➜Find the Perfect Gold IRA – With The Gold IRA Assistant! 24/7 chat!

Go To: ✅

🔥🔥🔥 Get a free Gold IRA Kit

🥇 ➜Get In Touch With Augusta Precious Metals,

Go To: ✅

or call 📱Augusta at: 1-855-470-4636

➜ Beware of Gold IRA Dealer Lies (Free Gold IRA Guide):

➜ Join Augusta’s Free Gold & Silver Web Conference Here:

Money Magazine Ranked APM #1 Best Gold IRA for 2022! Read more:

See full blog article:

#retirementplanning #economiccrisis #inflation #bidenisafailure #hyperinflation #gold #silver #preciousmetals

A proper gold IRA rollover ensures your hard-earned funds are safe and secure while earning you the best interest rates possible. If you’re not sure how to execute this process, don’t worry—this guide will walk you through the steps you need to take. Read on to learn about how to open a gold IRA rollover account and invest safely in gold over the long term with our Gold IRA Rollover Guide 2022.

gold ira rollover guide 2022,401k to gold ira rollover guide,gold ira rollover,convert 401k to gold,how to move 401k to gold without penalty,best gold ira company,401k to gold ira rollover,augusta precious metals review,gold ira rollover guide,physical gold in an ira,convert 401k to gold and silver,convert 401k to gold ira,401k to gold ira guide,gold ira rollovers guide

As many in America prepare for retirement, an increasing number of people are turning to IRAs as a means of saving money for their golden years. An Individual retirement account is essentially an investment account that lets you put aside cash for your future. This can come in handy when health issues arise or you need to cover basic expenses like college tuition bills and mortgage payments. Ideally, however, you want to choose a plan that will provide long-term growth potential so that you can increase your money’s purchasing power and be able to live comfortably in retirement. In order to make sure that your gold IRA rollover guide 2022 succeeds, it’s important to consider three basic factors when choosing where to invest: fees, liquidity, and security.

Fees are a huge factor when it comes to choosing an investment plan, as you want to make sure that you’re putting your money into a valuable vehicle that will benefit your financial future. Investing in gold typically involves high fees because precious metals carry more risk than other types of investments. They can fluctuate significantly and there’s always a chance that you could lose all of your money if there’s a significant market downturn or economic meltdown. This is why it’s crucial to find plans with low annual management fees or no annual fees at all so that you don’t end up paying more than necessary for your investment account.

What Is A Gold IRA?

A gold IRA rollover is one of many other types of investments that can be put into a self-directed IRA. There are rules and regulations when it comes to what you can and cannot invest in with your IRA, but gold is allowed. A gold IRA rollover guide provides detailed information about what Gold IRAs are, how they work, and other relevant information for someone who wants to find out more about investing in a Gold IRA. A person may also wish to open a self-directed custodial account that is often used for investing in precious metals like gold. These accounts may require a small fee depending on the type of account opened….(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

Gold IRA Rollover Guide 2022 | 401k to Gold IRA Rollover Guide: A Comprehensive Gold Investment Option

Investing in gold has always been considered a reliable and safe option to diversify one’s investment portfolio. With uncertainties looming around various financial markets, it’s no wonder that individuals are seeking alternative investment options such as gold.

If you are thinking about securing your retirement savings, a Gold IRA Rollover could be an excellent option to consider. This article aims to provide you with a comprehensive guide on Gold IRA Rollovers for the year 2022, specifically focusing on rolling over your 401k into a Gold IRA.

What is a Gold IRA Rollover?

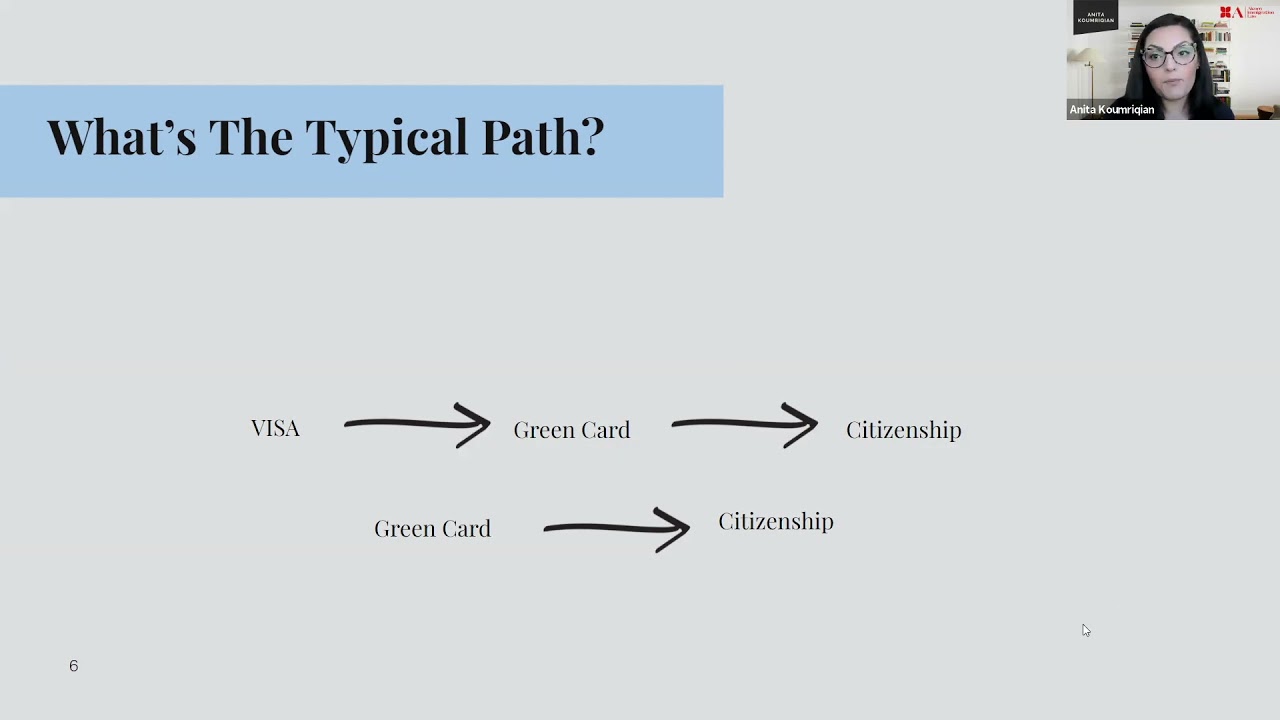

A Gold IRA Rollover involves transferring or rolling over the funds from an existing retirement account, such as a traditional or Roth 401k, into a self-directed individual retirement account (IRA) that allows for gold and other precious metals investments.

Why Consider a Gold IRA Rollover in 2022?

Gold has always been seen as a reliable store of value, especially during times of economic uncertainty. As markets fluctuate and geopolitical tensions persist, the demand for gold tends to increase. Therefore, considering a Gold IRA Rollover in 2022 can be a wise move to protect and diversify your retirement savings.

Steps to Follow for a 401k to Gold IRA Rollover:

1. Research and Choose a Reputable Gold IRA Custodian: The first step is to find a reputable custodian who specializes in self-directed Gold IRAs. Ensure that the custodian is accredited and has a track record of providing excellent customer service. Research online reviews and compare fees to make an informed decision.

2. Open a Gold IRA Account: Once you have selected a custodian, open a self-directed Gold IRA account with them. This involves filling out the necessary paperwork and providing identification documents.

3. Fund Your Gold IRA Account: After opening the account, you need to fund it with the funds from your 401k. Contact your 401k administrator and request a direct rollover to your Gold IRA custodian. This ensures that you don’t face any tax penalties or early withdrawal fees.

4. Choose Your Gold Investments: With your Gold IRA funded, it’s time to choose the gold investments that suit your investment goals. Seek advice from financial experts or the custodian regarding the types of gold products that are eligible for investment within an IRA.

5. Complete the Purchase: Once you have made your decision regarding the types of gold products you want to invest in, work with your custodian to complete the purchase. They will guide you through the necessary steps, including storage and insurance requirements.

Benefits of a Gold IRA Rollover:

1. Portfolio Diversification: Investing in gold through a Gold IRA Rollover allows for increased diversification in your retirement portfolio, reducing overall risk.

2. Protection Against Inflation: Gold has historically served as a hedge against inflation. During times of economic uncertainty or when the value of paper currency declines, gold tends to retain its value or even increase in price.

3. Potential for Higher Returns: Depending on market conditions, gold investments have the potential to outperform traditional stocks and bonds, leading to higher returns on your investment.

4. Tax Advantages: With a Gold IRA, you can enjoy tax advantages similar to those of traditional retirement accounts. While contributions are made with pre-tax dollars, gains within the account grow tax-deferred.

Conclusion:

A Gold IRA Rollover in 2022 can be a valuable addition to your retirement investment portfolio. By diversifying with precious metals, such as gold, you protect your savings against economic uncertainties, inflation, and potentially benefit from higher returns. Educate yourself, choose a reputable custodian, and carefully plan your gold investments to secure a prosperous retirement future.

Get a free Gold Kit or more info from Augusta Precious Metals"

Visit site: http://www.EasyGoldinvestments.com

or Call them at: 1-855-470-4636.