Why We LOVE 401(k) Plans (And You Should Too)

Jump start your journey with our FREE financial resources:

Reach your goals faster with our products:

Subscribe on YouTube for early access and go beyond the podcast:

Connect with us on social media for more content:

Take the relationship to the next level and become a client:

Bring confidence to your wealth building with simplified strategies from The Money Guy. Learn how to apply financial tactics that go beyond common sense and help you reach your money goals faster. Make your assets do the heavy lifting so you can quit worrying and start living a more fulfilled life….(read more)

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Retirement is a major milestone in life that many of us look forward to. It is a time to relax, enjoy life, and reflect on all the hard work we have put in over the years. However, in order to truly enjoy our golden years, it is important to start saving early and consistently. One great way to do this is through a 401(k) plan.

A 401(k) plan is a retirement savings account offered by many employers. These plans allow employees to contribute a portion of their pre-tax earnings to a retirement account. One of the main reasons why we LOVE 401(k) plans is the employer match. Many companies offer a matching contribution to your 401(k) up to a certain percentage of your salary. This is essentially free money that can help boost your retirement savings significantly.

Another reason why we love 401(k) plans is the tax benefits. Contributions to a traditional 401(k) are made with pre-tax dollars, which reduces your taxable income for the year. This means you pay less in income tax, allowing you to save more for retirement. Additionally, your contributions grow tax-deferred, meaning you do not have to pay taxes on the gains until you withdraw the money in retirement.

Furthermore, 401(k) plans offer flexibility and convenience. You can choose how much to contribute each paycheck and make changes to your investments over time. Additionally, most plans offer a variety of investment options to suit your risk tolerance and investment goals.

Lastly, 401(k) plans provide a sense of security and peace of mind. Knowing that you are actively saving for retirement can alleviate stress and anxiety about the future. By consistently contributing to your 401(k) plan, you are taking proactive steps towards securing your financial future.

In conclusion, 401(k) plans offer a myriad of benefits that make them a valuable tool for retirement savings. The employer match, tax benefits, flexibility, and peace of mind that come with 401(k) plans make them a must-have for anyone looking to secure their financial future. So if you are not already contributing to a 401(k) plan, consider starting today and take advantage of all the benefits it has to offer. After all, your future self will thank you!

My 401k Roth plan matches 4 % from the 1st day I started with the company and were 100% vested. I set mines up the 1st day of employment! A lot of healthcare companies have been doing this for years.

I hate calling 401k matches "free money." Its part of your compensation, the thing you are doing the job for. If you aren't taking it, you are giving your employer a discount on labor.

My 90-employee firm has a 401(k) and defined contribution plan that allows employees who set aside 6% of their pay to get 10.5% of their compensation from the company. Very grateful that we found each other!

More often than not, the word "use" should be used rather than "utilize." Utilize should primarily be used when indicating a creative use.

We know you're plenty smart…just say "use".

Some clown called Cedric Blake Jr just published a video called

401k’s are a scam.

I can’t find anything RIGHT with it.

My wife started a new job and they won’t let her enroll in the 401k plan for 6 months! I had never heard of that, such a bummer missing out on company match for that long

Where are these employers that match? I haven't had a match in 20 years.

Is your calculation with annualized return showing 11.9% an XIRR?

12.5% match. It is outstanding. They pay a bit less salary but when you take the benefits package into account the over all pay is damn good. Health insurance is less than $200 a month for our entire family.

I am thinking of putting my 401K at 50% for a few years to get up to that 100K I have 90K in my IRA’s but I am not sure if it is needed my wife’s retirement and SS would be enough to live in retirement with comfort but looking at replacing my income after dealing with changing jobs every 2.5 years.

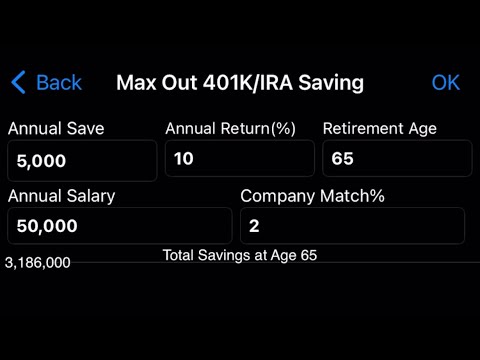

Investment Order One Should Follow:

-401(k) Up to the Maximum Company Match

-Pay Debt With an Interest Rate That’s Greater Than Six Percent As Well As IRS Debt and 401(k) Loans

-Max Out HSA If Eligible

-Max Out Roth IRA

-Max Remaining 401(k)

-Taxable Brokerage

-Pay Off Debt That Has An Interest Rate That’s Less Than Six Percent

Did anyone hear about Boeing employees who didn’t contribute to their 401K plans (or didn’t contribute enough to get the full match) around 2013? Collectively they left $98 million on the table in company matches.

My company contributes "30 cents on the dollar up to 6% of your compensation." I was so pissed when I figured out that the description translated into a 1.8% match. A great company otherwise but I felt deliberately mislead over that

I recommend first only investing enough in your 401(k) to maximize the company match and then move on to the Roth IRA and only invest the remaining amount in the 401(k) after first maximizing the HSA if eligible and the Roth IRA. 401(k) plans are lower on my list because of the high fees and limited investment options.