![]()

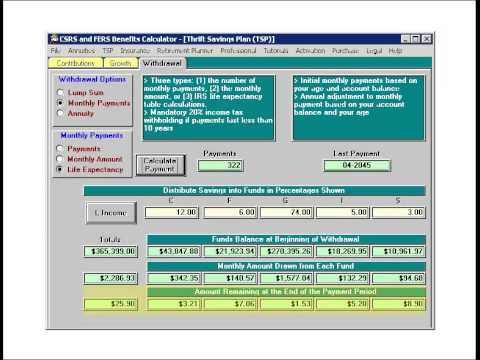

This video will demonstrate the withdrawal options for TSP….(read more)

LEARN MORE ABOUT: Thrift Savings Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

The Thrift Savings Plan (TSP) is a retirement savings plan for federal employees and members of the military. It offers several withdrawal options for participants to access their funds in retirement. Here are the most common TSP withdrawal options:

1. Single payment: This option allows you to withdraw your TSP account balance in a lump sum payment. You can transfer the payment to an IRA or use the money as you see fit. However, lump sum payments can have significant tax implications, especially if you withdraw a large amount at once.

2. Monthly payments: This option involves receiving a fixed monthly payment from your TSP account. You can choose to receive payments for a set period or for the rest of your life. This option can provide a steady income stream in retirement but may limit your access to your funds.

3. Life annuity: A TSP annuity provides regular payments for your lifetime. This option guarantees a fixed income stream, but payments stop when you die. You cannot change the payment amount or receive the remaining balance as a lump sum.

4. Partial withdrawals: You can also make partial withdrawals from your TSP account. This option allows you to access your funds without depleting your entire account balance. However, partial withdrawals may be subject to taxes and other fees.

Before choosing a TSP withdrawal option, you should consider your retirement goals, financial situation, and tax implications. It is crucial to understand the tax laws and regulations that apply to your TSP account to avoid unexpected tax consequences. You may want to consult a financial advisor or tax professional to help you make an informed decision about your TSP withdrawal options.

I need to take out all of my TSP money for college expenses. How much will I get if I take it all out? I have $16,000 in it. I’m in my 30s.

UPDATE: ACCORDING TO RECENT TSP INFO, IF ANY GOVERNMENT EMPLOYEE RETIRES AFTER AGE 55, YOU WILL NOT BE PENALIZED BY THE IRS FOR NEXT YEAR'S TAX TIME. FEEL FREE TO RECHECK W/YOUR FINANCIAL ADVISOR AND/OR THE IRS OFFICE. THANK YOU. MR. GARCIA IN SF, CA.

Doesn't look like they have answered any questions…..

I got fired from my government job, they were taking out money each check, but now I loss my job I need to stop the withdrawal, what should I do

Found the software. http://www.fedretiresoftware.com/ It costs $30.

Where do you download the calculator from?

Very helpful breakdown of withdrawal options. Thank you!

this not helpfull i need info not the bullshit where is my money when can i expect it why does it take so long

where is this calculator?

thanks!

Terrible, boring, way too long. Get to the point please.

This video used a few misleading figures. Was this intentional, a mistake, or am I missing something? What is your agenda?

I have a medical condition that needs equipment called bipap to help me breath at night and I need to withdraw the money to pay fo r the machine. I need to know how