In this video, Curt explains the 2024 contribution limits for employer-sponsored retirement plans like 401(k)s, 403(b)s, 457s, and TSPs.

He also shares the contribution limits for IRAs and HSAs, as well as any income limitations related to these accounts.

00:00 – Start

00:38 – Employer Sponsored Plans

01:16 – IRA Contribution Limits

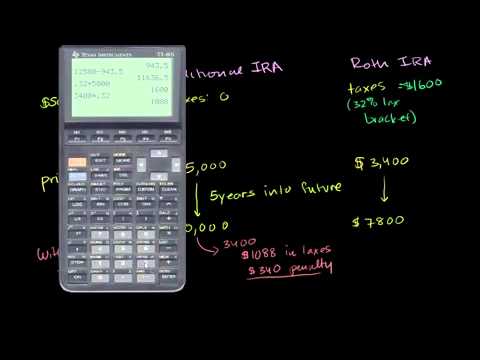

02:06 – Traditional IRA Income Restrictions

02:49 – Roth IRA Income Restrictions

03:12 – Health Savings Accounts

03:39 – Other Changes

04:30 – Wrap-Up

Our IRA Playlist:

Our Roth IRA Playlist:

Our website:

Here’s a link to the IRS press release announcing these updates:

Other Related Videos:

Other Related Blog Posts from

How to Use QCDs to Reduce RMDs –

The Tax Planning Benefits of Roth IRA Conversions –

How Much Would a Dollar Invested Today Be Worth in 10 Years? –

Thanks for watching! Let us know if there are any other topics you want us to cover in the comments below.

Don’t ever put any of your personal information in the comments! This makes you an easy target for scammers, some of whom may attempt to pretend that they are me.

Disclaimer: This video is for information and entertainment only. None of the contents should be considered legal, accounting, or other professional advice. You should reach out to a qualified professional before making your own financial decisions.

I try to respond to comments and questions, but I will never provide personal advice through YouTube….(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

As we approach the end of 2023 and start planning for the new year, it’s important to take into consideration the contribution limits for various retirement and savings accounts. For 2024, the contribution limits for 401(k), Individual Retirement Accounts (IRAs), and Health Savings Accounts (HSAs) have been announced, providing individuals with the opportunity to plan their financial strategies for the upcoming year.

The 401(k) is a popular retirement savings account offered by many employers. In 2024, the contribution limit for 401(k) accounts will increase to $20,500, up from $19,500 in 2023. This means that individuals under the age of 50 will be able to contribute up to $20,500 from their pre-tax income to their 401(k) accounts in 2024. For individuals aged 50 and older, the catch-up contribution limit remains the same at an additional $6,500, bringing their total contribution limit to $27,000 in 2024.

When it comes to IRAs, the annual contribution limits for 2024 have also seen an increase. The limit for Traditional and Roth IRAs will be $6,000 for individuals under the age of 50, up from $5,500 in 2023. For those aged 50 and older, the catch-up contribution limit will remain unchanged at an additional $1,000, bringing their total contribution limit to $7,000 in 2024. It’s important to note that these contribution limits are cumulative, meaning that individuals can contribute to both a Traditional and Roth IRA, but the total contributions cannot exceed the annual limit.

For those with a Health Savings Account (HSA), the contribution limits for 2024 have also been announced. The limit for HSA contributions will increase to $3,650 for individuals with self-only coverage, up from $3,600 in 2023. For those with family coverage, the limit will increase to $7,300, up from $7,200 in 2023. The catch-up contribution limit for individuals aged 55 and older will remain the same at an additional $1,000.

These increased contribution limits for 401(k), IRAs, and HSAs provide individuals with the opportunity to save more for their retirement and future healthcare expenses. By taking advantage of these higher contribution limits, individuals can maximize their tax-advantaged savings and work towards achieving their financial goals.

It’s important to note that these contribution limits are subject to change based on inflation and other economic factors. As such, it’s essential to stay informed about any updates or changes to the contribution limits throughout the year.

In conclusion, the 2024 contribution limits for 401(k), IRAs, and HSAs provide individuals with the opportunity to save more for their retirement and healthcare expenses. By taking advantage of these increased limits, individuals can make the most of their tax-advantaged savings and work towards securing their financial future. It’s recommended to consult with a financial advisor to develop a comprehensive savings strategy that aligns with your long-term financial goals and aspirations.

Thanks for a quality rapid update!