![]()

Two of the best books on estate planning here:

…(read more)

LEARN MORE ABOUT: IRA Accounts

CONVERTING IRA TO GOLD: Gold IRA Account

CONVERTING IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

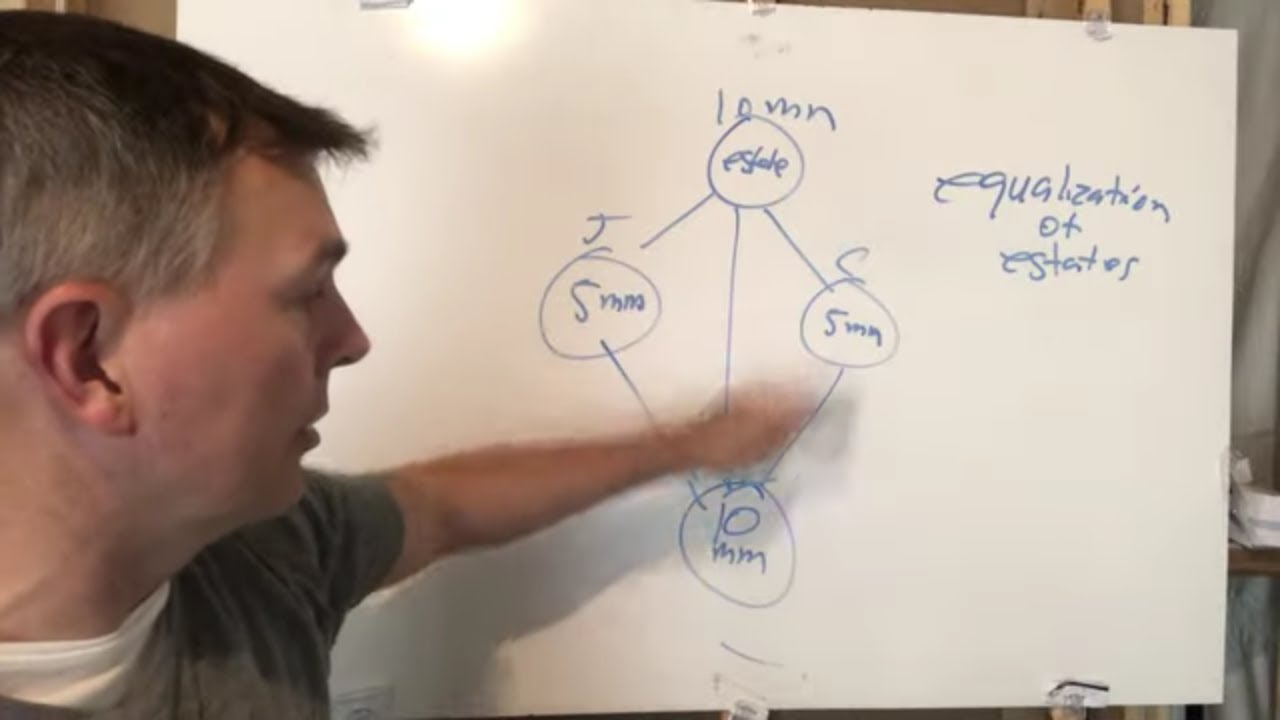

A bypass trust, also known as a credit shelter trust or a family trust, is a legal arrangement that is commonly used in estate planning to minimize estate taxes and protect assets for future generations. This type of trust allows married couples to take advantage of both of their estate tax exemptions, ultimately reducing the overall amount of taxes that their beneficiaries will have to pay after their passing.

The purpose of a bypass trust is to ensure that the assets of the first spouse to pass away are not subject to estate tax. Instead, the assets are placed into the trust, where they are managed and distributed according to the terms set forth by the deceased spouse. This arrangement effectively “bypasses” the estate tax, hence the name bypass trust.

There are several key elements to a bypass trust that make it an effective tool for estate planning. First and foremost, the assets placed into the trust are not considered part of the surviving spouse’s estate for tax purposes. This means that the assets can be preserved and passed on to the next generation without being subject to further estate taxes.

Additionally, a bypass trust can provide for the surviving spouse’s financial needs while also preserving the trust principal for the beneficiaries. This is accomplished by allowing the surviving spouse to receive income from the trust, as well as access to the trust’s principal for certain purposes, such as healthcare or living expenses.

Furthermore, a bypass trust can also protect the assets from being depleted due to the surviving spouse’s remarriage or potential creditors. By placing the assets in a trust, they are shielded from these potential threats, ensuring that they remain intact for the designated beneficiaries.

It’s important to note that the rules and regulations surrounding bypass trusts can vary depending on the jurisdiction and the specific circumstances of the individual or couple involved. As such, it’s crucial to consult with a knowledgeable estate planning attorney or financial advisor to determine the best approach for setting up a bypass trust based on individual needs and goals.

In conclusion, a bypass trust is a valuable and effective tool in estate planning, particularly for married couples who are concerned about minimizing estate taxes and protecting assets for future generations. By utilizing a bypass trust, individuals can take advantage of tax exemptions, provide for their surviving spouse, and ensure that their assets are preserved for their beneficiaries. With careful consideration and professional guidance, a bypass trust can be a crucial component of a comprehensive estate plan.

Yeah, screw the Yankees….

I'm saving this video!

Don't get me started…Major Crimes!!!

Studying for a midterm and this helped a lot thank you!

I live in Massachusetts where we have only a $1M estate tax exclusion each for my wife and I. Rather than a bypass trust, we have a disclaimer trust that allows the surviving spouse to “disclaim” a portion of the deceased spouses estate at or shortly after death to take full advantage of each spouses $1M exclusion and still have full access to funds (I.e. not restricted to HEMS only). Massachusetts definitely has one of the nation’s worst estate tax laws.