On todays webinar Chris Naugle and Greg Herlean from Horizon trust discuss using a self directed IRA to invest in things you know, like, and understand. They give examples on how to lend on real estate deals using your SDIRA and break away from the volatility of the stock market. Chris brings on Rob and Nicole Fuller who are well known Private Money Club borrowers. They borrow funds for large real estate developments and work with lenders who use funds from their self directed IRAs through Horizon Trust.

www.horizontrust.com

www.privatemoneyclub.com

:::::::::::::::::::::::::::::::::::::::::::::::

Stay Connected These Other Ways:

INSTAGRAM:

FREE WEEKLY WEDNESDAY WEBINARS:

GET CHRIS’ BOOK:

#Cashflow #banking #money #creativefinance

The material shared in this webinar has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, investment or accounting advice. You should consult your own tax, legal, investment and accounting advisors before engaging in any transaction….(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

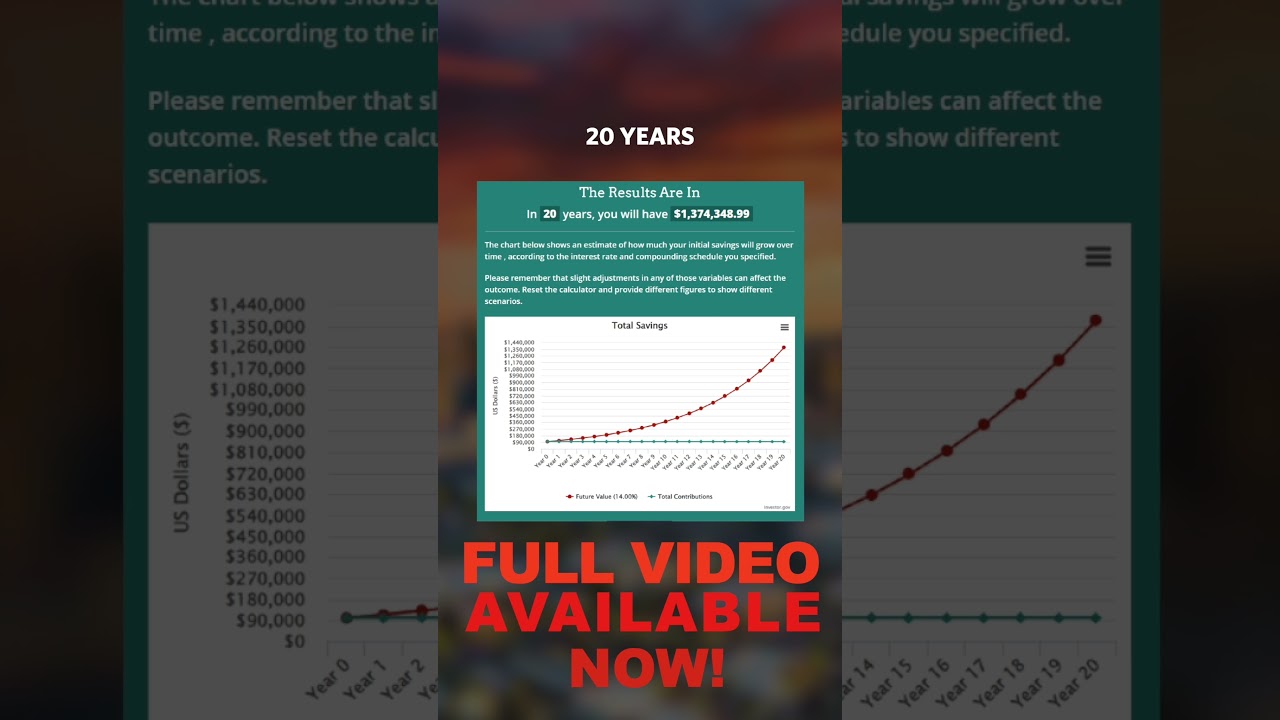

Investing in real estate can be a lucrative way to build wealth and secure your financial future. And with a self-directed IRA, you can take advantage of the tax benefits and freedom to invest in a wide range of assets, including real estate.

A self-directed IRA is a retirement account that allows you to choose and manage your investments, rather than relying on a custodian to make investment decisions for you. With a self-directed IRA, you have the flexibility to invest in a variety of assets, including stocks, bonds, mutual funds, and of course, real estate.

Investing in real estate with a self-directed IRA can offer a number of advantages. For one, real estate has the potential to generate rental income, allowing you to build a steady stream of passive income. Additionally, real estate can also appreciate in value over time, providing you with a potential source of capital gains.

Another benefit of investing in real estate with a self-directed IRA is the ability to diversify your retirement portfolio. By including real estate in your investment mix, you can spread out your risk and potentially increase your overall returns. This can be especially important in times of economic uncertainty, as real estate investments tend to perform differently than traditional assets like stocks and bonds.

Of course, there are also some important considerations to keep in mind when investing in real estate with a self-directed IRA. For one, you must be aware of the rules and regulations governing self-directed IRAs, including restrictions on prohibited transactions and the need to maintain adequate records of your investment activities.

Additionally, investing in real estate with a self-directed IRA can be more complex than traditional investment strategies. You will need to conduct thorough due diligence on potential properties, navigate the process of purchasing real estate within the confines of your IRA, and ensure that all income and expenses related to the property are properly accounted for within your retirement account.

Overall, investing in real estate with a self-directed IRA can be a powerful tool for building wealth and diversifying your retirement portfolio. By taking advantage of the tax benefits and flexibility that a self-directed IRA offers, you can potentially grow your wealth over time and secure your financial future. Just be sure to do your homework, seek advice from financial professionals, and carefully consider your investment options before diving into real estate with your IRA.

Hi all!!!

Would love to see you cover trusts.