Today we cover a broad range of topics from employee stock purchase plans to how to move on after you make a financial mistake. We discuss the difference between a traditional workplace 401(k) and a solo 401(k). We talk about 457(b)s, tax implications of K1 form upon partnership, and answer if you can have a solo 401(k) for each 1099 contract you have. We start this episode off discussing whether it is a good idea or not to be public about how much money you make and what you do with your money. At the end of the day we believe everyone should be able to do whatever they want with their career and their income – but it is unlikely there is any good reason to be public about that unless you are trying to make money online.

This podcast is sponsored by Bob Bhayani at He is an independent provider of disability insurance planning solutions to the medical community in every state and a long-time white coat investor sponsor. He specializes in working with residents and fellows early in their careers to set up sound financial and insurance strategies. If you need to review your disability insurance coverage or to get this critical insurance in place, contact Bob at today by email info@drdisabilityquotes.com or by calling (973) 771-9100.

The White Coat Investor has been helping doctors with their money since 2011. Our free financial planning resource covers a variety of topics from doctor mortgage loans and refinancing medical school loans to physician disability insurance and malpractice insurance. Learn about loan refinancing or consolidation, explore new investment strategies, and discover loan programs for specifically aimed at helping doctors. If you’re a high-income professional and ready to get a “fair shake” on Wall Street, The White Coat Investor channel is for you!

Main Website:

YouTube:

Student Loan Advice:

Facebook:

Twitter:

Instagram:

Subreddit:

Online Courses:

Newsletter:

00:00 Is Talking About Money Tacky?

02:00 Should Docs Feel Bad About FIRE?

07:30 Employee Stock Purchase Plans

11:34 A Huge Financial Mistake

17:53 Bad 401(k)s

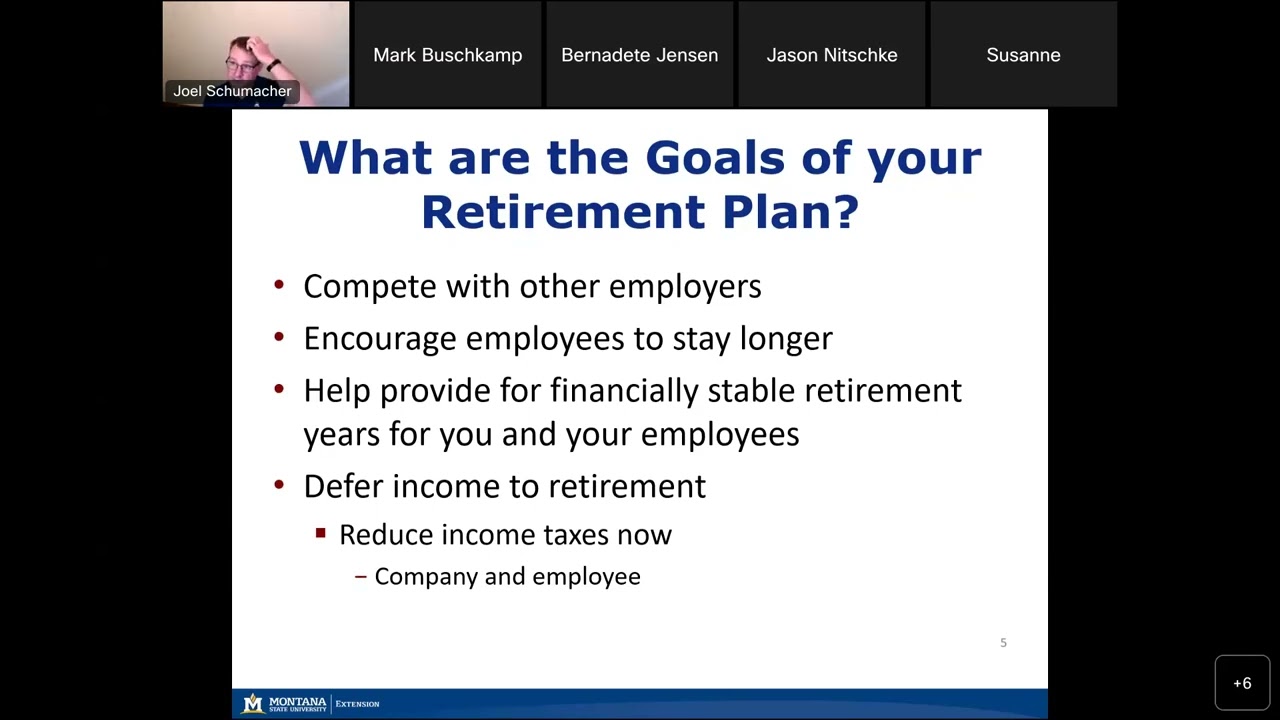

21:51 457 Plans – Vetting Your Employer

26:25 K-1 Tax Implications

32:15 Multiple 401(k)s

34:51 Dividends & Tax Losses

35:54 Wrap-Up…(read more)

LEARN MORE ABOUT: Retirement Planning

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

The case at 11:34 is a gut punch. Thanks for calling in, Sam. I hope you're doing ok.