![]()

Interested in a custom strategy to retire early? →

Are you in your early 50s and have saved $2 million?

Find out how soon you can retire while fulfilling your lifestyle and travel goals!

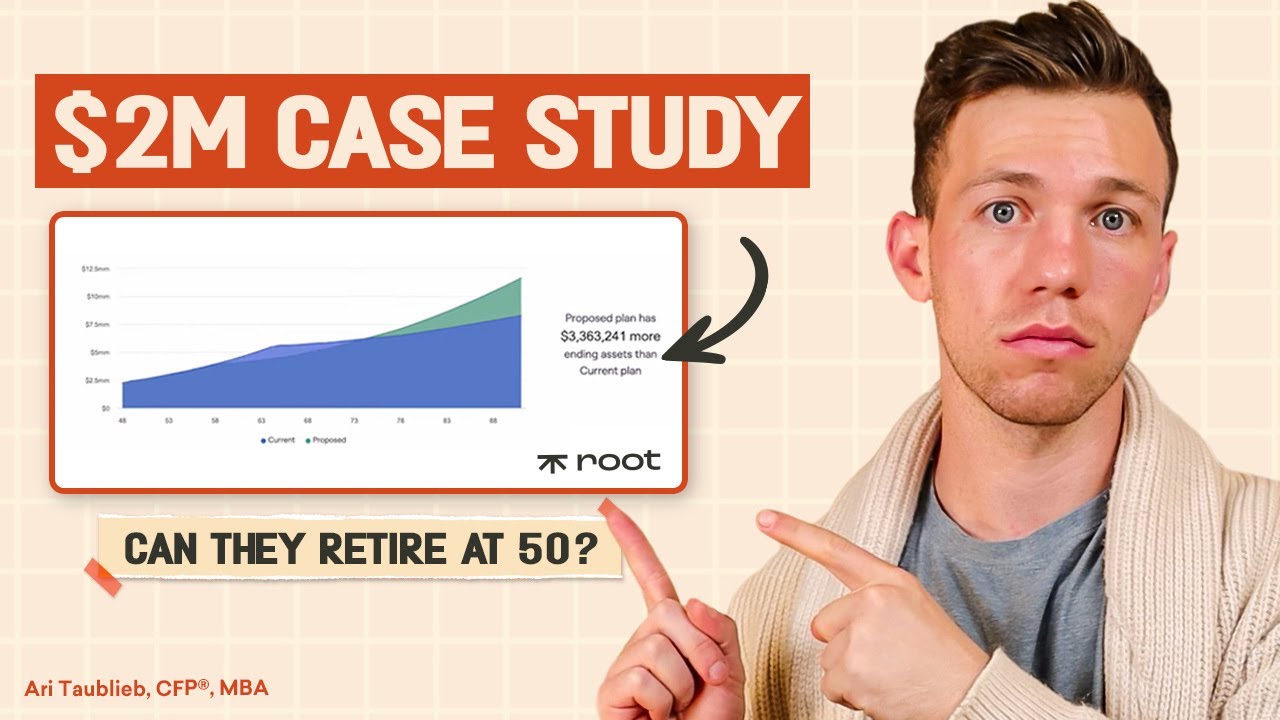

In this video, I’m sharing an analysis of a client’s case study. We were looking for the best way to retire early in the 50s with a $2 million portfolio.

We explored key aspects, from healthcare costs to investment strategies, tax planning, and optimizing expenses.

––––––––––––––––––––––––––––––

Time Stamp

00:00 Intro

01:20 Backstory and Context For Case Study

04:00 Maxing Out 2 IRAs

07:25 How Early Can I Retire With Confidence

10:05 Analyzing the Impact of Different Investment Strategies

14:42 How Much Do You Guys Want to Spend

16:00 Diversifying Investments Across Different Accounts

17:25 How Much Is Really Enough?

20:00 Summary

20:28 Work With Us

––––––––––––––––––––––––––––––

eBook: The Complete Guide To An Early Retirement (FREE)→

eBook: The Complete Guide To Health Insurance (FREE)→

Early Retirement Expense Calculator (FREE) →

PODCAST –

INSTAGRAM –

LINKEDIN –

What video topic would you like to see discussed in a future video?

Ari Taublieb, CFP®, MBA, is the Vice President of Root Financial Partners (Fiduciary) and host of the Early Retirement Podcast.

––––––––––––––––––––––––––––––

📣 Are you taking advantage of tax planning before 2026? Most people hoping to retire early know they’re leaving money on the table but don’t know how to fix it.

👉 Subscribe to our channel and press the bell icon.

–––––––––––––––––––––––––––––

⚠️ “DISCLAIMER:⚠️

All content is not to be received as financial advice, and each individual should consult with their dedicated financial planner, tax preparer, estate attorney, etc., before making any financial decisions.

This video contains content I created and got permission to use from its creators. This Channel DOES NOT Promote or encourage Any illegal activities; all contents provided by This Channel are meant for EDUCATIONAL AND ENTERTAINMENT purposes only….(read more)

LEARN MORE ABOUT: IRA Accounts

CONVERTING IRA TO GOLD: Gold IRA Account

CONVERTING IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

Many people dream of retiring early and enjoying a life of leisure and relaxation without the constraints of a traditional work schedule. For some lucky individuals, this dream may become a reality if they have saved up a substantial amount of money to support themselves in their golden years.

One question that often arises is whether or not $2 million is enough to retire early at the age of 50. While $2 million may seem like a significant amount of money, it may not be enough to sustain someone through their retirement years, especially if they are planning to retire at a relatively young age.

The key to determining if $2 million is enough to retire early at 50 lies in understanding one’s lifestyle and financial needs. Factors such as living expenses, healthcare costs, inflation, and potential for investment growth all play a crucial role in determining whether or not someone can comfortably retire with $2 million in savings.

First and foremost, it is essential to calculate how much money will be needed to maintain the desired standard of living during retirement. This includes expenses such as housing, food, transportation, healthcare, and leisure activities. It is also important to consider any outstanding debts that may need to be paid off before retiring.

Healthcare costs are a significant consideration for many retirees, as medical expenses tend to increase as one gets older. It is crucial to have a plan in place to cover healthcare costs, either through private insurance or through a government-funded program like Medicare.

Inflation is another important factor to consider when planning for retirement. Inflation can erode the value of savings over time, meaning that $2 million may not have the same purchasing power in the future as it does today. It is essential to factor in potential increases in inflation when calculating how much money will be needed to sustain oneself through retirement.

Lastly, the potential for investment growth can have a significant impact on whether or not someone can retire early with $2 million. By investing their savings wisely, individuals may be able to generate a steady stream of income that can supplement their retirement savings and help them maintain their desired standard of living.

In conclusion, while $2 million may seem like a substantial amount of money, it may not be enough to retire early at the age of 50, especially if one plans to live a comfortable and fulfilling retirement. It is essential to carefully consider all factors, including living expenses, healthcare costs, inflation, and investment growth, before making the decision to retire early. Consulting with a financial advisor can also help individuals develop a comprehensive retirement plan that will support them throughout their golden years.

Thanks Ari for another great video! It's always great to see how you make the decisions based on all the variables in your case studies.

Great analysis

Where can I send my numbers for you to run a video?

Excellent commentary; thanks, Ari!

What is your e-mail so I can e-mail you my case study?

Do you guys work with RealEstate investors? I haven’t seen you talk about it on your page at all. Just stock and cash portfolios.

Correction-you can no longer take out spouses SS anymore. New law passed.

So at 11:40 it was stated they could have 4500 per month plus 3600 in travel, which equals 6500 per month x 12 for 78,000 a year. Basically the 4% rule wins again for a couple with 2 mil in the market. Crazy.

What this video shows me is that you have an incredible software program.

Nice video to see what's possible just by changing some variables. Thank you for showing us the thought process to see how we can retire sooner than the traditional 65.

This was great, Ari. I like how you switch up so many variables and things change drastically as a result.