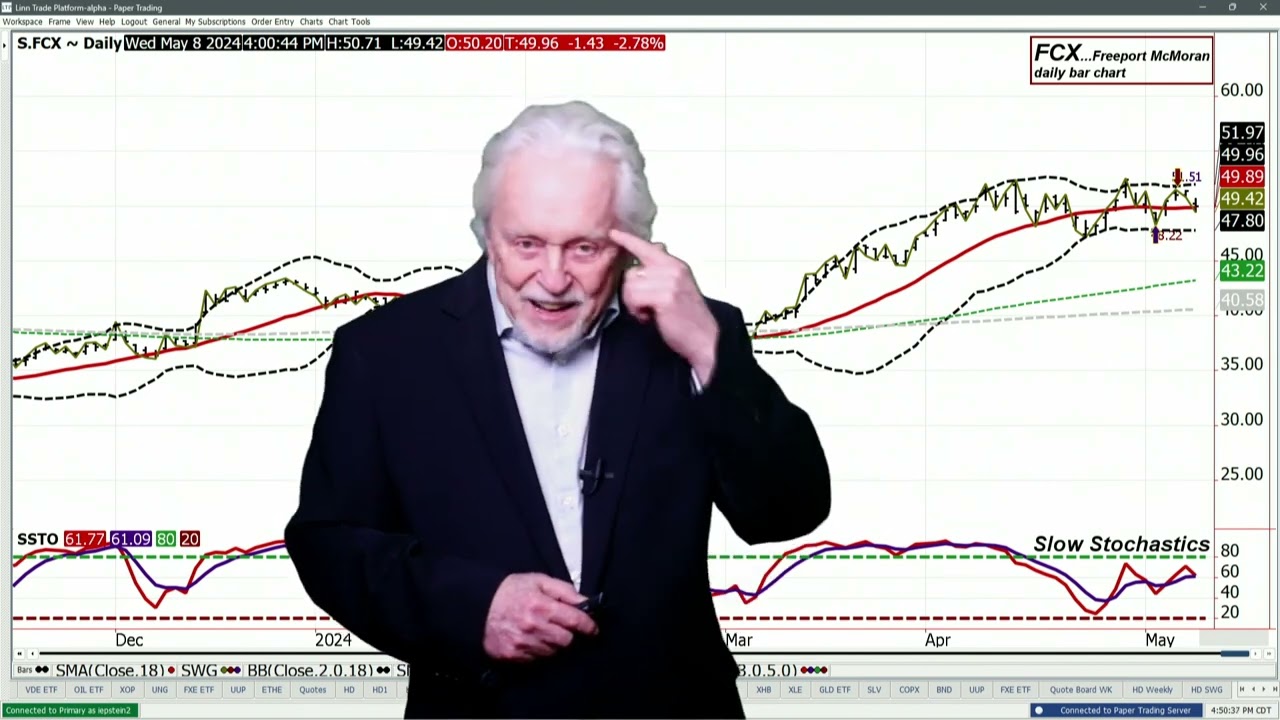

Ira Epstein reviews the days trading in various SPDR-ETF markets. For more information and access to Ira’s free offers for traders, visit

Link to Our Website:

Link for Ira’s Free Offers:

Learn about Ira’s Charting Course:

Commodities, Ira Epstein, Linn & Associates, Futures Trading, Online Trading, Technical Analysis, Stock Indices, S&P 500 Index, NASDAQ, Russell 2000, Treasuries, Finance, Fox Business News, CNBC, Bloomberg, Charting, SPY, QQQ, DIA, GDX, GLD, SLV, XLK, XLI,TLT, OIL, EFA, UFO, FXE, FXY, FXB,BETZ,OUSA,GMC,

AAPL,Pave,DWPCF,SLV…(read more)

LEARN MORE ABOUT: Precious Metals IRAs

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

REVEALED: Best Investment During Inflation

Investors and traders are closely monitoring the US weekly jobless claims data, which is set to be released at 7:30 AM Central time. This data is a key indicator of the health of the US labor market and can have a significant impact on financial markets.

One way investors can gain exposure to the US labor market is through SPDR ETFs. These exchange-traded funds track various market indexes, including those related to US jobless claims and employment data. One popular SPDR ETF that investors may be interested in is the SPDR S&P 500 ETF Trust (SPY), which tracks the performance of the S&P 500 index.

Ira Epstein, a renowned market analyst and trader, has released a video discussing the SPDR ETF market outlook for May 8, 2024. In his video, Epstein provides valuable insights and analysis on the current market trends and potential trading opportunities in SPDR ETFs.

Epstein’s expertise and market knowledge make his analysis a valuable resource for investors looking to navigate the complex and ever-changing financial markets. By staying informed and up-to-date on market developments, investors can make more informed decisions and potentially maximize their investment returns.

As the US weekly jobless claims data is released, investors will be closely watching for any surprises or deviations from expectations. This data has the potential to move the markets and provide valuable insights into the health of the US labor market.

Overall, SPDR ETFs provide investors with a convenient and efficient way to gain exposure to various market sectors, including the US labor market. By staying informed and utilizing valuable resources like Ira Epstein’s market analysis, investors can navigate the markets with confidence and potentially achieve their investment goals.

You called it Ira, you said wayyy back after 7OCT that the longer this drags out the more people will turn on Israel,,,our campus' are a mess and more to come this summer… be well

!

You are so funny, but I’m not laughing