What if your 401k, IRA, index fund wasn’t what you thought it was? Would you be open to looking at it from another perspective?The best way to start is learning what MPI is and what it can do for you. My LinkTree has free resources (books, videos and MPI Calculator) and my calendar. I’m a Certified MPI Advisor. I’d recommend scheduling a call and watching the MPI Video Series in the meantime. LINK IN BIO for free resources. Let’s connect.

MPI With Dom LinkTree –

Get your free copy of the best-selling book, “Every Ends Up Poor!” by Curtis Ray –

Book an MPI Strategy Call –

Run your numbers on the MPI Calculator –

Full MPI Video Series –

Get your free copy of the best-selling book, “The Lost Science of Compound Interest.” by Curtis Ray –

#4PercentRule #MPI #TaxFree #Money #BankOnYourself #Wealth #Stocks #RetirementPlanning #Retire #RetireEarly #Investment #Investing #Finance #FinancialEducation #Entrepreneur #FinancialFreedom #LifeInsurance #IULplus #RetirementIncome #RothIRA #401k #CollegeFunding…(read more)

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

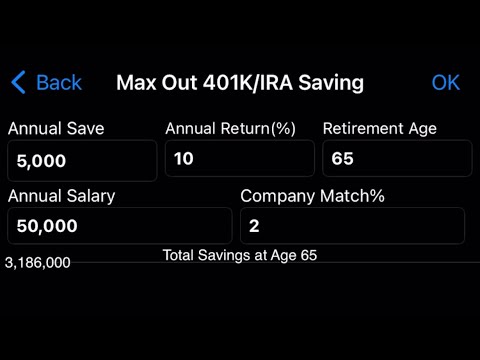

If you’ve ever invested in a 401k, IRA, or index fund, you may have thought that you were making a safe, secure investment. But what if these investments weren’t what you thought they were? Would you be open to looking into alternatives?

First, it’s important to understand the risks associated with 401k, IRA, and index fund investments. These investments are often subject to market fluctuations, meaning that their value can go up or down. This means that if the market takes a dive, you could be left with a much smaller retirement fund than you anticipated. Additionally, these investments are often subject to fees and taxes, which can further reduce your overall return.

The good news is that there are other options for retirement savings that may be more secure and potentially more profitable. For example, you could consider investing in real estate or gold. Both of these investments have the potential to increase in value over time, and they are not subject to the same market fluctuations as 401k, IRA, and index fund investments. Additionally, you may be able to avoid taxes and fees when investing in these assets.

It’s important to do your research before investing in any asset. Make sure you understand the risks associated with the investment, as well as the potential rewards. Talk to a financial advisor to get an unbiased opinion on the best investments for you.

At the end of the day, if you’re not happy with the performance of your 401k, IRA, or index fund, you may want to consider looking into other options. With the right research and advice, you may be able to find a more secure and potentially more profitable investment for your retirement savings.

0 Comments