Lets talk about how to build wealth during a recession – Add me on Instagram: GPStephan

GET YOUR FREE STOCK WORTH UP TO $1000 ON PUBLIC & READ MY THOUGHTS ON THE MARKET – USE CODE GRAHAM:

GET MY WEEKLY EMAIL MARKET RECAP NEWSLETTER:

The YouTube Creator Academy:

Learn EXACTLY how to get your first 1000 subscribers on YouTube, rank videos on the front page of searches, grow your following, and turn that into another income source: – $100 OFF WITH CODE 100OFF

THE NEXT RECESSION:

EVERYTHING BECOMES LESS EXPENSIVE

The way I see it – even though one person might think: “This is a bad time to invest…my stocks are down 30%” – a WEALTHY person would see this as an OPPORTUNITY to buy those exact same companies…for a 30% discount.

LESS COMPETITION

The fact is, when times are difficult – companies scale back, they fold, they conserve cash, and they play it safe – but, this opens the door for more aggressive, smaller companies to stand out and take their place.

MORE OPPORTUNITY.

In a way, a recession is the markets way of “Weeding out the weak,” giving opportunities to newer, smaller people and businesses to develop.

AFTER EVERY BEAR MARKET…COMES A BULL MARKET.

As Yahoo Finance points out, “historically, the S&P 500 has fallen an average of 29% around a recession with a median drop of 24%” – but, once stocks have found their low…the average return the following year is 40%…and, within two years…the market has increased by 58%.

In terms of what to do:

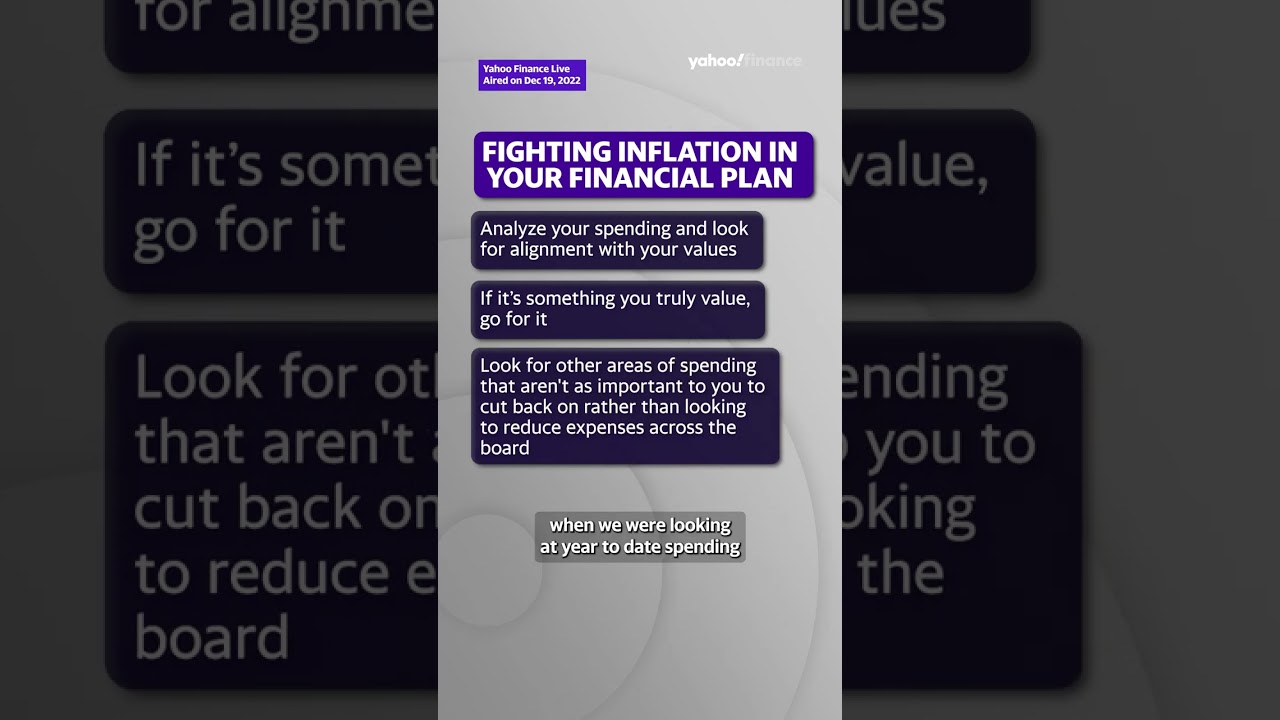

One, Scale Back On Your Expenses.

This means that you track your income, cut back on the unnecessary spending, and operate “lean” while you continue re-investing on a regular basis. It should also include a plan to outline what you would do if your income drops 20-50%, how you would make up that difference, and if you can take preventative measures – AHEAD OF TIME, to protect yourself from this happening.

Two, Hold Some Cash.

I’m a firm believer that, even though your money is statistically BEST OFF invested as soon as possible…there is the peace of mind of having a cash position, at all times, to take advantage of any opportunities that may come up.

Three, Protect your career.

This, at the end of the day, is going to be your BEST HEDGE against whatever happens…after all, your worst case scenario, financially, isn’t a market going down…it’s a market that goes down, during a time where you lose your job, and can’t afford to hold your investments long enough for them to recover. NOW is the time to IMPROVE yourself, learn new skills, double down on everything, and use that your advantage.

Four, ONLY INVEST LONG TERM

Generally, it’s best not to invest any money that you might need in the next 5 years…and, preferably, even longer. The best course is action – when it comes to investing – is not to do anything different, and carry on as usual. Its shown dollar cost averaging, or the practice of buying into the market at regular intervals over the long term – is the most profitable investing strategy. So, stay in the markets…and continue buying in.

And Five, DIVERSIFY YOUR INVESTMENTS.

If you personally can’t handle a 20% drop in prices without panicking…then, maybe, you’re invested too aggressively. For instance, if you’re completely in US tech stocks, look into adding large cap and international stocks into the mix. Or, potentially look into investing in real estate, where rents tend to be a little more stable. The more legs your portfolio has to stand on, the less likely it’ll collapse if one or two of them decline.

My ENTIRE Camera and Recording Equipment:

For business or one-on-one real estate investing/real estate agent consulting inquiries, you can reach me at GrahamStephanBusiness@gmail.com

*Some of the links and other products that appear on this video are from companies which Graham Stephan will earn an affiliate commission or referral bonus. Graham Stephan is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. This is not investment advice. Public Offer valid for U.S. residents 18+ and subject to account approval. There may be other fees associated with trading. See Public.com/disclosures/…(read more)

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Mrs Natalia the bitcoin trader is legit and her method works like magic I keep on earning every single week with her new strategies…

There are a lot of strategies to make tongue-wetting profit that the average joes don't know. . Personally, the financial-market for me seems the only way forward with my long time horizon (accrued roughly $457k in gains since Mid 2021 ) but if you don’t have that fortune of time it’s a tough market out there almost nowhere feels safe!

Is this a good time to buy stocks? I know everyone is saying stocks are at a discount and all, but just how long will It take for us to recover, obviously there are strategies to maneuver in this present market but these strategies doesn't come common to the average folk, or am I better off putting my money elsewhere?

I guess getting sponsor money scamming your viewers is a good way to be rich.

ayoooo Tom Cruise!

I don't understand how cash is an asset, and how its increased?

don't you make a "recession" video like, every month?

wow should i invest in established titles?

I had to stop watching because of his hand movement. I haven’t seen that many hand gestures since I was in my dads Italian social club as kid.

A fuckin' awesome video. Incredibile free content

I am aware that continuing to invest during periods of volatility can be a smart way to build wealth. I’ve heard testimonies of people accruing over $250k in this red period. What measures can I take to achieve this?

I’m trying to plan for my retirement and I understand that a recession is where many people make money. Someone I listened to on a podcast made a profit of $150K in less than a month. I'd appreciate any tips

If you buy a hamburger, you probably will eat it, not wait until it gains more value.

Bless you. Literally, You’re the only channel I love more than my own.

Nice video title. I hope you make a ton of money off this video.

Just stop talking

I feel sad that even though I am investing, I don't have the brain power to dig through how each company is doing, is this a good time to buy stocks or not, my reserve of $450K is laying waste to inflation and I don't know what to do at this point tbh, I need solid data on market trajectory

How can you give investing advice without mentioning Bitcoin? Btc will outperform everything given enough time.

What’s with all these comments recommending a trading system or a broker by name?

you are 1-2 years too late

This guy caused a lot of people to lose money with ftx. He takes on a sponsor for a check and really doesn’t care for his subs.

$MMAT / $MMTLP

mic drop

A very different and creative way to look at things

Quite sad what's happening in the market. Although, even the worst recessions offer wonderful buying opportunities in the markets if you're cautious. Volatility can also result in excellent short-term buy and sell opportunities. The market circumstances are driving me insane, my portfolio has lost almost $13K this month alone, my earnings are tanking. I'd appreciate some financial advice from anyone who knows more going forward.

Thank you for being there mitnickSystems when I wanted you to….. I was lost in this new world that I was hassled to start with ….you not only guided me along the way but you also showed me the proper way….whatever little I have been able to achieve in life is because of you today… I want to thank you for being there and showing me the proper way of doing the thing for me you are my best guide as you truly showed me the way to live…once again, I would like to tell you a heartfelt thanks for being there.

If you are not in the financial market space right now, you are making a huge mistake. I understand that it could be due to ignorance, but if you want to build generational wealth, and cultivate financial knowledge, you must be in the market.

I've held everything have shares in. No Point in selling now. I also understand that the market fluctuates. But what if we're witnessing a massive shift in history. The market has been around for less than 300 years. We could be at a turning point if the globalist fulfill what they are looking to achieve. 300 years is nothing. The market could be wiped out of existence as could the dollar bill. I just can't see a point in continuing investing right now when pur country is about to run out of oil. Farms being burnt up across the states. Food shortages coming next year. The realy concern is trying to survive what's coming. For me I'll put my stock market investing to a minimum. I may be wrong but what's coming doesn't look good.

Hello fellow millionaires…

8:14 is the most important part of the video and honestly what everyone needs to hear. This is the action item right here. This is how people get screwed and have to end up selling low.

Who is he talking to