![]()

An overview of one type of retirement account….(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

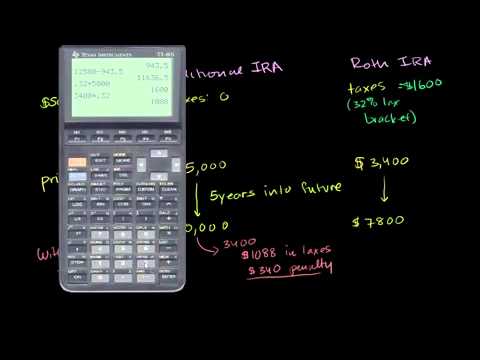

A Roth IRA is a type of individual retirement account that offers tax advantages to individuals who want to save for their retirement. Unlike a traditional IRA, contributions to a Roth IRA are made with after-tax dollars, meaning that you do not receive a tax deduction for your contributions. However, the earnings on your investments in a Roth IRA grow tax-free and withdrawals in retirement are also tax-free.

One of the key benefits of a Roth IRA is the flexibility it offers in terms of withdrawals. Unlike other retirement accounts, there are no required minimum distributions (RMDs) from a Roth IRA, which means you can leave your money in the account and continue to grow tax-free for as long as you like. This can be particularly advantageous for individuals who do not need to access their retirement savings immediately and want to preserve their assets for future generations.

Another advantage of a Roth IRA is that you can withdraw your contributions at any time without penalty. This means that if you have an unexpected expense or emergency, you can access the funds you have saved in your Roth IRA without incurring the usual early withdrawal penalties that apply to other retirement accounts.

Additionally, Roth IRAs offer more flexibility when it comes to estate planning. Since there are no RMDs, you can pass on your Roth IRA to your heirs and they can continue to benefit from tax-free growth on the investments. This can be a useful tool for individuals who want to leave a tax-efficient inheritance for their loved ones.

There are, however, income limits to contribute to a Roth IRA. For 2021, the income limits are $140,000 for individuals and $208,000 for married couples filing jointly. If your income exceeds these limits, you may still be able to contribute to a Roth IRA through a backdoor Roth IRA conversion, where you contribute to a traditional IRA and then convert it to a Roth IRA.

In conclusion, Roth IRAs offer a tax-efficient way to save for retirement with added flexibility for withdrawals and estate planning. If you qualify, a Roth IRA can be a valuable addition to your retirement savings strategy. It’s always a good idea to consult with a financial advisor to discuss your individual situation and determine if a Roth IRA is the right choice for you.

great video but that math mistake bothered me the entire time. Especially because your ending proving point isnt applicable anymore

Small mistake in your calculations. In the Roth IRA example, the initial $3400 doubled to $7800 instead of $6800. It then should have only doubled again to $13600.