![]()

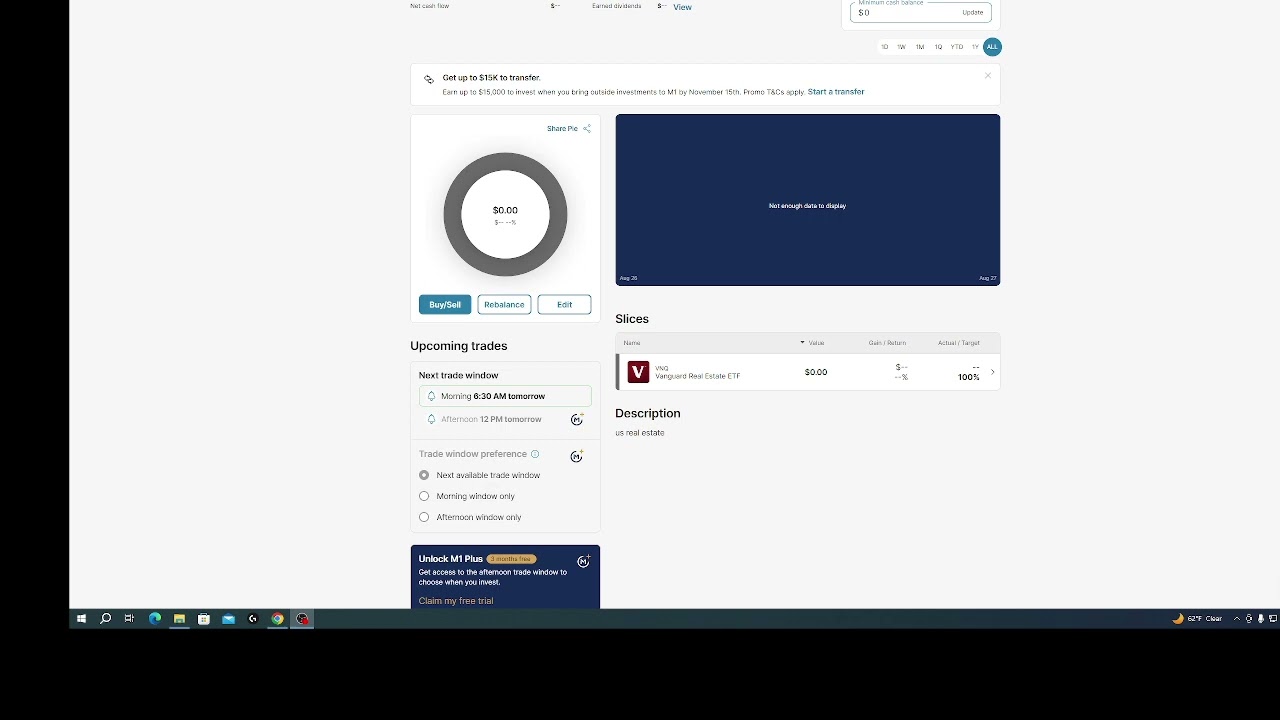

Roth IRA VNQ vanguard real estate etf 4 percent yield 8 27…(read more)

![]()

LEARN MORE ABOUT: IRA Accounts

INVESTING IN A GOLD IRA: Gold IRA Account

INVESTING IN A SILVER IRA: Silver IRA Account

REVEALED: Best Gold Backed IRA

Roth IRA VNQ Vanguard Real Estate ETF 4 percent yield 8 27

Investing can be a daunting prospect, especially when it comes to retirement savings. It can be difficult to determine which investments are the best fit for your specific financial goals. However, one option that is worth considering is the Vanguard Real Estate ETF (VNQ). This exchange-traded fund offers a 4 percent yield as of 8/27 and is a popular choice for investors looking to diversify their Roth IRA portfolio.

The VNQ ETF is designed to track the performance of the MSCI US Investable Market Real Estate 25/50 Index, which measures the performance of publicly traded equity REITs and other real estate-related investments. With over $50 billion in assets under management, VNQ is one of the largest and most liquid real estate funds available.

One of the main attractions of the VNQ ETF is its 4 percent yield, which is particularly appealing for investors looking for income-producing assets for their Roth IRA. This yield can provide a steady stream of income, which can be reinvested or withdrawn as needed during retirement.

In addition to its attractive yield, VNQ offers diversification benefits for Roth IRA investors. Real estate has historically demonstrated low correlation with other asset classes such as stocks and bonds, making it a valuable addition to a well-rounded investment portfolio. By adding VNQ to your Roth IRA, you can potentially reduce overall portfolio volatility and increase long-term returns.

Furthermore, the VNQ ETF is managed by Vanguard, a reputable investment management company known for its low-cost, passively managed funds. With a low expense ratio of 0.12 percent, VNQ offers cost-effective exposure to the real estate market, making it an attractive option for Roth IRA investors seeking minimal fees and expenses.

It’s important to note that while VNQ offers attractive features for Roth IRA investors, it also carries certain risks. Like any investment, real estate is subject to market fluctuations and economic conditions. Investors should carefully consider their risk tolerance and investment objectives before adding VNQ to their Roth IRA portfolio.

In conclusion, the Vanguard Real Estate ETF (VNQ) offers an attractive 4 percent yield as of 8/27 and provides diversification benefits for Roth IRA investors. With its low expense ratio and track record of solid performance, VNQ is a compelling option for those looking to add real estate exposure to their retirement savings. However, it’s essential for investors to carefully consider the risks and benefits before making investment decisions. As always, consulting with a financial advisor is recommended to ensure that VNQ is suitable for your specific financial goals and risk tolerance.

0 Comments