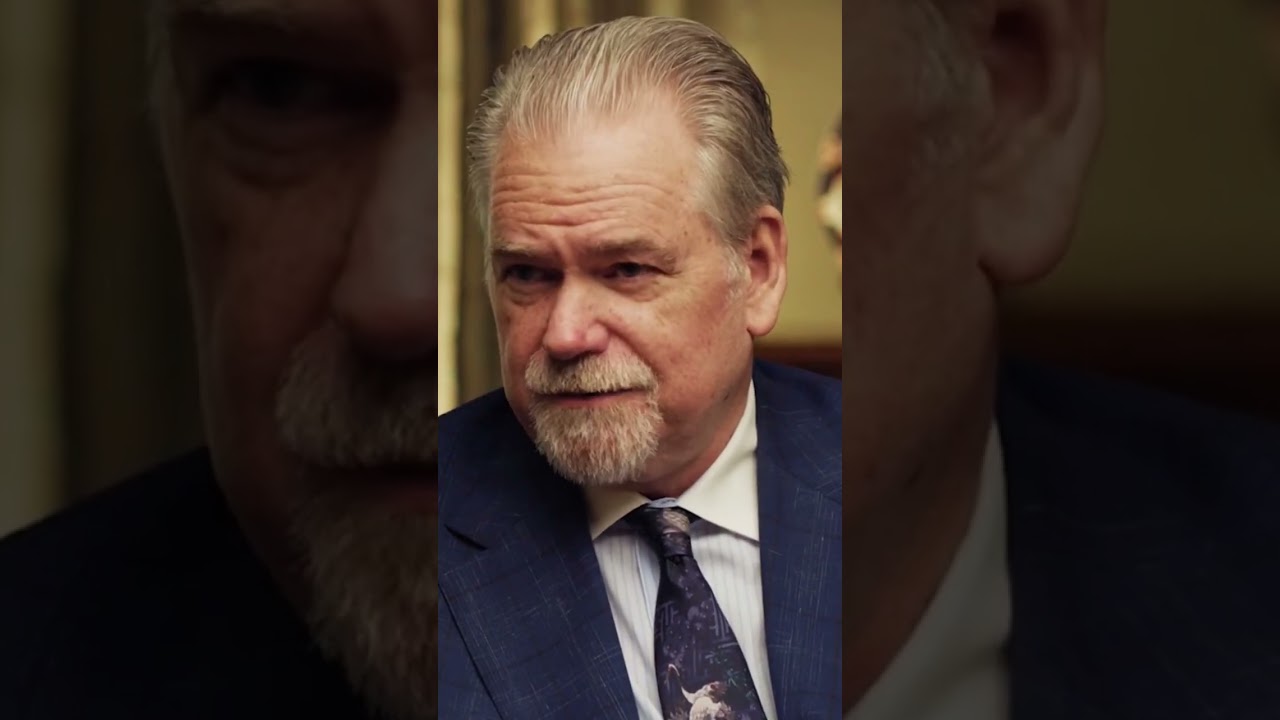

Rob Arnott, chairman at Research Affiliates, shares his views on central banks’ ability to keep inflation under control, and highlights the work of Knut Wicksell, a Swedish economist who 100 years ago pioneered work on “natural interest rate.”

Catch Rob’s full interview where he shares why indexing changed everything, why value is back and the fact that not all inflation is created equal:

#inflation #centralbanks

New episodes of FTSE Russell Convenes drop every Friday. Subscribe to LSEG’s YouTube channel to get new episodes of this show plus The Big Conversation and more. New financial insights published every weekday.

If you have any questions about this episode, financial markets or the economy, please leave us a comment or email fmt@lseg.com.

Follow FTSE Russell

About LSEG

At the centre of global financial markets, LSEG is a strategic enabler of sustainable economic growth, by accelerating the just transition to net zero, growing the green economy, and creating inclusive economic opportunity.

Disclaimer

The content and information (“Content”) in the program (“Programs”) is provided for informational purposes only and not investment advice. You should not construe any such Content, information or other material as legal, tax, investment, financial, or other professional advice nor does any such information constitute a comprehensive or complete statement of the matters discussed. None of the Content constitutes a solicitation, recommendation, endorsement, or offer by the London Stock Exchange Group (LSEG), its affiliates or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content is information of a general nature, is illustrative only and does not address the circumstances of any particular individual or entity. LSEG and its affiliates are not a fiduciary by virtue of any person’s use of or access to the Programs or Content. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content in the Programs before making any decisions based on such information or other Content. In exchange for accessing and/or participating in the Program and Content, you agree not to hold LSEG, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Program. LSEG and its affiliates make no representation or warranty as to the accuracy or completeness of the Content. LSEG disclaims all liability for any loss that may arise (whether direct, indirect, consequential, incidental, punitive or otherwise) from any use of the information in the Program. LSEG does not recommend, explicitly nor implicitly, nor suggest or recommend any investment strategy. LSEG and its affiliates do not have regard to any individual’s, group of individuals’ or entity’s specific investment objectives, financial situation or circumstances. The views expressed in the Program are not necessarily those of LSEG or its affiliates. LSEG and its affiliates do not express any opinion on the future value of any security, currency or other investment instrument. You should seek expert financial and other advice regarding the appropriateness of the material discussed or recommended in the Program and should note that investment values may fall, you may receive back less than originally invested and past performance is not necessarily reflective of future performance….(read more)

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Central banks have a crucial role to play in managing inflation in an economy. Inflation, the rate at which the general level of prices for goods and services is rising, can have a significant impact on a country’s economy, affecting everything from consumer purchasing power to investment decisions.

Central banks have a number of tools at their disposal to rein in inflation. One of the most commonly used tools is monetary policy, which involves controlling the supply of money in the economy. Central banks can do this by adjusting interest rates, buying or selling government securities, or changing reserve requirements for banks.

By raising interest rates, central banks can make borrowing more expensive, which in turn can help to slow down spending and investment in the economy. This can help to cool down inflationary pressures. On the other hand, central banks can also lower interest rates to stimulate economic activity and combat deflation, or falling prices.

Central banks also keep a close eye on the money supply in the economy. If they believe that the money supply is growing too quickly and fueling inflation, they can take steps to reduce it. This could involve selling government securities on the open market or increasing reserve requirements for banks.

In addition to these traditional tools, central banks can also communicate with the public about their inflation-fighting efforts. By setting clear targets for inflation and explaining their rationale for policy decisions, central banks can help to shape public expectations and influence behavior.

However, reining in inflation is not always an easy task. Central banks must carefully balance the need to control inflation with the goal of maintaining economic growth and employment. Tightening monetary policy too quickly or aggressively can lead to a recession, while being too slow to act can allow inflation to spiral out of control.

Overall, central banks play a vital role in managing inflation in an economy. Through a combination of monetary policy tools and clear communication with the public, central banks can help to keep inflation in check and ensure a stable and healthy economy.

Refund my Payment