Having trouble understanding the contribution deadlines for your Solo 401(k)? The Solo K contribution deadlines for 2023 depend on your business type and filing status. IRA Financial’s founder Adam Bergman breaks down everything you need to know to help allow you to optimize your retirement savings while minimizing your tax bill.

Download the PowerPoint & follow along:

Watch past masterclasses:

—

Ready to get started?

Still have questions? Our experts are here to help answer all of your questions! Set up a call with our reps today!

Check out our books:

Discover more videos by IRA Financial:

Subscribe to our channel:

—

About IRA Financial:

IRA Financial was founded by Adam Bergman, a former tax and ERISA attorney who worked at some of the largest law firms. During his years of practice, he noticed that many of his clients were not even aware that they can use an IRA or 401(k) plan to make alternative asset investments, such as real estate. He created IRA Financial to help educate retirement account holders about the benefits of self-directed retirement plan solutions.

IRA Financial is a retirement account facilitator, document filing, and do-it yourself document service, not a law firm. IRA Financial does not provide legal services. No attorney-client relationship exists between the Client and IRA Financial Group, its management, salespersons, or IRA Financial’s in-house legal counsel. IRA Financial provides IRA retirement facilitation service and CANNOT provide Client with legal, investment, or financial advice. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.

IRA Financial is not engaged in rendering legal, accounting or other professional services. If legal advice or other professional assistance is required, the services of a competent professional person should be sought. (From a Declaration of Principles jointly adopted by a Committee of the American Bar Association & a Committee of Publishers and Associations.). The scope of Professional Services does not include the costs of any custodian related services.

Learn More: …(read more)

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

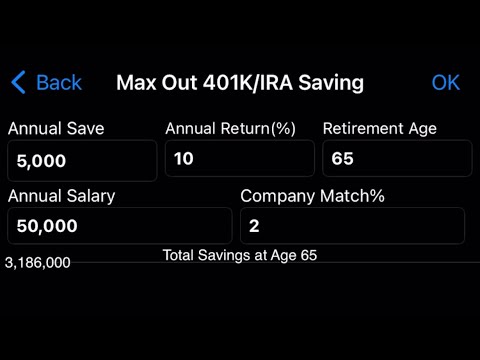

As a self-employed individual or small business owner, you may already be familiar with the benefits of a Solo 401(k) plan. This retirement savings account allows you to save for your future while enjoying tax advantages and flexibility in investment choices. However, to make the most of your Solo 401(k) plan, it is important to be aware of the contribution deadlines for the year 2023.

The IRS sets specific deadlines for contributing to your Solo 401(k) plan each year. For the 2023 tax year, the deadline for making employee salary deferrals is generally December 31, 2023. This means that you must contribute your desired amount to your Solo 401(k) account from your salary before the end of the calendar year. Keep in mind that if you are paid on a quarterly or semi-annual basis, you may need to adjust your contributions accordingly to meet this deadline.

In addition to employee salary deferrals, you can also make employer profit-sharing contributions to your Solo 401(k) plan. The deadline for making these contributions for the 2023 tax year is generally the due date of your tax return, including extensions. For most self-employed individuals, this means you have until the tax filing deadline of April 15, 2024 (or October 15, 2024 if you file for an extension) to make your profit-sharing contributions for the previous year.

It is important to note that if you file for an extension to your tax return, you must still make your Solo 401(k) contributions by the original tax filing deadline to receive a deduction for the current tax year. If you miss the contribution deadline, you may be subject to penalties or miss out on valuable tax savings.

To ensure that you maximize your retirement savings and take advantage of the tax benefits of a Solo 401(k) plan, it is crucial to stay informed about the contribution deadlines for each tax year. Consider working with a financial advisor or tax professional to help you navigate the rules and ensure that you make the most of your Solo 401(k) plan in 2023. By contributing to your account on time and in the appropriate amounts, you can build a secure financial future for yourself and your family.

You’re the man!

Great content! Thanks. Can the 20% employer profit sharing contribution be made to a Roth account? If yes, does the ER contribution have to be made to a separate Roth account, or can it be made to the same Roth account that holds the employee contribution?

Also, is this effective for 2023 contributions, or does this start with 2024 contributions? Thanks.