We’re often asked at the supermarket or other checkout lines if we’d like to make a donation to a charity. But is this legitimate and does your money really go to the organization? Also, facility fees are a mean trend in healthcare. Clark explains how we’re cheated and how to avoid this dirty game.

Plus, Christa shares your #AskClark questions and Clark gives his take. All this and more on the April 16, 2024, episode of The Clark Howard Show.

00:00 – Intro

01:15 – Are Cash Register Charity Donations Legit?

05:33 – Ask Clark – Paying Credit Card Debt Paying two Weeks or Once a Month? and Investing or Saving?

08:25 – Ask Clark – Parent Did not Save Enough for Own Retirement

12:56 – Ask Clark – Best Place to Retire on a Fix Budget

15:53 – Hospital Facility Fee Ripoffs

21:11 – Ask Clark – Hospital Prices Vs Self Pay

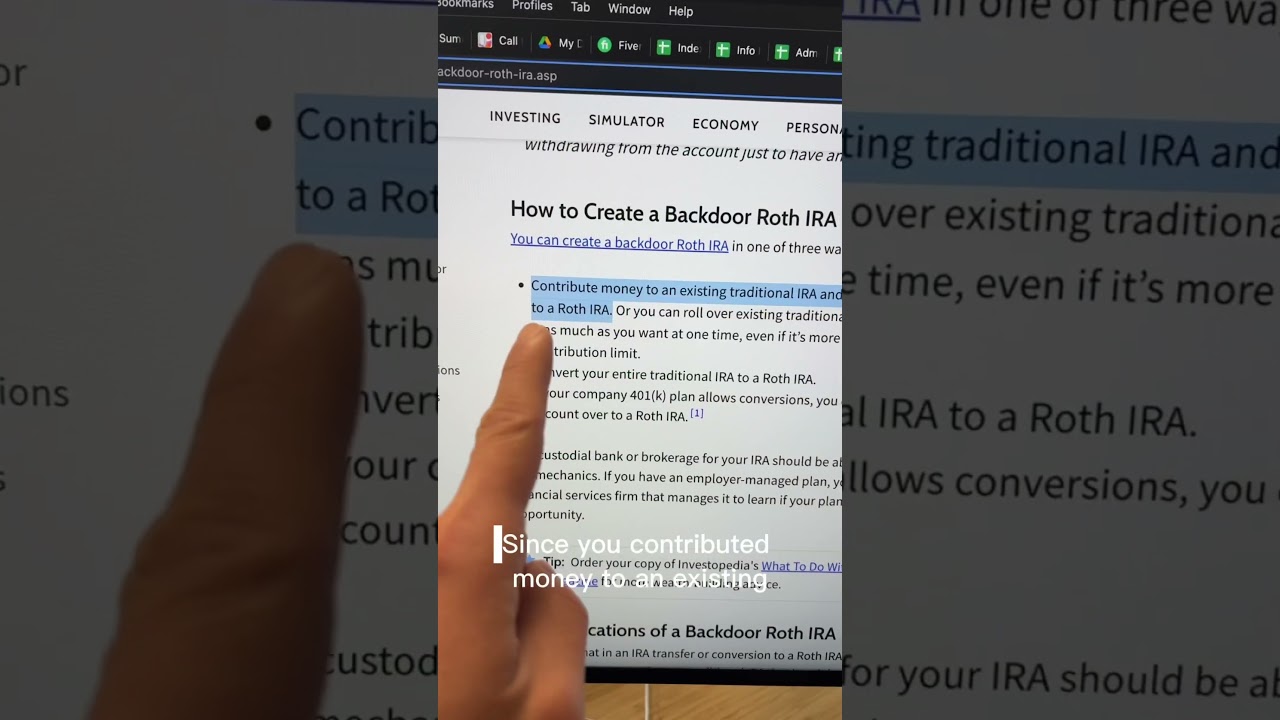

25:42 – Ask Clark – Over the Income Limit for Roth IRA

27:35 – Ask Clark – Buying Used EV

Mentioned on the show:

Clark.com: Advice You Can Trust:

SUBSCRIBE:

Follow Us for More Money Tips:

Website:

Podcast:

Newsletter:

Instagram:

Facebook:

Need Consumer Advice?

The Consumer Action Center is a free resource for advice on money and consumer issues. Call 636-49C-LARK (636-492-5275) and a member of Team Clark will assist you as soon as possible. The Consumer Action Center is available Monday-Friday from 10 a.m. to 4 p.m. ET.

If you found this video valuable, give it a like.

If you know someone who needs to see it, share it.

Leave a comment below with your thoughts.

Add it to a playlist if you want to watch it later.

Our Promise to You:

At Clark.com and ClarkDeals.com, we do not get paid for endorsements or reviews of any product or service, nor do we allow advertisers to place paid content on our sites. More information: …(read more)

LEARN MORE ABOUT: IRA Accounts

CONVERT IRA TO GOLD: Gold IRA Account

CONVERT IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

Full Show: Is Donating at Checkout Legit?

Many retailers offer customers the option to donate to various charities or causes at the checkout counter. This practice has become increasingly common in recent years, with customers being asked to make small donations of one or two dollars to support a particular cause. But is donating at checkout truly a legitimate way to support charity, or is it just a way for retailers to boost their bottom line?

On a recent episode of Full Show, the topic of donating at checkout was discussed in depth. Guest speakers included representatives from various charities and advocacy groups, as well as retail industry experts. The consensus among panelists was that while donating at checkout can be a convenient way for customers to support a cause they care about, there are some potential pitfalls to be aware of.

One concern that was raised is that some retailers may not be transparent about where exactly the donated funds are going. In some cases, a portion of the funds may be used to cover administrative costs or marketing expenses, rather than going directly to the intended cause. This can lead to customers feeling misled or disillusioned about the impact of their donation.

Another issue that came up is the pressure that customers may feel to donate at checkout. With cashiers often asking customers to donate in a public setting, some customers may feel uncomfortable saying no, even if they can’t afford to make a donation. This can lead to feelings of guilt or resentment, rather than the positive feelings of generosity that retailers may be hoping to evoke.

Overall, the panelists agreed that donating at checkout can be a legitimate and effective way to support charity, as long as customers are informed about where their money is going and feel confident in the integrity of the organization they are donating to. Customers should also feel empowered to say no if they are unable or unwilling to donate, without feeling pressured or judged by the retailer.

Hospital Facility Fee Ripoffs

In recent years, there has been growing concern over the rising costs of healthcare in the United States. One practice that has come under scrutiny is the charging of hospital facility fees, which are separate charges that hospitals levy for the use of their facilities or equipment during a medical visit. While these fees are intended to cover the costs of maintaining hospital facilities, some critics argue that they are unfair and can lead to exorbitant medical bills for patients.

On a recent episode of Full Show, the topic of hospital facility fee ripoffs was discussed at length. Guest speakers included healthcare policy experts, consumer advocates, and patients who have been affected by high hospital bills. The consensus among panelists was that while hospital facility fees may be a legitimate way for hospitals to cover their expenses, there are instances where these fees can be excessive or unnecessary.

One issue that was raised is the lack of transparency surrounding hospital facility fees. Patients are often unaware of these fees until they receive their medical bill, which can lead to confusion and frustration. In some cases, patients may be charged facility fees for services that could have been provided in a lower-cost setting, such as a doctor’s office or outpatient clinic.

Another concern is that hospital facility fees can disproportionately impact vulnerable populations, such as low-income patients or those with chronic medical conditions. For these patients, paying hundreds or even thousands of dollars in facility fees can be a significant financial burden, potentially leading to delays in seeking medical care or even bankruptcy.

The panelists on Full Show called for greater transparency and accountability in the charging of hospital facility fees, as well as for reforms to ensure that these fees are reasonable and justified. Patients should be informed about these fees upfront, and hospitals should be required to provide a clear breakdown of the costs associated with each medical visit. By addressing these issues, the healthcare system can work towards greater affordability and accessibility for all patients.

Who gets the tax deduction for the charitable donation? Assuming the retailer does, shouldn't they pass that on ?

Clark, I never realized you were gone from YouTube and the podcast 7 months ago for your surgery. Will someone filling in or was I just not noticing? Glad you're doing so well

Doesn't the company/corporation get a tax deduction for the charitable donation they made (using the donations made by their customers)? That to me is the real issue…

I love car edge. I’ve been listening to their you tube channel for years ❤