In today’s video I thought we should explore how much we should be investing per month in order to reach a state of financial independence and be able to retire early, living purely off our investment portfolio value. We’ll explore the concept of financial independence in detail, how we can achieve it, the impact on inflation, and how you can calculate exactly how much you need to invest per month to ensure that you’re on target to achieve it.

Recommended Platforms & Tools:

💰 Up To £100 FREE Share With Trading 212 Use PROMO Code “MITCH”:

📬 Subscribe To The FREE Weekly Market Memo:

📈 Learn How To Build Wealth With Investing:

How Much Should You Invest Each Month To Retire Early!

00:00 Intro

01:13 Financial Independence

05:15 How Much To Invest Per Month

12:25 Like & Subscribe

📷 Instagram: @mitchinvesting

#InvestingForBeginners #Trading212 #StockMarket

*Disclaimer: Your capital is at risk. Some of these links may be affiliate links. If you purchase a product or service using one of these links, I will receive a small commission from the seller. There will be no additional charge for you.*

*Disclaimer: All ideas presented within this video are that of my own based on my own opinions. Please do not consider any of these videos as financial advice as I am NOT a financial advisor. All financial decisions and choices made are solely your responsibility. The views shared in this video are just for entertainment purposes only. When investing, your capital is at risk and can go up in value as well as down in value. You should consult a suitably qualified professional when seeking out investment advice in order to fully understand the risks associated with investing.*…(read more)

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Retiring early is a dream that many people hold, but achieving it requires careful planning and financial discipline. One of the key factors in determining when you can retire early is how much you are able to invest each month. By setting aside a consistent amount of money each month, you can steadily build up your retirement savings and reach your goal of early retirement.

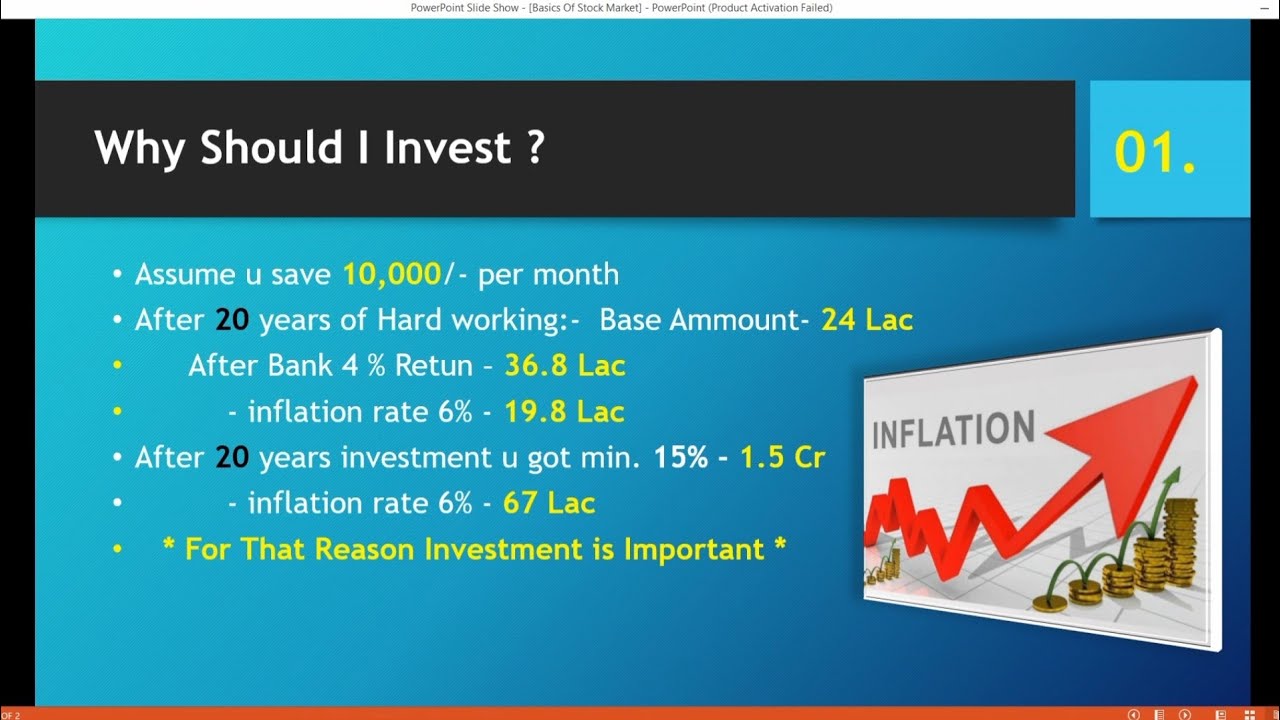

So, how much should you invest each month to retire early? The answer to this question depends on a variety of factors, including your current age, desired retirement age, expected rate of return on investments, and lifestyle goals. However, financial experts generally recommend saving between 10% and 20% of your monthly income for retirement.

To determine a specific amount to invest each month, you can start by calculating how much money you will need to retire early. This will depend on your desired retirement lifestyle, estimated inflation rate, and expected life span. Once you have a target retirement savings goal in mind, you can work backwards to determine how much you should invest each month to reach that goal.

It’s also important to consider the power of compound interest when determining how much to invest each month. By starting to invest early and consistently adding to your retirement savings, you can take advantage of the compounding effect of returns on your investments. This can significantly boost your retirement savings over time and help you reach your goal of retiring early.

One strategy to help you invest more each month is to create a budget and prioritize your retirement savings. By cutting back on unnecessary expenses and focusing on saving for retirement, you can free up more money to invest each month. Automating your investments can also help ensure that you consistently contribute to your retirement savings.

In addition, consider working with a financial advisor to help you develop a personalized retirement savings plan. A financial advisor can help you set realistic goals, determine how much to invest each month, and adjust your investment strategy as needed to stay on track for early retirement.

In conclusion, determining how much to invest each month to retire early requires careful consideration of your financial goals, current income, and investment strategy. By setting aside a consistent amount each month, taking advantage of compound interest, and working with a financial advisor, you can steadily build up your retirement savings and achieve your dream of retiring early. Remember, early retirement is possible with careful planning and disciplined saving habits.

Happy Sunday guys! Today we’ll explore how much you should be investing each month to achieve your financial goals. It’ll be a workshop style video which hopefully you can follow along and work out your own numbers. You can get started investing today on Trading 212 whereby if you sign up using this link you’ll get 1 FREE share valued up to £100: https://trading212.com/promocodes/MITCH