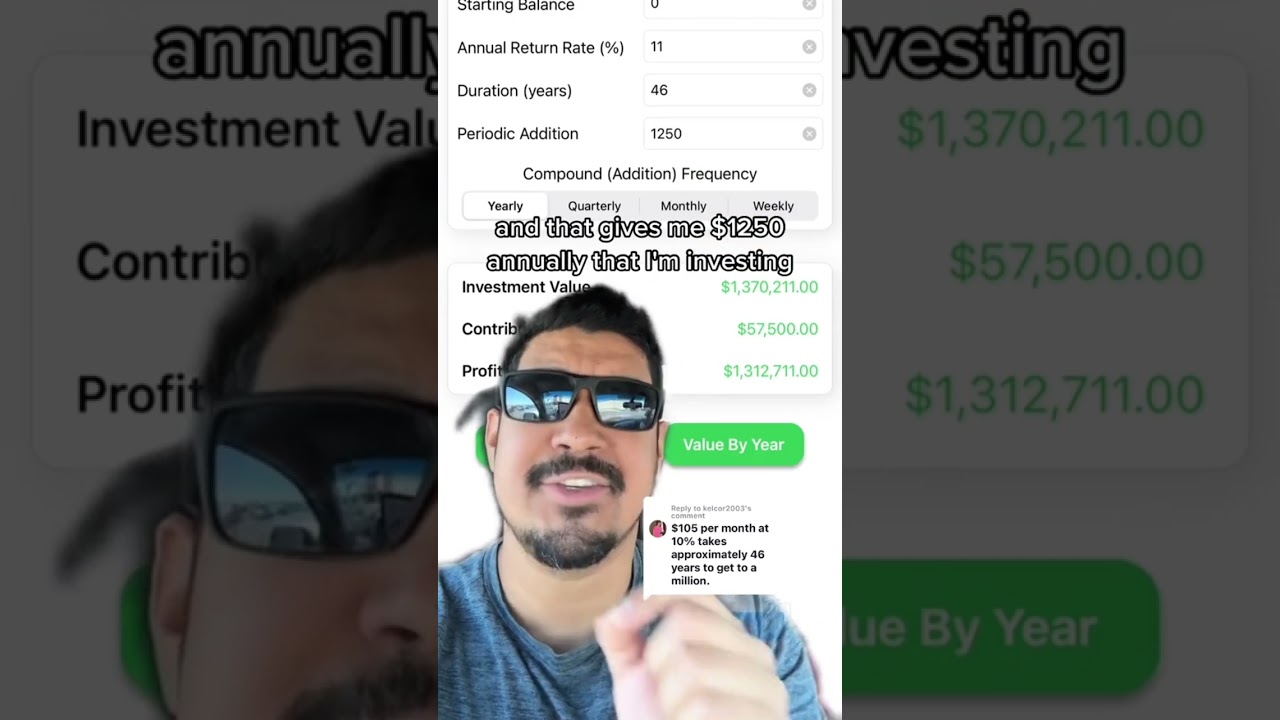

Being in canada using cad what percentage roughly would I lose if I invested into voo over 40 years through my rbc direct investing. Because I would pay the tax and I would pay the conversion rate from cad to usd. Because when I run a compound intrest calculator of 150$ bi weekly for 40 years at 8% ave annual return that would be 144000 invested with 1.1m total money's at the end of the 40 years. Would it still be close to 1 million after all the fees after 40 years ? Hypothetically if it was an 8% annual return for the next 40 years.

Can I convert VOO to VFIAX once I’ve accumulated 3k return from VOO?

Good stuff in one minute