In the financial world, whether one’s outlook is bearish or bullish, there’s a shared acknowledgment: Inflation in the United States has notably picked up pace after several years of remarkable calm. This recent period of inflationary pressure has turned heads, particularly because it follows a decade where inflation was so muted, it was almost considered a non-issue. From March 2012 to April 2021, the inflation rate was remarkably restrained, never once rising above the modest peak of 2.7%. This prolonged phase of low inflation had set in a certain mindset that perhaps we had seen the last of volatile inflation figures, a notion that recent trends have dramatically overturned.

CNBC Interview

Peter Schiff Interview

…(read more)

LEARN MORE ABOUT: Bank Failures

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Inflation is a term that is often thrown around in economic discussions, but it seems that not enough attention is being paid to the looming crisis that it may bring. Inflation is the rate at which the general level of prices for goods and services is rising, leading to a decrease in purchasing power for consumers. While a certain level of inflation is considered normal and even healthy for an economy, when it spirals out of control, it can have devastating effects on individuals, businesses, and the overall economy.

Currently, the world is facing a perfect storm of factors that could contribute to a significant increase in inflation. The unprecedented levels of government spending and monetary stimulus in response to the COVID-19 pandemic have flooded the economy with cash, leading to an increase in demand for goods and services. At the same time, disruptions in global supply chains have caused shortages of goods, driving up prices even further. Additionally, rising energy prices and labor costs are putting pressure on businesses to raise prices to maintain their profit margins.

The effects of inflation can be felt across all sectors of the economy. For consumers, it means that their hard-earned money buys less and less each day, making it difficult to afford basic necessities. Businesses may struggle to keep up with rising costs, leading to layoffs, closures, or price hikes that are passed on to consumers. Investors may see the value of their savings eroded as inflation eats away at their purchasing power.

Inflation can also have wider social and political implications. It can exacerbate income inequality, as those on fixed incomes or with lower wages are hit the hardest by rising prices. It can also erode trust in the government and financial institutions, as people feel that their savings and investments are being devalued without their control.

So why is nobody talking about this looming crisis? Perhaps because inflation is seen as a distant threat, something that happens in other countries or in other times. Or perhaps because policymakers are focused on the immediate challenges of the pandemic and are hesitant to take action that may slow down economic growth. Whatever the reason, it is crucial that we start paying attention to the signs of inflation and take proactive measures to mitigate its impact.

In conclusion, inflation may not be making headlines right now, but it has the potential to wreak havoc on individuals, businesses, and the economy as a whole if left unchecked. It is imperative that policymakers, businesses, and consumers start preparing for the possibility of rising prices and take steps to protect themselves from the effects of inflation. The time to act is now, before it’s too late.

According to my YouTube feed everyone has been talking about doom and gloom for a few years now.

This country is over, we have debt we can’t ever repay, the dollar i sent worth the paper it printed on,were in serious trouble.

Inflation is much higher than the current democrat Biden govt says . Were not fools . TRUMP 2024

Thank Biden for this

Inflation or just enough businesses unnecessarily raising the price of things and hiding it under the obscure excuse of Covid.

No one is talking about??? Everyone is talking about inflation.

djt will fix everything!

This feels kinda dumb. The 1% made a problem and the fix is to hurt the bottom 70%. Let the 1% loose their wealth. They caused this problem.

Stiglitz talking like "Inflation is good because it lowers wages, it's called the good old downward-rigiditydoo"

what a madman to keep a straight face saying that, holy moly

Inflation is great for the rich but kills the working class

"Downward rigidity" is cultural and can adjust. I still think that the right inflation rate averages zero. Stable prices. There are economic costs associated with having to reprice for inflation.

Well I wonder caused that ?

What changed in 2020?

I love hearing people that are never harmed by the actions of the market talk about job losses as if they aren’t devastating for regular people.

Is it bc Billionares wanted to get there profits back that was lost during covid

if they wanted to prevent a historic crash we wouldnt have seen several cracks the last few years they just wouldnt have happened. 1918 spanish flu, covid19 2019 m2 money supply contracting back in 1920s happening again for the 1st time in 2022- present bank collapse in early 2023 you got an ex president that knows there is a crash coming. IF ANYTHING I THINK THEY WANT IT TO HAPPEN why NOT USE THE EXCUSE OF A 100 YR PANDEMIC TO CRASH EVERYTHING thats what happened 100 years ago

unlike the last time we had high inflation we risk deflation in assets along side high prices of goods we must consume. We have manipulated markets high debt and we are prone to booms and busts today unlike any period 1940-2000(years) there is something to be hopefully about sales on homes boats cars artwork collectables over the next 2-4 years if we actually get meltdown in the news for the 1st time in 16 years soon.

The problem with Austrian economics is that it is fundamentally rooted in abstraction, the same abstraction that all forms of liberalism are based on (classical or modern for that matter). You cannot examine the economics in isolation from the rest of the society and you cannot dismiss "the political pain" as if it were some collective weakness, rooted in either stupidity or laziness. The resulting political backlash and subsequent pursuit of socialism, communism, fascism (or whatever other radical extremism that manifests in that scenario) is as "real" as the basic laws of economics upon which Austrians worship at the alter of.

Fundamentally, societal stability is as important as the economic considerations and the libertarian is no better than the Marxist or the socialist they are inadvertently facilitating via their "necessary pain", when they fail to account for that fact. I am sympathetic to the hard money arguments and the need for fiscal restraint and solvency. However, I am also a realist and in my view no real world scenario will ever live up to the idealist pipedream laid out in some ideologically dogmatic textbook. For as much as Marx and Mises differ, they share this same fundamental flaw and thus it is no surprise that so many young libertarians, end up converting into socialists and Marxists as they get older. They are both searching in vain for the ideal utopia, that can never exist in the real world. "It's not real socialism!" sounds very much like "It's not real capitalism" for this reason.

The second the government begins to pare down the enormous national debt, deflation will set in about a second later.

Biden says just raise wages which makes American labor more expensive leading to outsourcing of jobs which leads to layoffs. Wages too low is not the problem. Money printing leading to devaluing of the US dollar is the problem. But democrats don't tell you that because they don't care about your sufferings.

The human cost for what is needed to correct the market is going to be near-apocalyptic.

Did you contact each and rvery human in the USA and confirm they weren't talking about INFLATION ?

If not, your headline is dishonest

What? Another trump administration?? The match that lights the fuse.

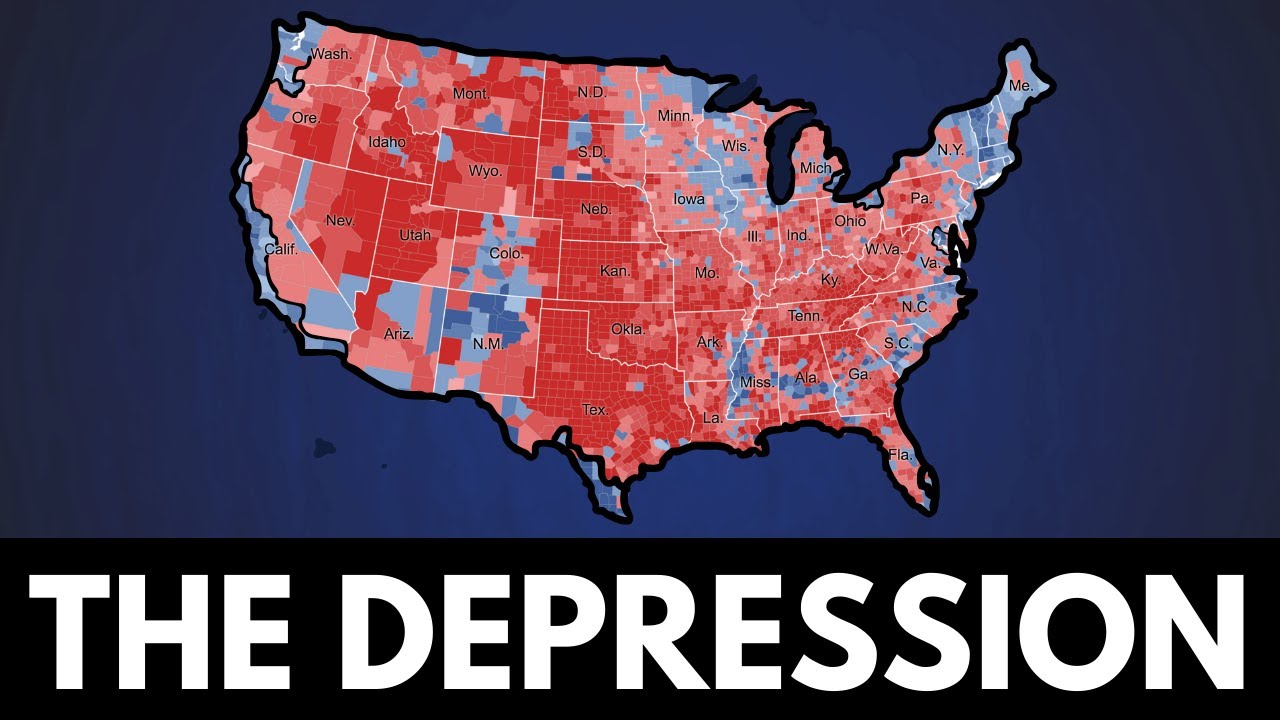

Here’s your lovely Depression.

Wake up