In this video you will get to know the secrets that how Businessmen Pay Less or Zero #Taxes and still keep on becoming #Rich.

#FinancialEducation

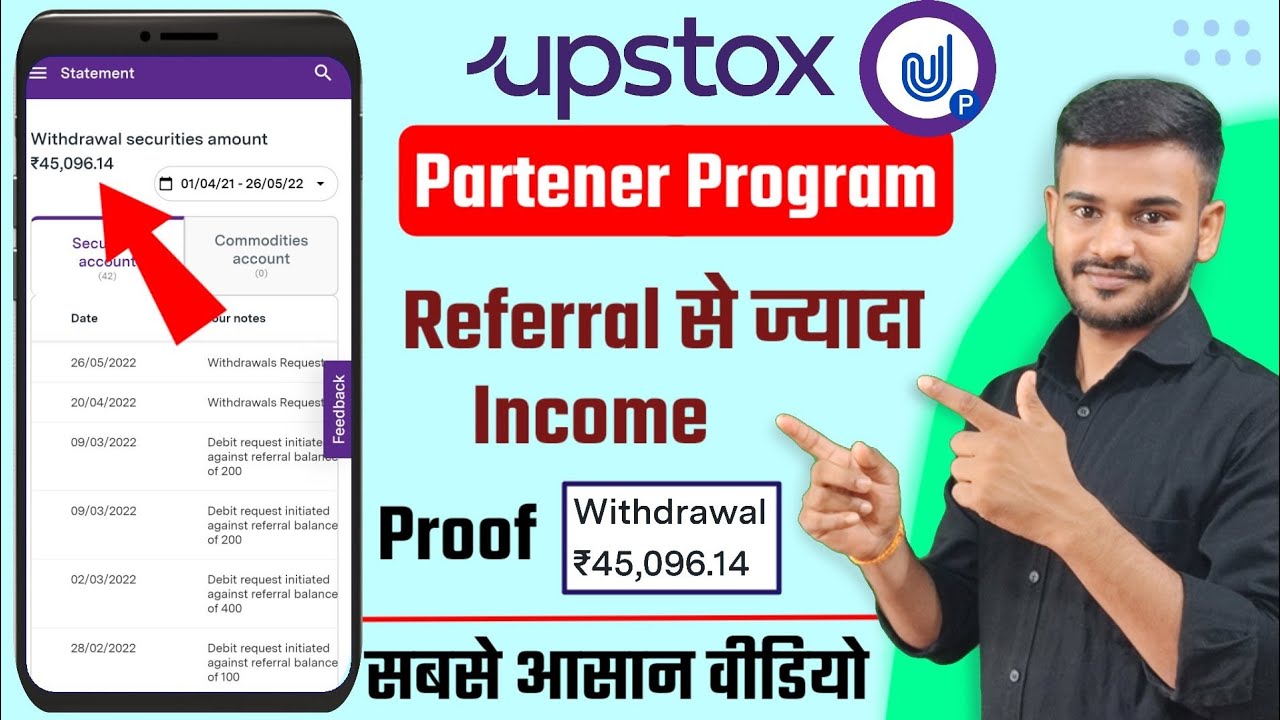

Open Free Demat Account on Upstox:

Download Fast Track Millionaire PDF:

Join FastTrack Millionaire Training:

For IOS Log in @

For Any Query: Call @ 9999277330

About the Trainer :

Master of Leadership Psychology, Pushkar Raj Thakur is one of the Most Influential Motivational Speaker & Digital Entrepreneurship Coach in India. A SelfMade Millionaire on the Mission to Make India #GoSelfMade. Inspiring millions of people, he is regarded as the Youth Icon and the Change Expert.

He has been featured into several publications such as The Times of India, Hindustan Times, etc. He trains on Success Mindset, Influencing People, Network Marketing, Leadership, Sales, Performance Acceleration, Wealth Creation and Life Mastery.

He is the Creator of his trademark Courses, “The Last Course for Your Best life”, “Bang On in Network Marketing”, “The Design of My Life” & “The Fast Track Millionaire Course”.

He is a Serial Entrepreneur and Founder of Coursedes Learning Solutions Pvt, India’s Leading E-Learning Platform committed to provide Self Help, Skills Development & Income Oriented Training Courses by the Best Trainers in the Industry!

He is the founder of PRT GLOBAL SOLUTIONS, which is a Peak Performance Training & Development firm, providing Leadership & Entrepreneurship Skills to the Individuals & Organisations to attain continuous growth & acceleration in revenue generation & overall brand enhancement.

People love Pushkar Raj Thakur for his Electrifying Motivation and Life Transforming Wisdom. He is a Humorous and yet Thought Provoking Master of Motivation, a deadly combination in a Motivational Speaker!

Caution: Getting into his Courses Immediately Leads to Change in Mental Framework and Chances for Success in any area of Life!

Ask any question you have in comments below or email:

Info@coursedes.com

#GoSelfMade

Follow us on:

Facebook:

Instagram:

Youtube:

Twitter:

LinkedIn:

To Join our Course, Call @ 9999470710…(read more)

LEARN MORE ABOUT: Profit Sharing Plans

REVEALED: How To Invest During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Title: How Businessmen Pay Low/Zero Taxes & Still Become Rich

Introduction:

For the average taxpayer, the complexity of the tax system can often feel overwhelming. However, when it comes to successful businessmen, they often employ clever strategies and utilize legal tax loopholes to significantly reduce their tax burdens. While these practices may raise eyebrows, it is crucial to remember that tax planning is an integral part of business management. In this article, we will explore how some businessmen pay low or even zero taxes while still acquiring immense wealth.

1. Exploiting Legal Tax Loopholes:

One of the most common methods employed by businessmen to minimize their tax obligations is by exploiting tax loopholes. These loopholes are often created by legislators to incentivize certain behaviors, such as investing in specific industries or locations. By taking advantage of tax credits, deductions, and exemptions, businessmen can substantially reduce their taxable income. For instance, research and development tax credits or investment in economically distressed areas can significantly lower a business’s tax liability.

2. Incorporation and Offshore Tax Havens:

Another popular strategy is to incorporate businesses in tax-friendly jurisdictions or take advantage of offshore tax havens. By doing so, businessmen can legally maneuver their profits to countries with low or no corporate taxes. This enables them to shield a significant portion of their income from high tax rates in their home countries. While the use of offshore tax havens is legal, questions arise regarding fairness and the long-term sustainability of this practice.

3. Utilizing Tax Deductible Expenses:

Deductible business expenses provide a means for businessmen to lower their taxable income. Entrepreneurs often leverage this opportunity to save on taxes by maximizing justifiable deductions. These expenses can range from travel and entertainment to office space and equipment purchases. These deductions are well within the legal framework, enabling businessmen to lower their overall tax liability while investing in their companies and fueling economic growth.

4. Utilization of Losses:

Businesses can experience financial losses in certain periods of operation. Enterprising businessmen can strategically utilize these losses to offset taxable income of future periods. By carrying forward the losses or attempting to restructure their business activities, they can significantly reduce or eliminate their tax obligations. This practice ensures that business owners can navigate economic downturns and still maintain profitability in the long run without being overly burdened by taxes.

5. International Tax Planning:

Multi-national entrepreneurs can also employ international tax planning to minimize their tax burdens. By structuring their operations across different countries, they can exploit variances in tax laws and rates. By establishing a presence in countries with more favorable tax systems, businessmen can allocate resources intelligently to reduce overall taxation. This practice often involves intricate legal and accounting strategies to optimize the tax efficiency of cross-border transactions.

Conclusion:

While the concept of businessmen paying low or zero taxes may raise moral and ethical questions, it is essential to distinguish between strategic tax planning and illegal tax evasion. Entrepreneurs’ ability to navigate the complex tax system allows them to strategically allocate resources, support economic growth, and generate profit. However, these practices may necessitate a reevaluation of the tax system to create greater fairness and ensure that everyone, including businesses, contributes their fair share to society’s development.

Open Free Demat Account on Upstox: https://bit.ly/UpstoxAccountOffer

Download Fast Track Millionaire PDF: http://bit.ly/FTMBrochureDownload

Join FastTrack Millionaire Training: https://bit.ly/FastTrackMillionaireTrainingProgram

For IOS Log in @ https://www.coursedes.com/

For Any Query: Call @ 9999277330

Sir gst pr clam kse kre

Good explanation sir thank you ❤

You Opened my eyes..

❤❤❤

I m govt employees

Is it good to join to you ?

Which businesses have expenses allowance?

businessman pahle kharch karte hai fir tax dete hai,or employee pahle tax dete hai fir kharch karte karte hai,ye maine rich dad poor dad audiobook me suna tha,great ❤❤❤

1 ladke ke 15 shop hai to kya ushe income tax bharna hoga ya nahi

Good evening pushkar sir good information

Your lecture is based on Rich dad poor dad book by Robert Kiyosaki , Nothing new or you content

Absolutely precise and to the point. But, common man shouldn't expect much from the Govt.

सर कोई व्यक्ति बिजनेसमैन है साल का एक करोड़ कमाता है खर्चे में पूरे पैसे को उठा देता है तो उसको टैक्स देना पड़ेगा या नहीं कृपया जवाब दीजिए बिजनेसमैन को

Sir apne to bataya ki investment karne se income tax deduct ho jayega lekin jaab mai investment karunga taab to tax dena parega. Let assume aap ek 50 lakh ki property kharide apka income tax deduct ho gaya par aaap jo property kharid rahe hai uspe to apka tax lagega tab usko to bacha nhi payenge

Real talk starts at 1100

What about partnership firm if we want to save tax and earn more

you got a new subscriber

Exilent

You are very correct

G hmm d