![]()

Roth Conversions can be a great tax strategy to implement, but when should you do it? When is it best for your individual situation?

Timestamps:

00:00 – Intro

0:56 – IRA v. Roth IRA

1:48 – What is a Roth Conversion?

2:16 – When Should I Do a Roth Conversion?

3:12 – 3 Times To Do a Roth Conversion

4:34 – Roth Conversion Example

5:51 – 2020 Stock Market Example

6:28 – Save Money On Taxes!

6:54 – Subscribe!

SUBSCRIBE HERE:

_ _

For more resources and content, check us out here!

Website:

Podcast:

Instagram:

Facebook:

LinkedIn: …(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

A Roth conversion can be a powerful tool for optimizing your retirement savings strategy. However, determining when to make Roth conversions can be a complex decision that requires careful consideration of your financial situation and long-term goals.

A Roth conversion involves moving funds from a traditional IRA or 401(k) into a Roth IRA. This can be a valuable strategy for several reasons. Roth IRAs offer tax-free growth and withdrawals in retirement, which can provide significant tax savings over time. Additionally, Roth IRAs are not subject to required minimum distributions after age 72, giving you more flexibility in managing your retirement income.

So when should you consider making Roth conversions? Here are some key factors to take into account:

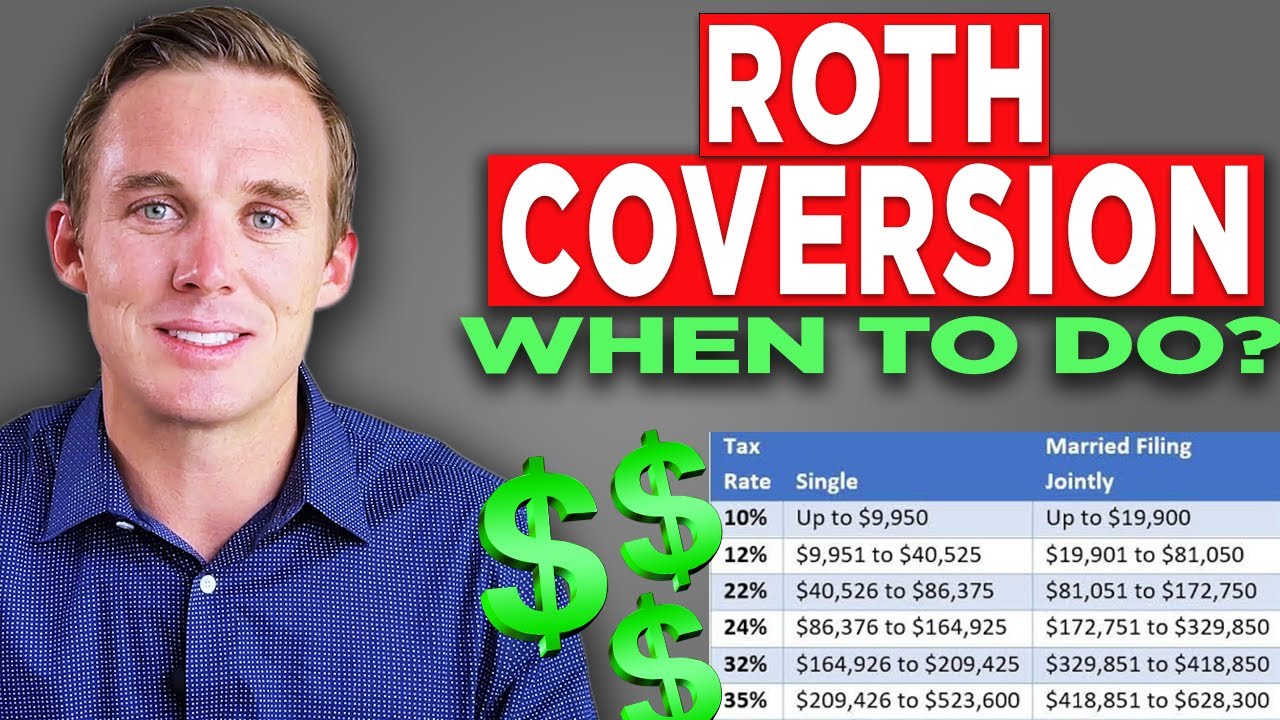

1. Tax implications: One of the most important considerations when deciding whether to make a Roth conversion is your current tax bracket and expected future tax bracket. If you expect your tax rate to be lower in retirement, it may make sense to defer taxes by keeping your funds in a traditional IRA. On the other hand, if you anticipate being in a higher tax bracket in retirement, a Roth conversion could be advantageous.

2. Time horizon: Your age and time until retirement are also important factors to consider when evaluating Roth conversions. The longer your funds have to grow tax-free in a Roth IRA, the more beneficial the conversion will be. If you are close to retirement, you may have less time for the tax-free growth to offset the immediate tax hit of a conversion.

3. Cash flow needs: Consider your current and future cash flow needs when deciding whether to make a Roth conversion. Converting a large sum of money all at once could result in a substantial tax bill, so it may be more feasible to spread out conversions over several years to manage the tax impact.

4. Estate planning goals: Roth IRAs offer unique estate planning advantages, as they can be passed on to your heirs tax-free. If you have substantial assets in a traditional IRA that you plan to leave to your beneficiaries, converting some or all of your funds to a Roth IRA could be a tax-efficient way to transfer wealth.

Ultimately, the decision to make Roth conversions should be based on a holistic assessment of your financial situation and goals. Consulting with a financial advisor or tax professional can help you evaluate the potential benefits and drawbacks of Roth conversions and determine the best strategy for your individual circumstances.

In conclusion, Roth conversions can be a valuable tool for optimizing your retirement savings strategy, but they require careful consideration and planning. By evaluating your tax situation, time horizon, cash flow needs, and estate planning goals, you can determine the optimal timing for making Roth conversions and maximize the benefits of tax-free growth in retirement.

Great video! Understand the theory but any software you can advise that calculates the optimal timing and amounts for Roth conversions? Thanks.

I know I need to ask my company what their policy/rules are on 401k for the right answer. But I just want to ask if anyone has come across this. My company stops their 401k match for six months if I withdraw any amount from my 401k. Will my company also stop the 401k match for six months for Roth conversions? If that’s the case repeat conversions will stop company matches for years if I do repeat Roth conversions. So not only will I have to pay tax on the conversions I will also loose the 401k match. Anyone know if this is the case with their company?

Sean mullaney at https://youtu.be/DfuUPLkHbYU?si=EtzeXY6VkItQIzfE references this big push to do Roth conversions.His point is that by his example even a $3M trad IRA is not getting eaten alive by uncle sam, and that the effective tax rate is actually very low even for his high earner example. He even postulates tax increases from 22 to 30 percent.If he is right all this emphasis on Roth conversions doesn't seem to make a lot of sense. Is he wrong, and if so, can you explain why? I'm having a hard time fighting the angel/devil on my shoulder telling me never pay the irs till they make you do it. Thanks!

MAGI amount is also important to consider for Medicare premiums.

Excellent

I think another benefit is the ability to withdraw the Roth-converted money earlier than age 59.5 (5 years from the conversion if I remember right). In other words, more liquidity.