AJ is considering investing in a self-directed IRA, but is unsure about the higher interest rates on a non-recourse loan. I’m sharing some insights on this process on today’s Q&A video!

❓Ask me a 30-second question at

📞 Ready to buy your first fully done for you rental property? Book a free call with us:

📺 Watch Next: How to Create Your Personalized Path to Financial Freedom:

🏠 What’s Your Freedom Number? Download our free PDF to help you determine how many rental properties you would need to achieve financial freedom:

💵 Ready to get your finances in order? Download the FREE 90-Day Financial Empowerment Bootcamp:

🎓 Want to learn more about creating your individualized plan to wealth with a proven system? Join us in Financial Freedom Academy:

👨🏻💻 Sign Up for My Webinar:

—————–

How to Determine If You Should Invest in a Self-Directed IRA

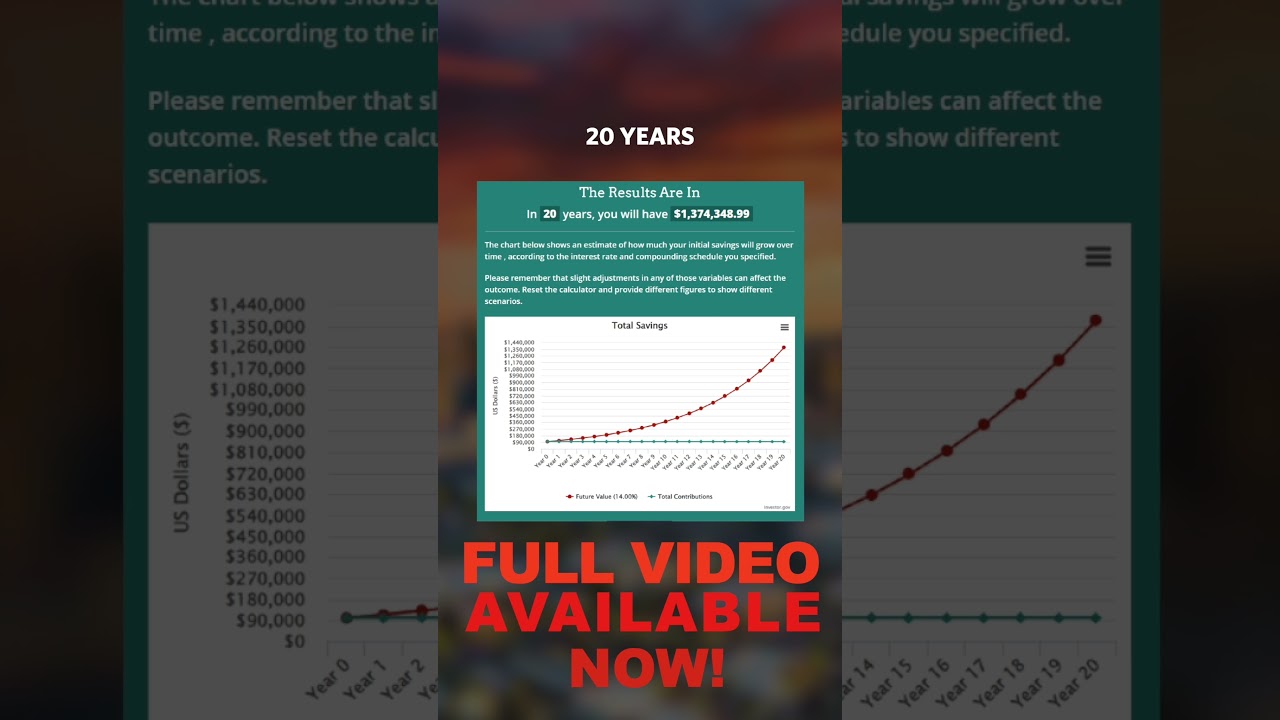

If you’re working with my team to invest in a self-directed retirement account, it’s possible that we will suggest a non-recourse loan. If you don’t have the entirety of the funds available in your IRA, a non-recourse loan plays well with the self-directed account. One drawback of a non-recourse loan is that it offers slightly higher interest rates than other loans.

I can’t tell you whether or not you should move forward with an investment, but my advice would be to weigh the pros and cons. While a non-recourse loan does offer a higher interest rate, there are many other benefits to this banking product. I would also say that generally speaking, it’s usually a good move to start investing sooner than later.

—————–

DISCLAIMER: I am not a financial adviser. I only express my opinion based on my experience. Your experience may be different. These videos are for educational and inspirational purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. There is no guarantee of gains or losses on investments.

AFFILIATE DISCLOSURE: Some of the links on this channel are affiliate links, meaning, at NO additional cost to you, I may earn a commission if you click through and make a purchase and/or subscribe. However, this does not impact my opinion. We recommend them because they are helpful and useful, not because of the small commissions we make if you decide to use their services. Please do not spend any money on these products unless you feel you need them or that they will help you achieve your goals….(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

Book a free call with our team: https://morrisinvest.com

Not a fan of the Gary V look.