Large week of News, Global Macro heating up. US Dollars in Spotlight

Be prepared, Not Scared!

LINKS:

DISCORD: Join us when Live!

STOP The “Great Taking”: David Rogers Webb on how to stop “The Great Taking” (youtube.com)

MMRI:

LAVA’s Substack:

LAVA on Twitter: Lava Girl (@LavaGirl2082651) / X (twitter.com)

Crypto? Gemini Link: gemini.com/share/nxxmm4c9

MTG Rates: Mortgage Rates and Market Data (mortgagenewsdaily.com)

Fed Calendar:

Food Store:

eMail me: pyroclasticenergy@gmail.com

#Economy #stocks #MarketNews #MarketUpdates #DailyMarkets #macroeconomics

*Some of the links included are from our affiliate partners or sponsors meaning we will get compensated if you make a purchase.

There is no additional cost to you. Investing has risks. You are never guaranteed to make money when you invest, you might even lose money.

Always do your own due diligence…(read more)

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

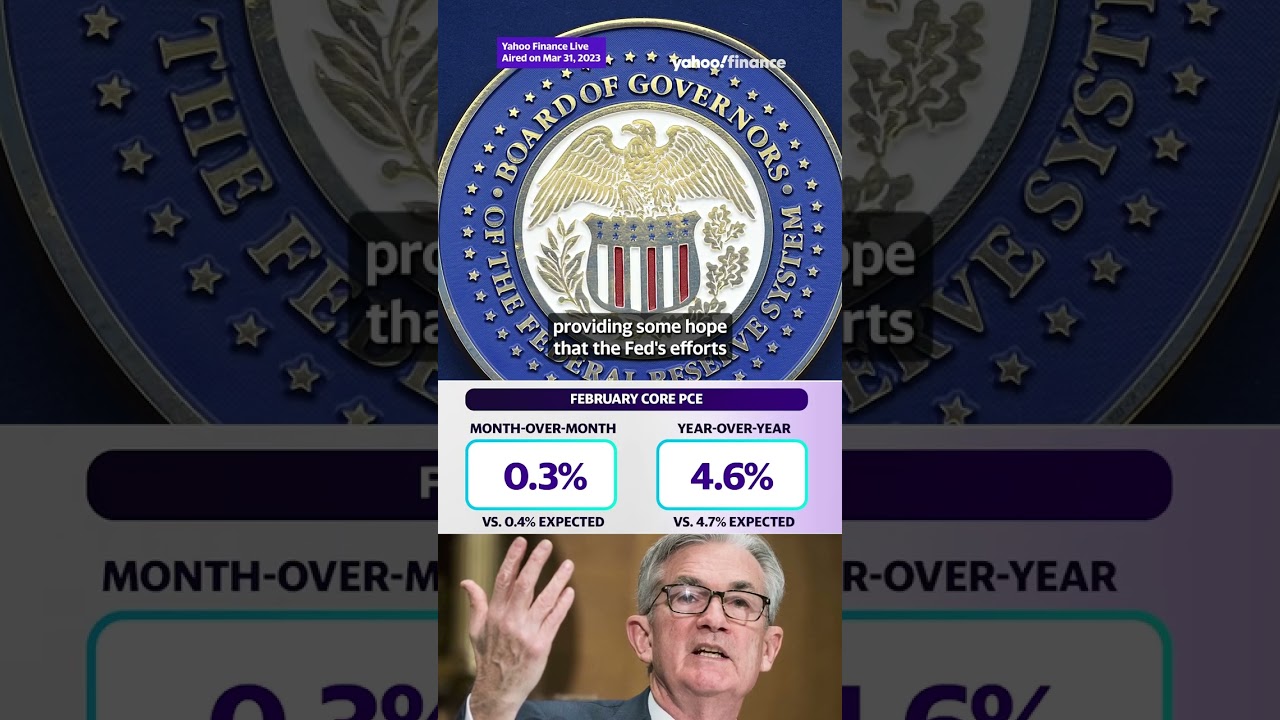

This past week was a big one for the stock markets, with a lot of important economic news coming out that had investors on edge. The Federal Reserve announced its labor market and inflation targets, which sent shockwaves through the financial world.

The Federal Reserve, or Fed, is the central bank of the United States and is responsible for setting monetary policy to help achieve stable prices and full employment. On Wednesday, the Fed announced that it would keep its benchmark interest rate near zero until labor market conditions reach levels consistent with its maximum employment goal and inflation reaches its 2% target. This news was surprising to many investors, as it indicated that the Fed may not raise interest rates as soon as previously expected.

This announcement had a big impact on the stock markets, with major indexes such as the S&P 500 and Dow Jones Industrial Average experiencing significant fluctuations throughout the week. Many investors were concerned about the implications of the Fed’s decision on the economy and the stock market, leading to increased volatility in trading.

In addition to the Fed’s announcement, there were also several other important economic reports released this week that influenced the stock markets. The Bureau of Labor Statistics released its latest data on jobless claims, showing that initial jobless claims fell to 553,000, the lowest level since the start of the pandemic. This news was seen as a positive sign for the labor market and the overall economy, helping to boost investor confidence.

On the other hand, the Commerce Department released data showing that personal income and spending both fell in March, raising concerns about consumer demand and economic recovery. This news had a negative impact on the stock markets, contributing to the overall volatility seen throughout the week.

Overall, this past week was a big one for the stock markets, with a lot of important economic news driving investor sentiment. The Fed’s announcement on its labor market and inflation targets, along with other key economic reports, all played a role in shaping market trends. As we move into the next week, investors will be closely watching for any further developments that could impact the stock markets.

'Smoke em if ya got em" that is if ya can afford em. Thanks for the great info Lava. Have a sweet week!

another week of trading………..yessssssssssssss……are we ready…….yesssssssssssssssss

Cheers ✌️

Ty LG!

Thank you Lava. Speaking of auto insurance: I was contemplating leasing a Tesla model 3 at their new discounted rate of $299/month. Then I found out insurance would be $200/month. A show-stopper there. . .