![]()

Year End Tax tips for RMD, 401(k), gift giving, donations

Tips on Required Minimum Distribution (RMD)

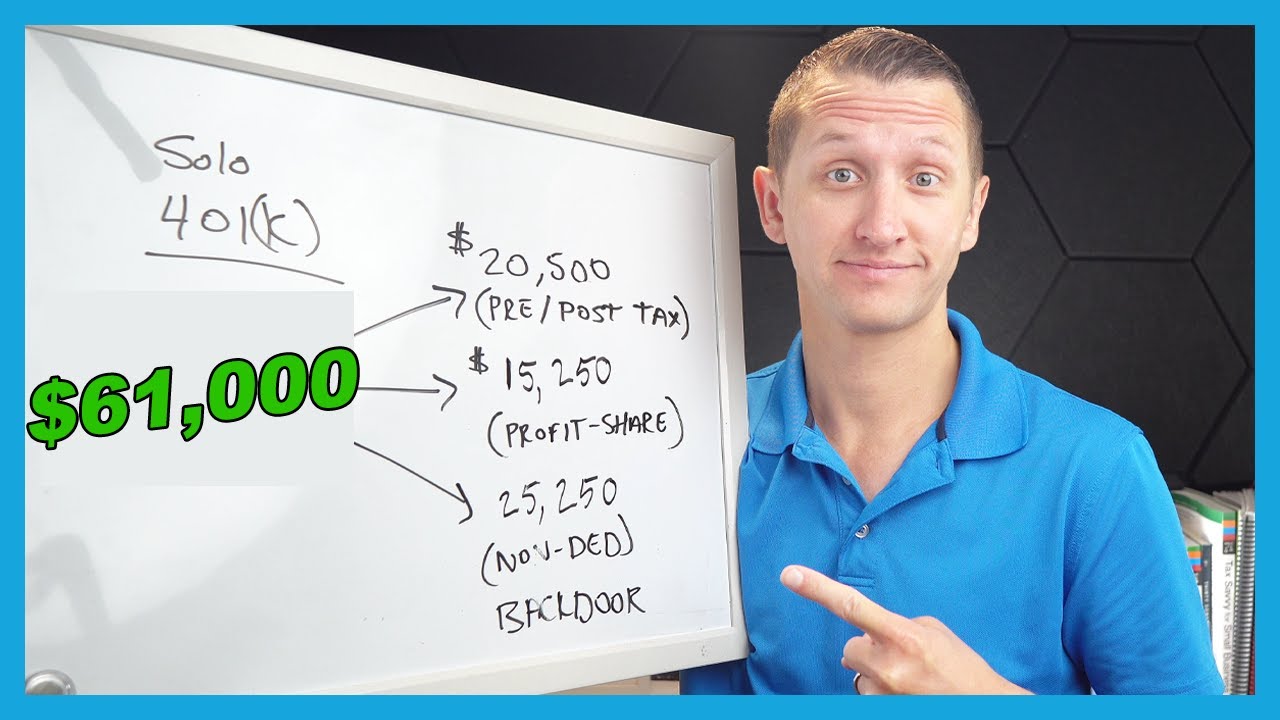

Funding Retirement accounts 401(k), 403(b), SEP, Simple Plans

Tips on self employment Keogh Plan

Loss Harvesting on capital gains

Tips on Gift Giving by December 31, 2019

Tips on Donations and Donation Receipt

Finally, a photo of cute puppies if the Tax tips were too boring.

_________________________________________________

Katie St. Ores CFP®, ChFC®, EA, LTC

• 97 Hours of Continuing Education each year to maintain Professional designations

• CFP® – Certified Financial Planner

• ChFC® – Chartered Financial Consultant

• EA – Enrolled Agent – Empowered by the U.S. Dept of the Treasury

• Licensed Tax Consultant –Licensed by the State of Oregon

• Registered Investment Adviser- Oregon Div. of Financial Regulation

• Tax Accountant – Markusen & Schwing CPA’s

• Certified Investment Management Analyst program -Wharton – University of Pennsylvania

• Certified Mergers & Acquisition Advisor program – Loyola University

• Certificate in Accounting – UC Berkeley

• Master of Science in Project Management – University of Wisconsin

• Master’s in Administrative Management with Honors – Moscow State University

• ACAMS – Anti-Money Laundering Specialist Program

• YouTube – Educational Channel-Finance, Investment, Taxes

• Series 63 – Uniform Securities Agent State Law Exam

• Financial Advisor, Tax Consultant – St. Ores Wealth Management

Katie St. Ores Yamhill County

Offices across from the Yamhill County Treasurer & Yamhill County Courthouse

McMinnville, Oregon 97128

Katie St. Ores CFP®, ChFC®, EA, LTC

St. Ores Wealth Management llc

www.SaintOres.com

2020 Women’s Initiative (WIN) CFP® Board

2020 Financial Women to Watch on Youtube…(read more)

LEARN MORE ABOUT: Keogh Plans

REVEALED: How To Invest During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

0 Comments