![]()

================================

Sign up for email list here.

My course “Everything You NEED to Know About Investing” will help reduce your stress when it comes to your investments.

Get it here:

and don’t forget there IS a 30 day money back guarantee if you’re not satisfied!

Find this video of value? Buy me a cup of coffee!

Get my books on Audible here:

My Amazon Product page:

Anything you buy there Amazon pays me a commission. Much appreciated!

GET MY BOOKS:

ALL are FREE to Kindle Unlimited Subscribers!

You Can RETIRE on SOCIAL SECURITY:

The Tax Bomb In Your Retirement Accounts: How The Roth IRA Can Help You Avoid It:

Strategic Money Planning: 8 Easy Ways To Put Your House In Order

GET ALL MY LATEST BLOGPOSTS:

…(read more)

LEARN MORE ABOUT: Thrift Savings Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Investing is a crucial aspect of financial planning and wealth-building for many individuals. However, it is also vital to be cautious and mindful of faulty investment return assumptions that could potentially derail your financial goals.

One common mistake that investors make is assuming consistent high returns on their investments. While it is tempting to forecast high returns based on past performance or the potential of a particular investment, it is crucial to remember that the market is unpredictable and returns can vary widely from year to year. Assuming a high return consistently can lead to disappointment and financial setbacks if the market does not perform as expected.

Another faulty assumption is not taking inflation into account when calculating investment returns. Inflation erodes the purchasing power of your money over time, meaning that the actual return on your investment may not be as high as it appears on paper. It is crucial to factor in inflation when estimating your investment returns to ensure that your money is growing in real terms.

Furthermore, some investors make the mistake of underestimating the impact of fees and expenses on their returns. Management fees, transaction costs, and other expenses can eat into your investment returns significantly over time. It is essential to be aware of all the costs associated with your investments and factor them into your return calculations.

Lastly, it is crucial to consider your risk tolerance and investment timeframe when making return assumptions. High-risk investments may offer the potential for higher returns, but they also come with a higher level of volatility and the possibility of significant losses. It is essential to align your return assumptions with your risk tolerance and investment goals to ensure that you are comfortable with the potential outcomes.

In conclusion, while investing can be a rewarding way to build wealth, it is essential to be cautious of faulty investment return assumptions that could lead to financial pitfalls. By considering factors such as market unpredictability, inflation, fees, and risk tolerance, you can make more informed investment decisions and avoid unrealistic expectations. Remember to review your assumptions regularly and adjust them as needed to stay on track towards your financial goals.

Man, I've watched a ton of your videos but this one was especially eye opening!

Good video about percentages.

The way I explain it is the following

Assume you have $1,000,000 in the stock market and it drops 50%

So it is worth $500,000 (1,000,000 * 50%)

To get your $500,000 back to $1,000,000 you have to double your money or a 100% return.

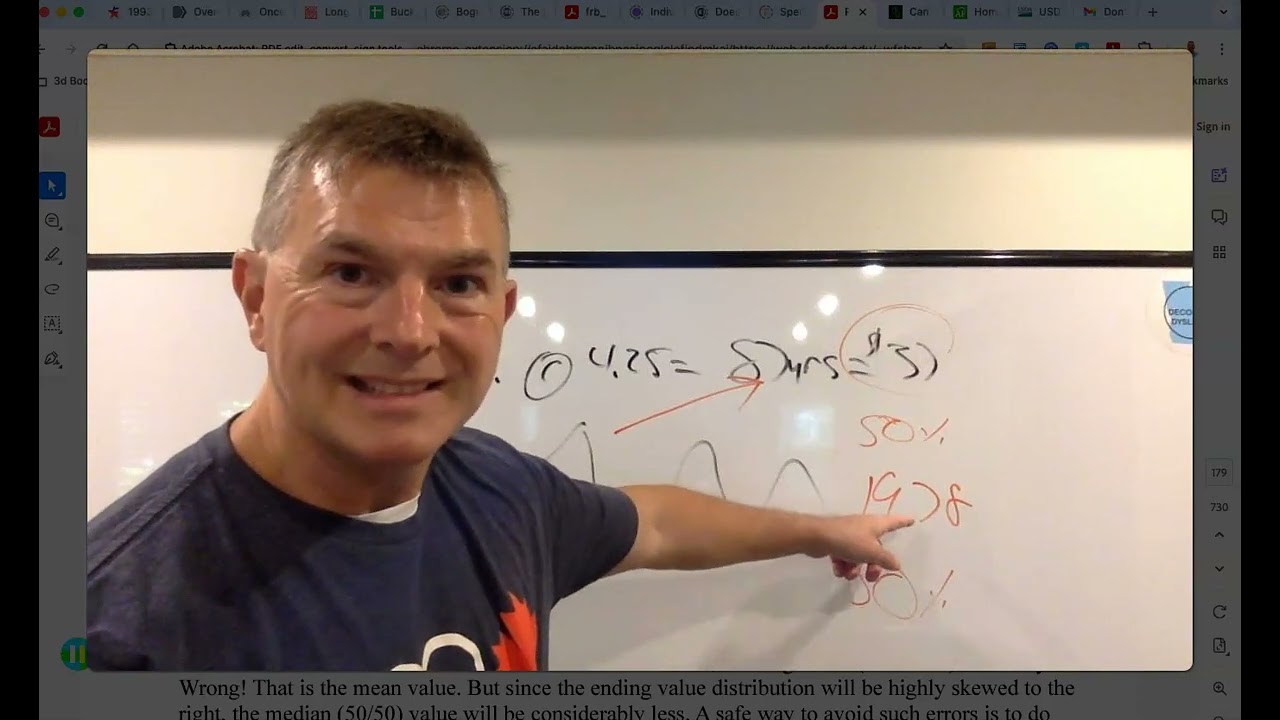

This isn’t how math works. Nor average rates of return. 100% of the people who began with $1 87 years ago ended with $37.

The median return is hypothetical and irrelevant from a practical standpoint.

What truly matters, is the internal rate of return of your individual portfolio. Not everyone has the same cash flows at the same time. People buy and sell through it their investing careers, which causes substantial skew from the average rate of return of the market.

Was that based on the S&P 500 or what the average investor invests in? Heck investing in US treasuries and covered call ETFs I could do slightly better than 4.5% a year.

Time is your friend in the accumulation stage.

As early as possible, max out your savings and put it on auto-pilot just like FICA and Tax withholding on your paycheck. After a few pay cycles, you’ll never miss it. Don’t babysit the market. Simply periodically verify your savings are being properly accounted for.

We “survived” the tech crash and the 2008 mortgage scam/taxpayer bailout of big banks. And yet we more than quadrupled our money.

Josh that's why I think my parents yrs ago invested in US Savings bonds fixed rate til 1980s when bank interest rose to 15% but as a long term seeing now what a 1000 bond interest for 30yr is amazing for a 500 initial investment. You have to be careful now a days market is all over the place you can loose a lot!

Josh, I’m totally confused on what the hell are you talking about?

All I know when my wife retires at 62 we’re spending down trying to dying with zero.