Shrinking homes, soaring rents: The hidden costs of inflation. Explore how the housing market copes with affordability challenges through ‘shrinkflation’ while rents continue to climb.

🏡 Ready to buy a freedom-producing income stream? Book a free coaching call:

🎙️The Get Rich Education Podcast:

🎧

📲 The Get Rich Education Apps:

🎧 iOS:

🎧 Android:

🎥 “Real Estate Pays 5 Ways” Course:

✉️ Convenient Free Financial Education:

Don’t Quit Your Daydream Newsletter:

📖 80-Page Life-Changing Ebook:

7 Money Myths That Are Killing Your Wealth Potential:

📲 Follow Us On Instagram

🎥 Follow Us On Rumble:

🔔 Check us out on LinkedIn, Twitter, Facebook, and

This is not investment advice. This is Financial Education.

Disclaimer: …(read more)

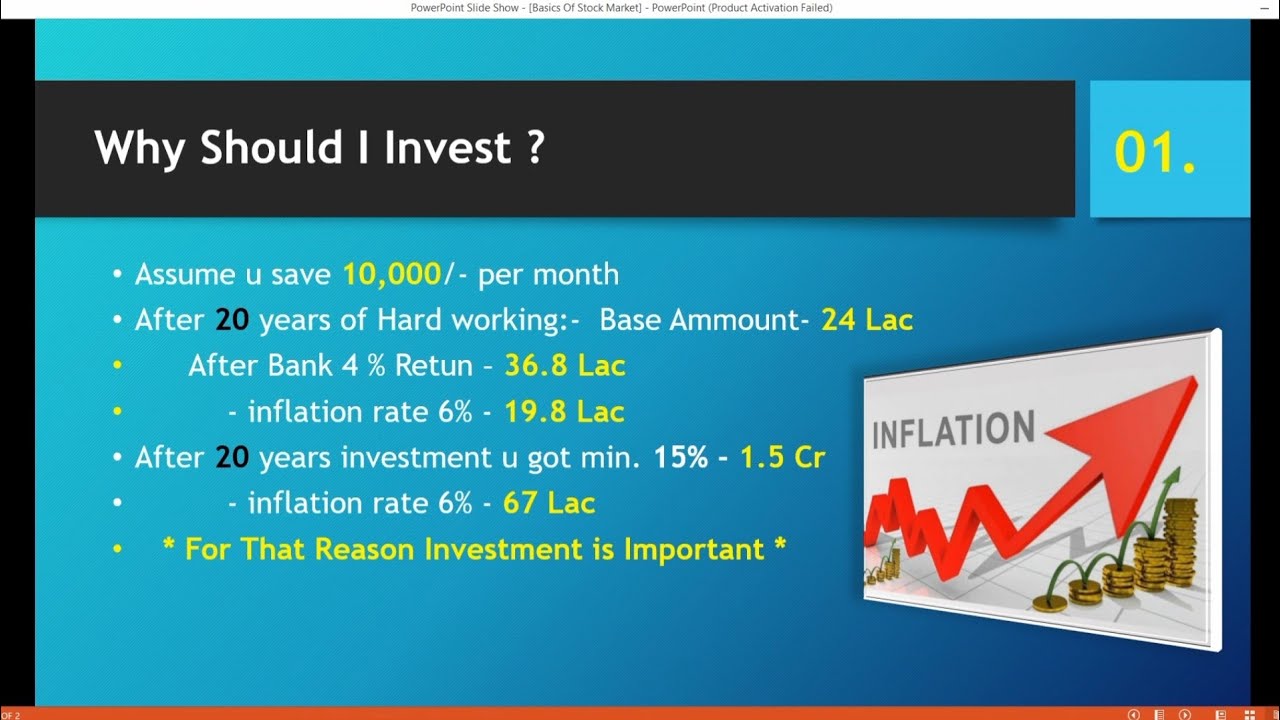

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Shrinkflation is a term that has been gaining popularity in recent years, especially in the real estate industry. It refers to the practice of reducing the size or quality of a product or service while keeping the price the same. In the world of real estate, shrinkflation has become a common tactic used by developers and landlords to maximize profits while maintaining the appearance of offering a good deal to consumers.

The true cost of shrinkflation in real estate goes far beyond the surface level price tag. While consumers may initially be attracted to a lower price point, they often fail to realize the long-term consequences of these reduced sizes or amenities. For example, a developer may advertise a new apartment complex with smaller square footage but fail to mention that the units lack essential features such as adequate storage space or soundproofing.

This can lead to a decrease in the overall quality of life for residents, as they are forced to make compromises and sacrifices in order to live in a space that may not meet their needs. Additionally, the reduced size or amenities of a property can impact its resale value in the future, as buyers are less likely to be willing to pay top dollar for a property that lacks key features.

Furthermore, shrinkflation in real estate can have a ripple effect on the surrounding community. As developers continue to cut corners and offer lower quality properties, it can perpetuate a cycle of declining property values and decreased investment in the neighborhood. This can result in a deterioration of the overall quality of life in the area, as residents are left with fewer options for housing that meets their needs.

In order to combat the negative effects of shrinkflation in real estate, consumers must take a proactive approach to researching and understanding the true cost of the properties they are considering. This includes carefully reviewing floor plans, amenities, and potential resale values to ensure that they are getting the best value for their money. Additionally, consumers should be wary of developers and landlords who use misleading tactics to lure in buyers, and should be prepared to walk away from a deal if it does not meet their standards.

Ultimately, the true cost of shrinkflation in real estate is not just a financial one, but also a social and community one. By being informed and vigilant consumers, we can help to create a more sustainable and equitable real estate market that benefits everyone involved.

This is the dumbest thing. Its not because of more money in circulation its because of more money hoarded. Money in circulation mean wealth transferring from one hand to another. But that isnt the problem the problem is the rich arent actually using its money but are putting string on it with investment. Investment is not money in circulation its just another form of hedge funds to avoid tax.

I bought a house in 2021 for 315k a fixer upper that we got very lucky on as the last owner couldn’t afford it anymore and had to get out. We spend about 30k on it and 3 years later it’s worth around 475 little 1400 sq fr house on an acre in a very nice PA suburb of Philly. Our rate was 2.75% or payment is 1400/month. We made around 120k annually at the time between me and my wife. We could not afford to buy this house today nor could we even afford to sell it and upgrade, even if we were to downgrade with the 220k of equity our payment would be higher. Higher rates, inflation increased home prices. I don’t know how people buy houses now. I feel bad for people trying. This needs to be fixed.

Rent has outpaced inflation by 40% for the last decade. Inflation isnt the issue, shitty landlords are.