Warren Buffett is an American investor, business tycoon, and philanthropist, who is the chairman and CEO of Berkshire Hathaway. He is considered one of the most successful investors in the world and has a net worth north of $90 Billion, he is often referred to as the Oracle of Omaha. Charles Munger is an American investor, businessman, former real estate attorney, and philanthropist. He is vice chairman of Berkshire Hathaway, the conglomerate controlled by Warren Buffett. Berkshire Hathaway wholly owns Geico, Duracell, Dairy Queen, BNSF, Lubizol, Fruit of the loom, Helzberg Diamonds, Pampered Chef and NetJets. It also owns a significant holding in American Express, Wells Fargo, Coke, Bank of America, and Apple.

Berkshire’s annual shareholders’ meetings take place at the CHI Health Center in Omaha, Nebraska. Attendance has grown over the years with recent numbers totaling over 40,000 people a year. The 2007 meeting had an attendance of approximately 27,000. The meetings, nicknamed “Woodstock for Capitalists”, are considered Omaha’s largest annual event along with the baseball College World Series.

#WarrenBuffett #BerkshireHathaway #Buffett…(read more)

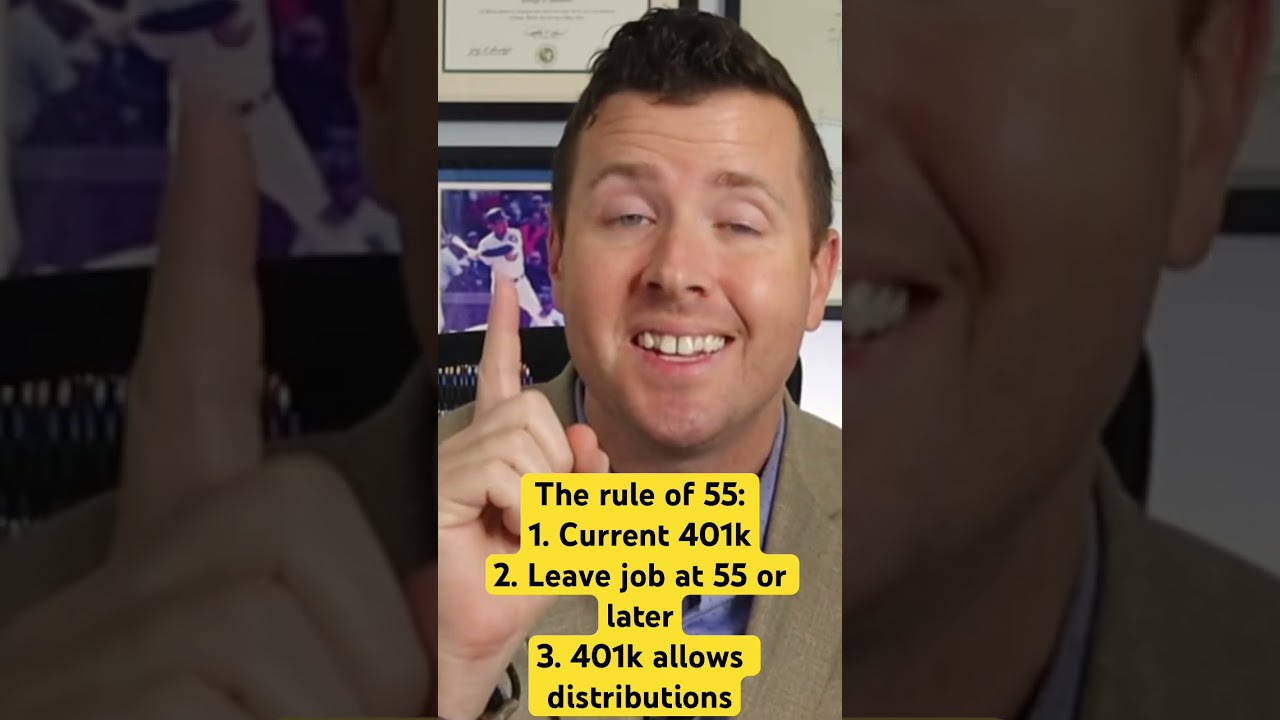

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Warren Buffett, the legendary investor and billionaire, recently discussed Berkshire Hathaway’s 401k program during the annual shareholders’ meeting in 2018. The 401k plan is a popular retirement savings option offered by many companies in the United States, allowing employees to set aside a portion of their salary on a pre-tax basis for their future.

During the meeting, Buffett emphasized the importance of 401k plans and how they can significantly contribute to an individual’s retirement savings. He noted that Berkshire Hathaway has always considered providing its employees with a generous retirement plan as essential. Buffett stated, “We want our employees to have a comfortable retirement, so they can focus on what they do best – their work.”

Furthermore, Buffett praised the tax advantages associated with 401k plans. The contributions made by employees are tax-deductible, providing an opportunity for tax savings. Additionally, the earnings from investments within the 401k account are tax-deferred until withdrawal, allowing the funds to grow and compound over time without being subject to immediate taxation.

One notable aspect of Berkshire Hathaway’s 401k program is the company’s contribution matching policy. For every dollar an employee contributes to their 401k plan, Berkshire Hathaway matches the amount up to a certain percentage of the employee’s salary. This matching policy helps accelerate the growth of employees’ retirement savings by effectively doubling their contributions.

Buffett further emphasized the importance of taking full advantage of the company’s 401k match. He urged employees to contribute at least the maximum amount that will be matched by Berkshire Hathaway, as it is essentially free money. By overlooking the match, employees are essentially leaving money on the table, thereby missing out on the opportunity for significant long-term wealth accumulation.

Moreover, Warren Buffett encouraged workers to start contributing to their 401k plans as early as possible. He stressed the power of compounding, stating that even modest contributions made in one’s twenties or thirties can grow into substantial retirement savings over several decades. The time value of money is a crucial concept that Buffett believes everyone should understand and take advantage of when planning for retirement.

In conclusion, Warren Buffett’s discussion of Berkshire Hathaway’s 401k program highlights the company’s commitment to providing its employees with a robust retirement saving option. By offering generous matching contributions and advocating early and consistent participation, Berkshire Hathaway aims to ensure that its employees can enjoy a comfortable retirement. Buffett’s insights into the power of compounding and the tax advantages associated with 401k plans provide valuable lessons for individuals looking to secure their financial future.

0 Comments