Elyse Ausenbaugh, global investment strategist at JPMorgan Private Bank, joins CNBC’s ‘Squawk Box’ to discuss her forecast for future interest rate hikes from the Federal Reserve. For access to live and exclusive video from CNBC subscribe to CNBC PRO:

» Subscribe to CNBC TV:

» Subscribe to CNBC:

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

The News with Shepard Smith is CNBC’s daily news podcast providing deep, non-partisan coverage and perspective on the day’s most important stories. Available to listen by 8:30pm ET / 5:30pm PT daily beginning September 30:

Connect with CNBC News Online

Get the latest news:

Follow CNBC on LinkedIn:

Follow CNBC News on Facebook:

Follow CNBC News on Twitter:

Follow CNBC News on Instagram:

#CNBC

#CNBCTV…(read more)

BREAKING: Recession News

LEARN MORE ABOUT: Bank Failures

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

JPMorgan’s Elyse Ausenbaugh has recently made a bold statement that the United States is positioning for a recession in 2023. As a managing director for the bank’s North America economics team, Ausenbaugh’s predictions are given a lot of weight in financial circles. So what exactly does this prediction mean, and what should investors be doing to prepare?

First, it’s important to understand what a recession is. In simple terms, a recession occurs when there is a sustained period of economic decline, usually marked by a decrease in GDP, rising unemployment, and other negative indicators. Recessions can have a wide range of causes, from natural disasters to changes in government policy to global economic downturns.

So why does Ausenbaugh think a recession is likely in 2023? One factor is the current state of the U.S. economy, which has been growing steadily since the last recession ended in 2009. However, this growth has largely been fueled by government spending and low interest rates, rather than sustainable economic fundamentals. Additionally, there are a number of potential factors that could trigger a recession in the next few years, including an international trade war, rising interest rates, and a slowdown in the housing market.

At this point, it’s impossible to say exactly what will trigger a recession or how severe it will be. However, Ausenbaugh’s prediction is a reminder to investors that recessions are a natural part of economic cycles and it’s always wise to have a diversified portfolio that can weather economic storms. This means having a mix of stocks, bonds, and other investments that don’t all react in the same way to economic downturns.

It’s also important to remember that not all investments are created equal. Some companies and sectors will be hit harder by a recession than others. For example, consumer goods companies may see a decline in sales as people cut back on spending, while healthcare companies may fare better as people continue to need medical care. Investors should carefully research and consider the risks and potential rewards of individual investments before making any decisions.

Ultimately, Ausenbaugh’s prediction is a reminder to stay vigilant and prepared for whatever the economic future may bring. By having a well-diversified portfolio and carefully evaluating individual investments, investors can weather economic storms and emerge stronger on the other side.

I have come to realize that as a beginner you will achieve close to nothing investing in the vast stock market all on your own, that's why there are professional stockbrokers and account managers to assist beginners to achieve their financial and stock investment goals.

Wife's account. You can Trust the government just ask an Indian

the recession started early 2022, hell 3 degrees can't find a job you know It's a terrible place to live, gas going up, housing market is inpossible if your not the 1%. Decline birthrate, no hope for the Future and I lost 2 friends due to how terrible job market to the point It's a 2nd great depression

The best source of income, are multiple sources of income. Sometimes we need to get our minds off negativity and just motivate ourselves, , stop giving excuses because you will end up not achieving your dreams, take a chance and try something new.

hope that many broken and failed companies get buried for good, fraud is one of the worst sins

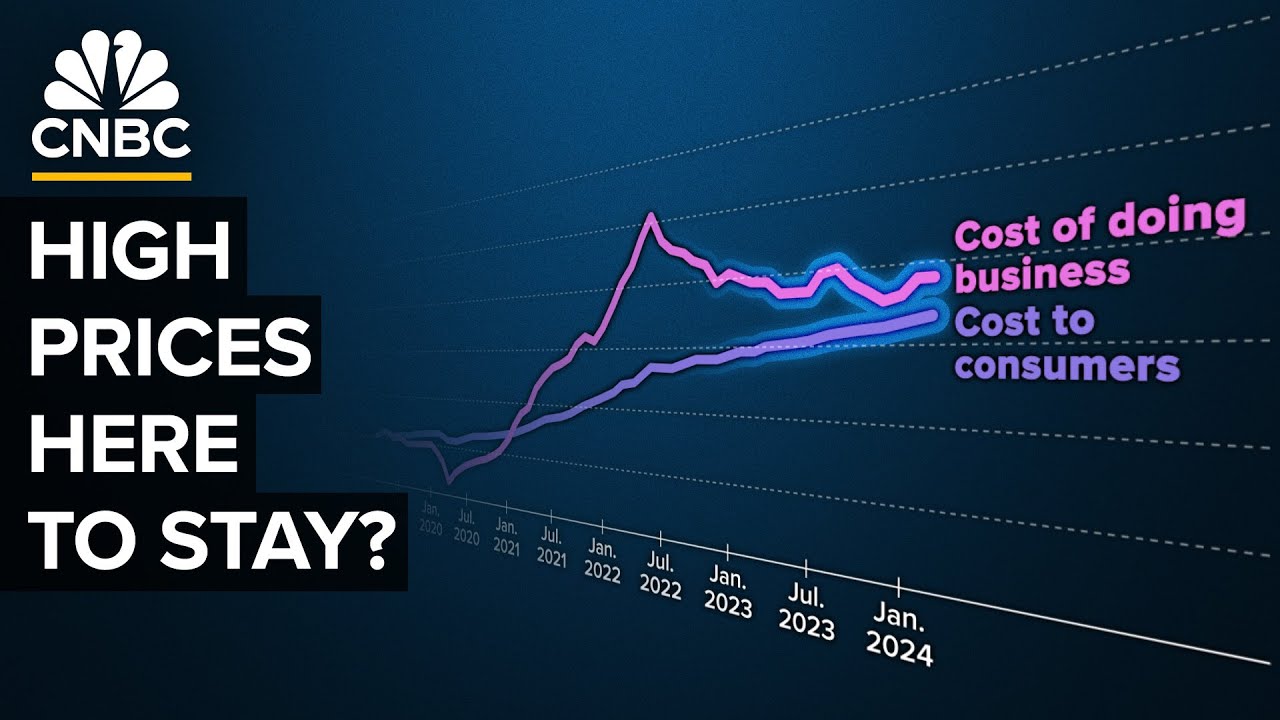

Central banks around the world, printed 30% of all the money they ever created. We will have cumulative inflation of 30%. Just matter of when and where.

Disgusting how people use words these days. What even is a recession? When you lose your job then can we call it a recession?

2% growth with 8% inflation IS a recession. Stagflation.

Fed fighting inflation is tough, if we don't fix this inflation problem we won't have a monetary system in the future.

They change the parameters for recession every week

Informative video. You said all asset classes are going up and I confirmed this from an article I read of an investor that made a profit of $80K in 3 months from $50K and I'd like to know how can do I take advantage of the rising market and make better profit.

Yet another , right-wing created recession. Keeping rates low for ten years too long ended in a predictable disaster. Thanks extreme right-wing cheerleader, Kernan for supporting Trump, McConnell, Ryan.

Large box of premium cereal at a local family market I shop at is 7.58$.

What in the world is going on?

Increase crude oil gold and silver price RIGHT NOW they are the main demand

My take, it will be a 50bp hike…

Started at the beginning of 2022. How dumb you think we are?

I don't think it will be 75 points