How does inflation effect interest rates?

SUBSCRIBE ➡️

Visit our website:

Follow us on Instagram ➡️

Like us on Facebook ➡️

Follow us on Twitter ➡️

Barron’s is the world’s premier investing publication since 1921.

#Barrons…(read more)

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Inflation is a rise in the general price level of goods and services in an economy over time. Inflation can lead to a decrease in the purchasing power of money, which can cause a reduction in the standard of living of individuals and businesses. Fighting inflation is a major challenge for governments, policymakers, and central banks around the world.

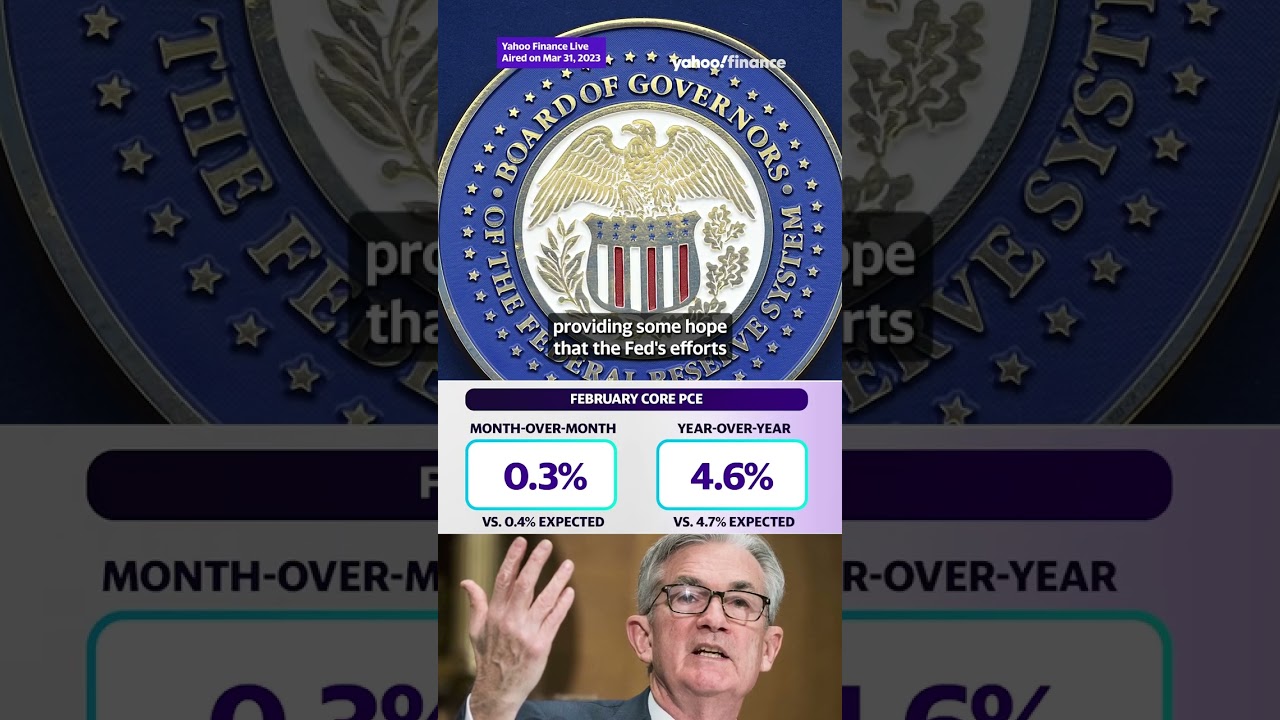

One of the primary ways to fight inflation is through monetary policy. Central banks, such as the Federal Reserve in the United States, control the money supply and interest rates to impact the economy. Higher interest rates can reduce consumer spending and borrowing, which can help reduce demand and lessen price increases. Lowering interest rates, on the other hand, can encourage borrowing and increase demand, which can lead to higher inflation.

Fiscal policy is another way to fight inflation. Governments can adjust their spending and tax policies to influence inflation. For example, reducing government spending can decrease demand and reduce inflation, while increasing taxes can reduce consumer spending and reduce inflation.

Supply-side policies can also help fight inflation. These policies aim to increase the output of goods and services in an economy, which can help meet growing demand without causing inflation. Supply-side policies can include investment in education and training, reducing barriers to entrepreneurship and innovation, and investment in infrastructure.

In addition to government policies, consumers and businesses can also take steps to fight inflation. Consumers can focus on buying goods and services with stable prices and avoid purchasing luxury goods during periods of high inflation. Businesses can invest in their operations to increase efficiency and productivity, which can help reduce costs and prices over time.

In conclusion, fighting inflation requires a multi-faceted approach that involves a combination of monetary, fiscal, and supply-side policies. Consumers and businesses also have a role to play in managing inflation. A successful anti-inflation policy can help stabilize prices, maintain economic growth, and improve the standard of living for individuals and businesses alike.

mmmmmmm hhmmmmm….

Interesting

The problem here begins with the “central banking system” and pretend currency that only exists in fantasy land… as long as you believe the banks lies, the problem will never be solved.

Learn how the banking system works and the lies will slap you in the face!

They depend on you being ignorant and not having the ability to reason.